2018 Legislative Session: Jobs Must Be Job One

Although a lengthy budget battle carried the 2017 General Assembly more than four months past its June 7 deadline, the session brought several positive developments for Connecticut’s economy and business community.

Now, with the start of the 2018 session just a month away, CBIA and its members urge policymakers to keep the state moving forward, toward a stronger economy and a more sustainable fiscal footing.

Connecticut has lost 15,300 jobs since June, a five-month slide that now marks a crisis point for the state’s struggling economy.

CBIA’s recently released 2018 Government Affairs Agenda contains recommendations for doing just that, with workforce development and continued fiscal reform as top priorities.

“2018 will be a pivotal year, as the spending cap, the borrowing cap, and some of the other budget reforms start to be implemented,” says Brian Flaherty, CBIA’s senior vice president, public policy.

“Much of our focus this year will be working with the administration and state agencies to ensure that all the fiscal reforms and other pro-jobs, pro-growth legislation approved last year is implemented.

“In particular, we’ll be looking to policymakers to deliver for Connecticut’s workforce and deliver for our members—especially those employers who are desperate for talent and relying on our high schools and community colleges to produce job-ready graduates.”

No Major Tax Hikes

One of the most significant legislative accomplishments in 2017 was the approval of a two-year, $41.3 billion bipartisan budget that closed a $3.5 billion shortfall without any major, broad-based tax hikes.

Although the plan contains nearly $1 billion in various tax and fee increases over the biennium, it does not raise the state income tax, sales tax, or corporate earnings tax.

“Over the last couple of legislative sessions, we’ve been able to close budget deficits totaling around $6 billion with no major tax hikes,” says CBIA president and CEO Joe Brennan.

The key is keeping the momentum going by making it easier for companies to create jobs in Connecticut.

"But we've really just scratched the surface.

"The key now is not only that we don't go backwards but that we keep the momentum going by expanding the fiscal reforms contained in the budget and making it easier for companies to create jobs in Connecticut.

"In the coming months, we'll be relying heavily on our members to keep the pressure on lawmakers to keep Connecticut moving in the right direction and ensure that we continue to defeat proposals that make it harder for employers to hire people and grow our economy."

Mandates Hurt Job Growth

The legislature avoided inflicting job-killing labor mandates on businesses last year, despite considering many such proposals—including a paid FMLA measure and a bill to increase the minimum wage.

"Ultimately, very few bad things happened last year on the labor front," says CBIA counsel Eric Gjede, "but all the same threats we've seen in past sessions still came up, and we had to spend a lot of time making sure they didn't materialize.

"It would be a wonderful session this year if we could simply avoid seeing all these cumbersome, new, one-size-fits-all mandates rolled out again.

One-size-fits-all mandates reinforce the perception Connecticut isn't a good place to grow jobs.

Lawmakers also moved forward on workforce development to help bridge the talent gap in Connecticut, a serious concern among many of the state’s employers, including manufacturers.

"The legislature took a very important step to strengthen Connecticut's technical high schools, which are critical to the supply line of jobs," says Flaherty.

"They pulled the tech high school system out from the Department of Education so that it's an independent entity, ensuring that the tech high schools don't get lost amid all the other state education programs.

"They also took steps to strengthen the pool of faculty in the tech schools by making it easier for people with real-world manufacturing experience to teach."

'A Long Way to Go'

Taking steps to see that industry can meet its workforce needs and continuing to rein in state spending are critical if the state is to meet its fiscal and economic challenges going forward.

In November, the state's nonpartisan Office of Fiscal Analysis reported that, based on spending levels in the new budget, deficits in 2020 and 2021 would total $1.9 billion and $2.7 billion respectively.

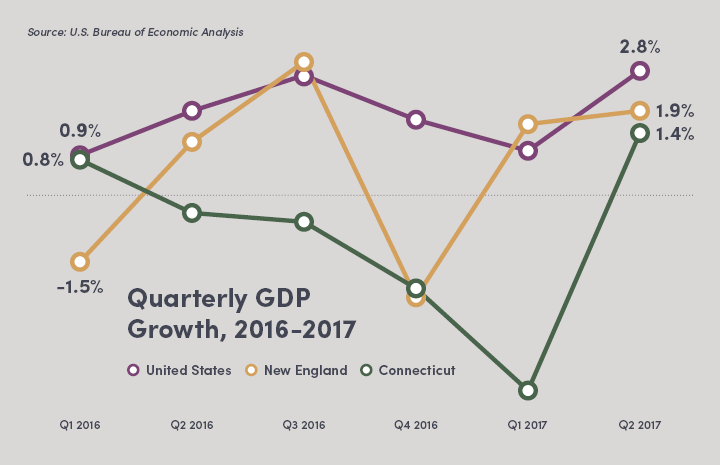

Connecticut's economic growth continues to lag the region and the nation.

