Top 10 Things They’re Not Telling You About Paid FMLA: Part II

As we noted last week, if something sounds too good to be true, it probably is—as is the case with the packaging of paid family and medical leave.

State lawmakers are considering two paid FMLA bills—SB 1 and HB 6212—mandating that companies with two or more employees allow employees up to 12 weeks annual paid leave at 100% of pay (capped at $1,000 per week) for their own or a family member’s illness.

It’s why CBIA and other organizations continue to stress that paid FMLA proposals are bad for employers, employees, and taxpayers.

As promised, here are the second five of the top 10 things paid FMLA advocates don’t want you to know:

5. State employees are exempt from the law. Before the two bills were voted out of the Labor Committee, they were changed so the new mandate applies only to the private sector and municipalities.

It appears the state exempted itself after agencies realized the cost and burden of the proposed program.

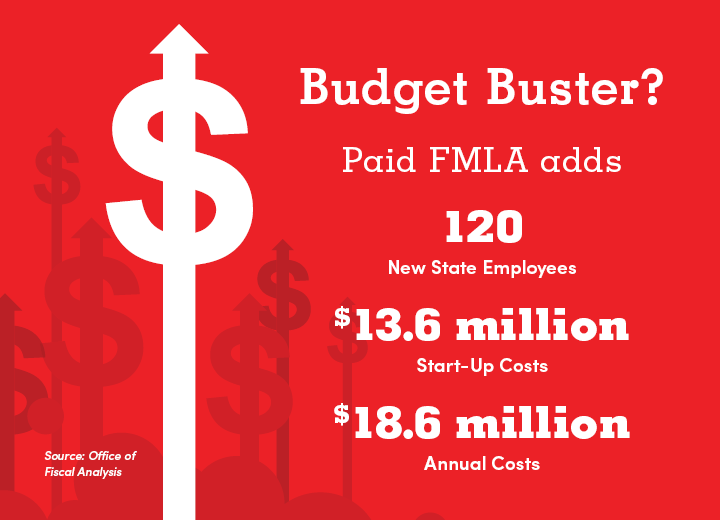

4. The state needs at least 120 new employees to run the program. Two years ago, the legislature instructed the Labor Department to hire a consultant to determine the costs of managing a paid FMLA program.

The only bid came from the Institute for Women’s Policy Research—a group with a history of supporting paid FMLA. Despite the institute’s support, its report indicated the state would need 120 new employees.

This year, the Labor Department’s testimony indicated the FMLA mandate actually requires the hiring of more than 120 employees. And while no official number was given, it may be as high as 180.

With state budget deficits over the next two years projected to be $5 billion or more, now is not the time for Connecticut to hire up to 180 new workers.

3. No other state has a paid FMLA programs like the one proposed in Connecticut. None. California, New Jersey, and Rhode Island actually have temporary disability requirements that were expanded in recent years to cover more than the employee. A similar program in New York takes effect in 2018.

While these programs function somewhat like a paid FMLA program, they are not the same. In addition, the benefits allowed under these programs are considerably more limited than Connecticut’s proposal.

The FMLA mandate requires hiring more than 120 new state employees, possibly as high as 180.

Even with the limited amount of leave offered in her state, Rhode Island Governor Gina Raimondo noted in her 2016 budget address that lawmakers need to "target waste and fraud, especially in our temporary disability program, and do more to make it easier to do business in the state."

In fact, the only program that comes close to what's been proposed here was in the state of Washington. The Washington state legislature approved it, but it was never implemented because its annual operating cost was estimated at $235 million. It offered the same benefits as the Connecticut proposal, and is probably a truer reflection of the cost here.

2. Paid FMLA will not attract people to our state. Actually, the opposite appears to be true. A 2016 article on TrendCT.org noted that the majority of residents leaving Connecticut are moving to Florida, North Carolina, and Pennsylvania.

None of these states have a paid family leave program in place.

That article also notes that more people came to Connecticut from Washington, New Jersey, Massachusetts, and New York than Connecticut residents went to any of those states—despite three of those states having some version of paid FMLA.

Connecticut residents are leaving for better tax climates or places where there are jobs. Paid FMLA is not a factor when deciding where to live.

1. Nothing keeps businesses that like paid FMLA from developing their own plan. CBIA encourages businesses that can afford it to voluntarily adopt such a program, but not all businesses can.

There's no need for a one-size-fits-all mandate because there are few barriers for a business to implement an FMLA program. Many do.

A business can offer the program by simply having employees sign a Labor Department-approved waiver. Then, they withhold a portion of their employees' wages and hold onto them in the event of a medical emergency for the employee or family member.

Businesses often use these waivers to set up holiday-savings programs or payback schedules when employees borrow from them.

And when a business and its employees decide to do this voluntarily, there is no cost to the state or taxpayers.

Employees and businesses that don't want this can simply opt out.

The reality is that many FMLA advocates appear more concerned about growing the size of state government and gaining more control of employee wages than providing paid leave.

Of all the facts of paid FMLA that advocates don't want you to know, that may be the most chilling of all.

For more information, contact CBIA's Eric Gjede (860.480.1784) | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.