Mandates, State Healthcare Plan Audit Top Committee Agenda

The General Assembly’s Insurance and Real Estate Committee held its first public hearing of the 2023 legislative session Feb. 14, with healthcare proposals dominating the agenda.

CBIA testified in opposition to SB 976, which mandates that fully-insured group healthcare insurance policies in the state cover 21 additional benefits beginning next year.

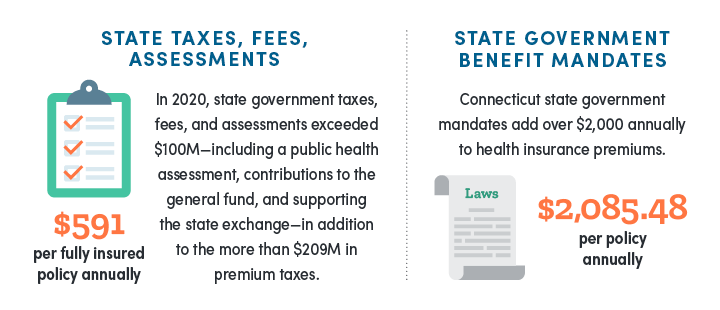

Connecticut is in the top three states for state-mandated healthcare benefits.

These mandates drive up the cost of insurance for small employers because with each new requirement, insurers must expand coverage to include additional services or devices.

This in turn increases the cost of healthcare insurance premiums, and those costs are passed directly onto enrollees.

Benefit Review

As with other past mandate bills, CBIA urges the committee to utilize the Health Benefit Review Program, enacted in 2009, to authorize the Connecticut Insurance Department to conduct a cost-benefit analysis of proposed mandates.

The review program goes well beyond the fiscal note provided by the legislature’s Office of Fiscal Analysis and includes pertinent information that will better inform the legislature and the general public on how mandates impact costs, often outweighing coverage benefits.

For example, the review would include:

- Portion of the population that would utilize the benefit

- Extent to which the benefit is currently available

- Extent to which coverage is already available

- Level of public demand for the benefit

- Impact the benefit would have on the availability of other benefits

- Cost to carriers and employers

- Overall social implications of the mandate

State Healthcare Plan Audit

The committee also heard testimony on SB 437, which provides greater transparency and legislative oversight of the state-run health plan for municipalities.

CBIA supported the bill due to past concerns with legislative proposals expanding the plan to allow small businesses and nonprofits to buy into the plan.

Known as the Partnership Plan, its poor financial performance compared with private sector plans made it a risky vehicle to expose taxpayers and small businesses to potential insolvency.

Since the plan’s inception in 2016, it has averaged a medical loss ratio of 100.6%, posting losses in three out of past six years.

Since the plan’s inception, it has averaged a medical loss ratio of 100.6%, posting losses in three out of past six years.

Coming out of the pandemic, the plan also posted a staggering 108.7% medical loss ration between July 2021 and June 2022.

The plan is further threatened by the departure of 14 towns—representing over 4,000 enrollees—opting to leave in the last year.

Towns were hit with a 10.5% premium increase last year and are facing a potential double digit increase next year as well.

The bill provides policymakers with important information, based on an independent actuarial analysis and audit, that better explain the plan’s impact on taxpayers and recommended design changes to provide future financial stability.

For more information, contact CBIA’s Wyatt Bosworth (860.244.1155) | @WyattBosworthCT

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.