GOP Lawmakers Propose $746M Tax Cut Plan

Republican state lawmakers this week proposed a $746 million tax cut plan that includes income tax reductions and temporary sales tax cuts.

Legislators called for a special legislative session to consider the plan, as residents and businesses grapple with rising inflation, including soaring gas and grocery prices.

GOP lawmakers want the General Assembly to meet before an expected steep increase in the state’s diesel fuel tax takes effect July 1.

The tax cut plan features both permanent and temporary relief measures, including:

- Reduce the 5% income tax rate to 4% for singles earning less than $75,000 annually and couples making less than $175,000

- For 2022, temporarily reduce the sales tax rate from 6.35% to 5.99% and suspend the 1% surcharge on prepared meals

- Suspend the scheduled July 1 diesel fuels tax increase, expected to add 10 cents to the current 40.1 cents per gallon levy

- Repeal the highway use tax scheduled to take effect Jan. 1, 2023

- Allocate an additional $42.5 million in energy relief for low-income households

Soaring Inflation

Inflation hit 8.6% in the 12 months ending in May, climbing at the quickest pace in four decades amid an unprecedented surge in gas prices.

Overall prices rose 1% from April—exceeding the projected 0.7% and much higher than the previous month’s increase of 0.3%, the highest since December 1981.

“Connecticut is unaffordable and growing more unaffordable by the day,” Senate Minority Leader Sen. Kevin Kelly (R-Stratford) said. “At the same time, Connecticut is overtaxing its residents.

“While state revenues surge because of inflation, household budgets are strained to the breaking point.”

Inflation hit 8.6% in May, the highest since December 1981.

House Minority Leader Rep. Vincent Candelora (R-North Branford) said the July 1 diesel tax hike “will drive prices for goods and services to a point that’s untenable for so many Connecticut residents.”

“Connecticut residents need relief, and our combination of short and long-term solutions such as a targeted income tax reduction will give residents confidence that government finally recognizes the state’s affordability crisis,” he said.

Finance, Revenue, and Bonding Committee co-chair Rep. Sean Scanlon (D-Guilford) said House Democrats were “open to additional relief.”

“The question is: ‘What is sustainable?'” he asked.

Reaction

Senate President Sen. Martin Looney (D-New Haven) and Majority Leader Sen. Bob Duff (D-Norwalk) issued a joint response, calling the Republican proposals “short-sighted and foolish fiscal ideas” that will “steer our state right back into the cycle of cuts and tax increases.”

Republican gubernatorial candidate Bob Stefanowski also called for the legislature to use one-third of the state’s current $3.8 billion budget surplus for tax relief.

“We need to understand what people are going through,” he told the Connecticut Mirror.

“We need to empathize with what they’re going through and most importantly, we need to do something about it.”

Gov. Ned Lamont told reporters he had no plans to call for a special session, pointing to the $600 million in individual tax relief included in the budget revisions adopted by the legislature earlier this year.

“You’re going to have a significant tax cut dropping into people’s pockets over the next two to three months,” he said.

“I think it’s going to represent $1,000 to most folks and that will make a real difference now, not at the end of the year.”

Economic Impact

CBIA president and CEO Chris DiPentima said that while this session’s budget measures were “a small step in the right direction for addressing the state’s high cost of living,” $330 million was temporary, including suspension of the state’s 25 cents per gallon gas tax through Dec. 1.

“While any tax relief is welcome, less than half of what’s in the budget package is recurring, so there are questions about the long-term impact beyond this year,” he said.

DiPentima added that lawmakers also ignored calls during the session to provide tax relief for struggling small businesses, battling rising costs and the labor force crisis.

“Connecticut’s high costs of living and doing business are major contributing factors behind our labor force crisis.”

CBIA’s Chris DiPentima

CBIA pushed for a number of small business relief measures, including paying down the state’s unemployment loan debt, repealing sales taxes on workforce training and safety equipment, expanding the R&D tax credit, and restoring the pass-through entity tax credit to 93%.

“Connecticut’s high cost of living and high cost of doing business are major contributing factors behind our labor force crisis and slow job growth,” he said.

“We must get people back to work—our labor force decline since February 2020 represents half of the region’s losses and 14% of the country,” he said.

Voter Opinion Polling

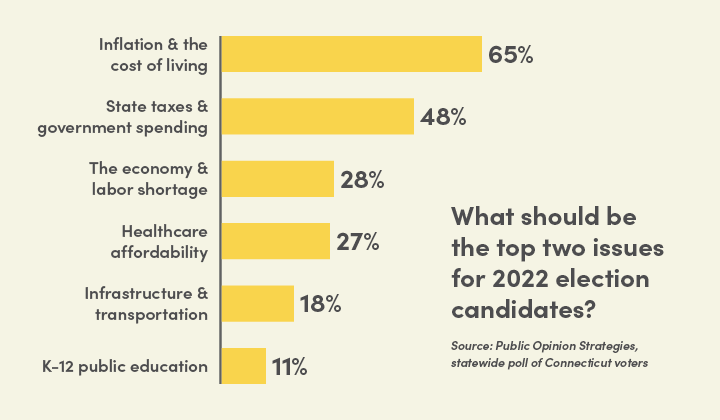

Recent opinion polls show that the state’s high cost of living and soaring inflation are major concerns for Connecticut voters.

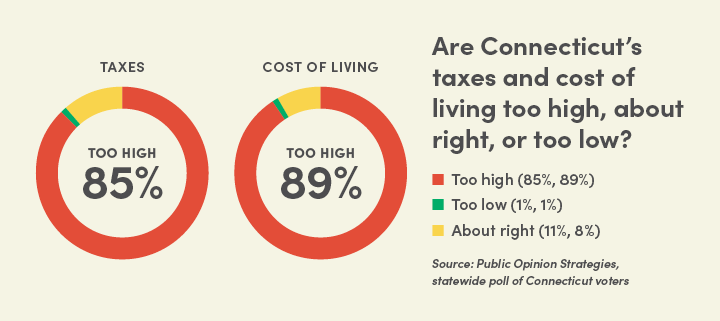

An April Public Opinion Strategies poll commissioned by CBIA showed 85% of voters believe state taxes are too high and 89% believe Connecticut’s cost of living is too high.

State taxes were seen as too high by 79% of Democratic voters, 88% of independents, and 91% of Republicans.

When asked to identify the two top issues for election candidates, 65% of respondents said inflation and the state’s high cost of living and 48% cited state taxes and government spending.

Inflation and affordability are the top issues regardless of political affiliation, identified by 63% of those who said they were registered Democrats, 66% of independents, and 67% of Republicans.

Fifty eight percent of voters told a May Quinnipiac University poll that they were worse off financially than a year ago, with 25% saying they were better off and 15% unchanged.

Only 13% believed the state’s economy is improving, while 45% told the Quinnipiac Poll it was getting worse and 40% thought it was static.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.