In addition, sluggish economic growth is exacerbating the state's fiscal troubles.

Although the state's economy posted 1.4% GDP growth in the second quarter of 2017—a marked improvement over the first quarter, when the economy shrank by 4.4%—Connecticut continues to lag the U.S. economy, which expanded by 2.9% in the second quarter.

To add insult to injury, Forbes recently ranked Connecticut's business climate 42nd in the U.S., citing the state's poor fiscal health as a major factor.

Jobs Growth Hits Crisis Point

Connecticut has lost 15,300 jobs since employment hit a post-recession high in June, a five-month slide that now marks a crisis point for the state's struggling economy.

CBIA economist Pete Gioia says that trend stands in stark contrast to what's happening in the region and the country.

"You can't deny the fact that we now have a full-blown crisis in jobs," Gioia said.

Connecticut has a full-blown jobs crisis. We need bold reforms to jump start our economy.

"We know there are many thousands of jobs in manufacturing, trucking, building trades, and certain financial services that are going begging, so it's important that the administration, the legislature, and the private sector work closely together to supply employers with the skilled employees they need."

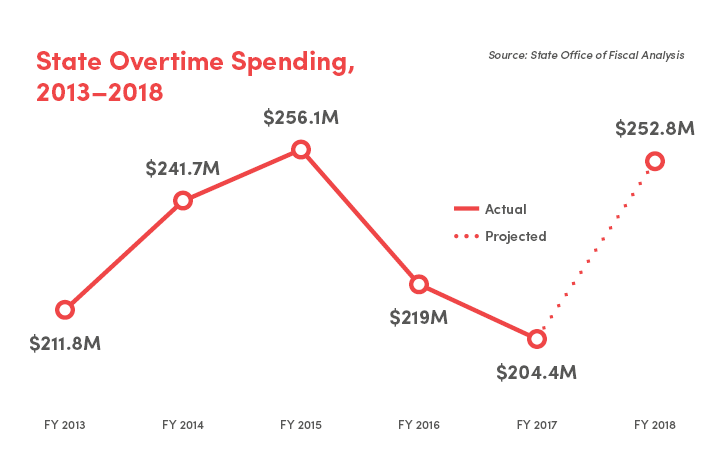

State Overtime Costs Rising

One area Gioia continues to see as ripe for reform is the use of overtime in state agencies.

OFA's quarterly overtime spending report released in November cited a 12% jump in overtime costs in the first quarter of fiscal 2018 compared to the same period last year.

Combined overtime costs for all state workers in the quarter was $63.2 million, an increase of $6.7 million over last year’s first quarter.

State employee overtime costs jumped 12% in the first quarter of fiscal 2018.

Overtime spending fell 7% in fiscal 2017 from 2016, when the state spent about $219 million. In 2016, state agencies cut overtime costs by $37.1 million compared with the previous fiscal year.

"Just five state agencies account for 94% of the total overtime bill for the first quarter, and four of them are up over the previous year," says Gioia.

"Clearly, the first quarter data showed that the management of overtime that started to take hold two years ago has evaporated."

To get the overtime trend moving in the right direction again, Gioia suggests bringing in outside auditors.

"It's a good idea that the comptroller's office and OFA monitor state overtime spending, but it may be time for the Auditors of Public Accounts to get involved.

"When agencies have 10, 20, or 100 workers using excessive overtime, professional outside oversight is warranted, and further reforms are sorely needed."

Growing the Tax Base

Solving the state's fiscal problems and driving economic growth will also require building up Connecticut's workforce, critical for keeping the state's businesses globally competitive and increasing tax revenue without resorting to economy-killing tax hikes.

"How do you bring in more revenue under our current tax system? You need more taxpayers," says Gioia.

He points out that there are currently more than 25,000 good-paying positions waiting to be filled in Connecticut in sectors such as manufacturing, trucking, construction, financial services, and energy.

"We have to develop a comprehensive solution to create a strong pipeline of new graduates to fill those jobs now,” he said.

"That's a lot of work, but it has to be done, because ultimately what it does is produce more taxpayers.

How do you bring in more revenue? You need more taxpayers.

"If we have 25,000 or 30,000 or 40,000 more taxpayers, by the time that comes around, we've got a much smaller problem."

The new two-year budget also created the Commission on Fiscal Stability and Economic Growth, charged with sending the General Assembly specific policy recommendations for fixing the state's economy.

The commission, which features eight business leaders among its 11 members, must make its recommendations by March 1 2018.

Those recommendations will be presented as a bill for an up or down vote by the state legislature.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.