Employers Will See Lower FUTA Tax in 2016

In a recent statement the Connecticut Department of Labor announced that Connecticut employers will pay lower Federal Unemployment Tax Act taxes, with no special assessment required, this calendar year.

The lower rates are the result of the state’s (i.e., the state’s employers) repaying the nearly $1 billion federal loan that was needed to make the Unemployment Compensation Trust Fund solvent and continue paying unemployment insurance benefits during the Great Recession—a debt that Connecticut businesses have been paying back for the last five years.

For more information, contact CBIA’s Eric Gjede (860.480.1784) | @egjede

As a result, an employer’s tax will return to an average of $42 per employee compared to the $189 paid while the loan was being repaid.

In addition, the state will pay the final interest due to the federal government this year, which means employers will not pay the additional special assessment.

Reforms Urgently Needed

Now that the federal debt has been repaid, Connecticut employers want to be sure it doesn’t come back.

“Much of the borrowing could have been avoided if Connecticut had made the same unemployment compensation reforms our neighboring states had made,” says CBIA Assistant Counsel Eric Gjede.

Many of those reforms, adds Gjede, are contained in HB 5367, a bill currently under consideration at the State Capitol. Reforms include:

- Raising the minimum earnings to qualify for unemployment benefits to $2,000. Claimants in Connecticut need only earn $600 in a year to qualify for benefits—the third lowest earnings requirement in the U.S. For perspective, 32 states/territories require between $2,000 and $5,000 in earnings. The earnings requirement in Connecticut has not been raised since the statute went into effect in 1967.

- Requiring claimants to post their resumes online to receive benefits after six consecutive weeks of unemployment. Rhode Island recently instituted this reform, which studies show gets the unemployed back to work faster. Connecticut’s Department of Labor already has an online resume listing portal in operation that can be used for this purpose.

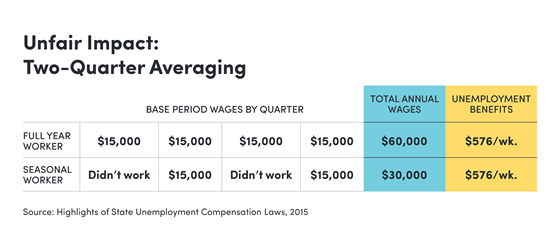

Connecticut employers pay more than four times the rate that businesses in neighboring states are paying. - Basing benefits on an employee’s annual salary rather than two highest quarters, to avoid inequitably rewarding seasonal workers. Sixteen states base employees’ benefits on a full year’s salary. Under current law, a seasonal worker in Connecticut earning $30,000 over the course of two calendar quarters would get the same amount of unemployment benefits as a full time worker earning $60,000 over four quarters. This reform will provide relief to businesses—especially farms—that hire a lot of seasonal workers.

- Freezing the maximum weekly benefit rate for three years. The maximum weekly benefit rate is allowed to increase by $18 every year. Freezing this for three years could save as much as $10 million per year.

Employers urge members of the Connecticut State House to move forward on HB 5367.

While Connecticut businesses had to pay a heavy price for lawmakers’ failure to enact solvency promoting reforms in the past, the mistake doesn’t have to happen again.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.