Red Ink: State-Run Health Plan Lost Over $10 Million in 2018

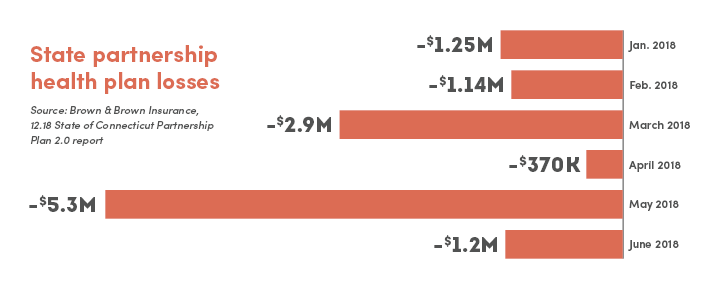

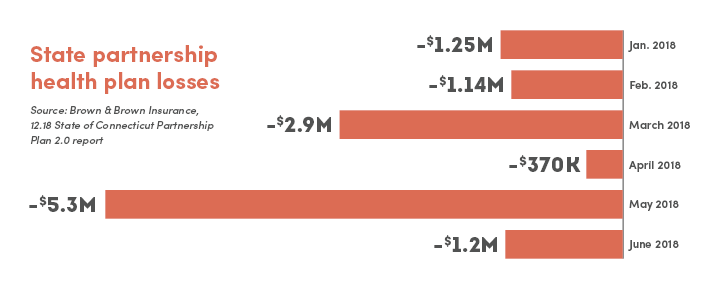

Connecticut’s state-run health insurance plan for cities and towns lost over $10 million in 2018.

State Comptroller Kevin Lembo acknowledged the plan paid out $10.3 million more in claims than it collected in premiums last year, raising new concerns about public option healthcare proposals.

Lembo’s office administers the Partnership Plan 2.0, which covers approximately 44,780 town, city, and other public sector employees.

“The claims loss experienced over the last year in the Partnership 2.0 plan will be factored into premium rates applied to both the state employee plan and partnership for fiscal year 2020,” he wrote in a letter to House Republican Leader Themis Klarides (R-Derby).

An independent study of the plan’s performance also shows claims exceeded premiums by more than $12 million through the first six months of 2018.

The state charges municipalities over $10,000 per enrolled employee annually to participate in the plan.

Public Option Bills

Lembo supports public option legislation, including bills opening the state employee health insurance plan—also managed by his office—to small businesses.

In his March 26 letter to Klarides, he wrote that the partnership plan, which launched in 2015, remains solvent and no state resources have been transferred to it.

These bills will not reduce the cost of insurance, and given the state’s precarious financial condition, could exacerbate the situation by adding more risk and more liability.

CBIA’s Joe Brennan

Klarides said the partnership plan’s financial performance raised questions about the viability of opening the state employee health plan to other groups.

“Any financial problems that impact the state, as well as our cities and towns, are of great concern to me and other members,” she said.

“Problems with the operation and finances of the partnership plan would raise more concerns regarding the state’s ability to further expand state-run programs.”

Affordable Option?

CBIA president and CEO Joe Brennan says the costs for municipalities to buy into the state employee program would have to be cut considerably, or less rich plans offered, to make it an affordable option for small business.

“We greatly appreciate the committee and Comptroller Lembo’s efforts to reduce the cost of healthcare insurance for small businesses,” he told the legislature’s Insurance and Real Estate Committee last month.

“Looking for innovative ways to expand access to health insurance should be encouraged.

“However, we believe that creating a buy-in to the state employee plan for small businesses will destabilize the health insurance market, require taxpayer subsidies to finance the program, and do little or nothing to reduce healthcare or premium costs—the biggest barriers to acquiring health insurance.

“These bills will not reduce the cost of insurance, and given the state’s precarious financial condition, could exacerbate the situation by adding more risk and more financial liability on the state.”

Brennan also noted that government-run programs could undermine the state’s insurance industry, a key economic sector that accounts for over 60,000 jobs in Connecticut.

For more information, contact CBIA’s Michelle Rakebrand (860.244.1921) | @Mrakebrand

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.