Navigating Travel Advisories and COVID-19 Paid Leave Laws

As employees make summer travel plans, employers are confronted with scenarios where the time the employee is out of the workplace extends well beyond the planned-for-vacation.

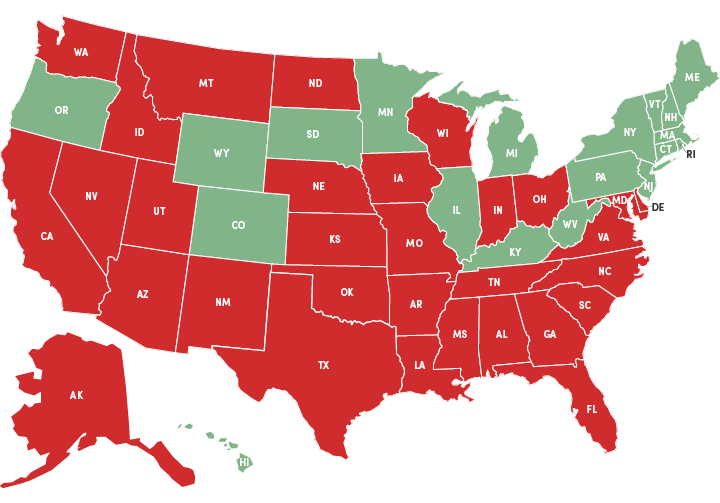

If an employee voluntarily travels to a state listed on Connecticut’s COVID-19 travel advisory, even for recreational purposes, that employee is subject to a mandatory 14-day self-quarantine.

Employees subject to the mandatory self quarantine are also eligible for up to two weeks (10 days/80 hours) of emergency paid sick leave at full pay under the Families First Coronavirus Response Act.

The FFCRA paid sick leave provisions apply to certain public employers and private employers with fewer than 500 employees (“covered employers”).

Covered employers qualify for dollar-for-dollar reimbursement through tax credits for qualifying wages paid under the FFCRA.

The FFCRA generally provides that covered employers must provide to all employees two weeks (up to 80 hours) of paid sick leave at the employee’s regular rate of pay where the employee is unable to work because they are quarantined pursuant to federal, state, or local government order.

Quarantine Orders

The FFCRA applies to a broad range of governmental quarantine or isolation orders including orders that advise some citizens to shelter in place, stay at home, quarantine or otherwise restrict their mobility.

Connecticut’s order is sufficient to trigger applicability of the emergency paid sick provisions of the FFCRA.

The mandatory extension of time an employee is out of the workplace with pay following a vacation is, perhaps, an unintended consequence of the confluence of the FFCRA and various state mandatory travel-quarantine orders including New York, New Jersey, and Connecticut.

Connecticut’s travel advisory order is sufficient to trigger the emergency paid sick provisions of the FFCRA.

Employers may not discharge, discipline, or otherwise discriminate against any employee who takes paid sick leave under the FFCRA and files a complaint or institutes a proceeding under or related to the FFCRA..

Over the course of the summer vacation season, employers have found and may continue to find themselves impacted by situations where employees are entitled to such paid leave benefits.

Employers should be aware of and consider the following issues regarding voluntary/recreational employee travel to impacted states, mandatory quarantine orders, and paid sick leave under the FFCRA.

1. Employer policies on employee travel

Employers may consider a memo to employees advising they keep abreast of and avoid booking a recreational trip to any of the designated states as doing so may delay their ability to return to work.

It is questionable as to what extent an employer can restrict employees’ personal travel to impacted states or take disciplinary action against an employee for such travel.

Whether employees may claim such restrictions violate their protections for off duty conduct and whether employers may have a defense based on business needs are currently open issues.

2. Telework is an option

An employee subject to the quarantine order may be able to telework, in which case the availability of such telework would make them ineligible for the paid sick leave provisions under the the FFCRA.

3. Testing Alternative

In some cases where an employee is unable to self-quarantine for the required period, the self-quarantine may not apply if the employee has had a negative test result for COVID-19 in the 72 hours prior to arriving in Connecticut.

It is questionable however, how “unable to self-quarantine” would be described or defined and it may be assumed that most travelers would be able to self-quarantine.

For more information, contact CBIA’s Brian Corvo (860.244.1169).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.