Report Highlights State-Run Healthcare Plan’s Solvency Issues

From Jan. 1, 2016 through Sept. 30, 2020, the state-run healthcare plan for municipal employees paid out $1.01 in claims and fees for every $1 collected in premium payments according to a new report.

The Brown & Brown Insurance State of Connecticut Partnership Plan 2.0: Claims, Demographics, and Other Considerations report, released this week, highlights the plan’s troubling fiscal performance and uncertain outlook.

The partnership plan lost $31.9 million in fiscal 2019—more than triple the $10.1 million in losses recorded the previous year.

The corresponding medical loss ratio for those years was 108.5% in 2019 and 105.2% in 2018.

Unlike private plans that are regulated by the Connecticut Insurance Department and must maintain an MLR well under 100%, the partnership plan is not subject to those same regulations.

While the partnership plan’s per member per month cost has risen consistently over time, the report does show that for fiscal 2020, its loss ratio declined to the lowest point in three years.

Claims Increase

State Comptroller Kevin Lembo, whose office administers the plan, made this point several times at a Feb. 9 public hearing of the legislature’s Insurance and Real Estate Committee.

However, the latest Brown & Brown report explains this past year’s MLR “was primarily due to delay in care related to COVID-19” and warned to “expect an increase in claims for the near future.”

The report shows that the plan had an MLR of 96.5% for fiscal 2020. However, this number does not reflect two important factors.

First, the fiscal 2020 numbers must factor for COVID-related adjustments. For instance, some carriers are estimating the rate of deferred medical services to be as high as 8%.

Second, the plan’s MLR does not include incurred but not reported costs. Brown & Brown estimates the current IBNR costs, or the plan’s current shortfall, at $33.3 million.

Premium Shortfalls

The Brown & Brown study utilized underwriting projections that “raise some concerns regarding the adequacy of the premiums being collected versus the claims being paid out.”

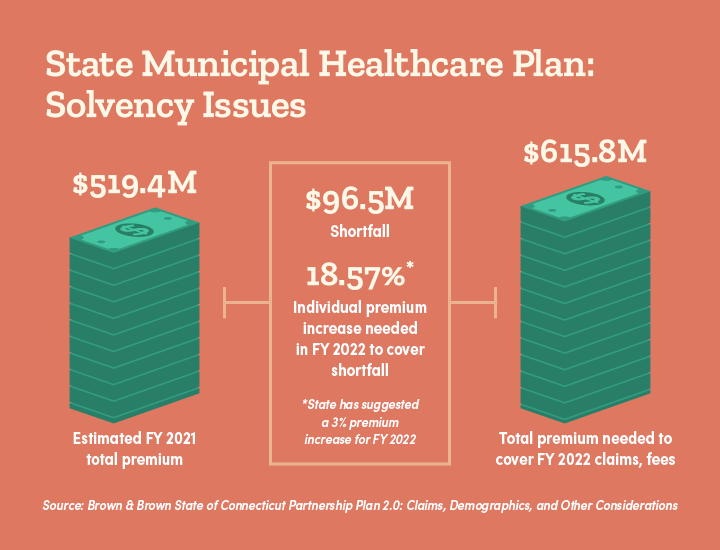

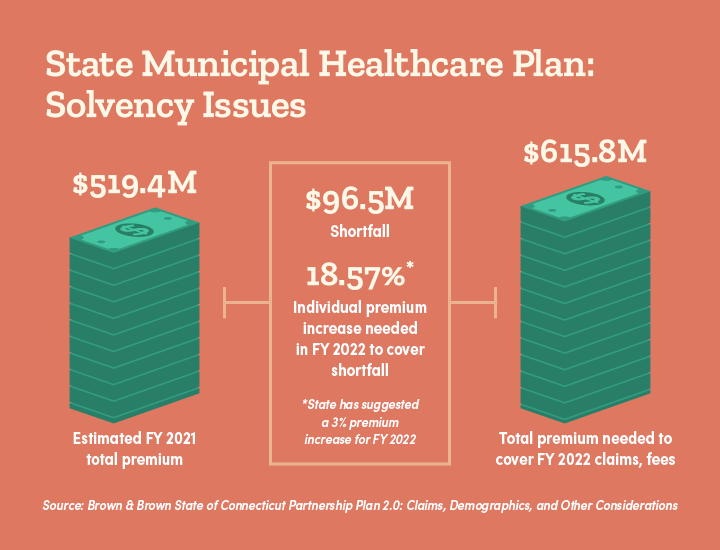

For example, Brown & Brown estimates that a total of $519 million in premiums will be collected by the plan in 2020-2021.

However, total premiums needed to cover claims and fixed costs for fiscal 2022 are projected at $616 million—a total shortfall of $96.4 million.

Premiums need to increase 18.57% to cover the projected deficit. The state released a preliminary premium increase of just 3%.

The Brown & Brown report notes annual premiums need to increase 18.57% to cover the projected deficit. However, the state released a preliminary premium increase of just 3% for the next fiscal year.

The partnership plan’s fiscal picture becomes visibly worse when adjusted for estimated current shortfalls and the reserve needed to cover runout claims.

After factoring in the $33.3 million IBNR shortfall and forecasted base costs for fiscal 2022, Brown & Brown estimates that plan premiums must rise 25% to cover a projected overall $129.8 million deficit.

This is evidence that partnership plan premiums are artificially suppressed, with fiscal reality clearly illustrating the need for significantly higher increases.

Public Option Concerns

The partnership plan’s uncertain fiscal outlook amplifies widespread concerns with a proposal to expand access to state-run healthcare through SB 842, the public option bill the Insurance Committee is currently reviewing.

That proposal allows the Comptroller’s office to establish a risk fund to pay claims that exceed premiums collected in a given plan, levying assessments on small employers, nonprofits, and multiemployer plans.

The provision means small businesses who opt into the public option plan will be the financial backstop for covering future deficits.

The provision means small businesses will be the financial backstop for covering plan deficits.

It’s either that or the state once again is on the hook for year-over-year deficits, with the dollar amount growing in size, along with the plan’s covered populations.

Meanwhile, the private market will shrink and suffer both the impact of adverse selection and possible job losses as a result.

Almost two-thirds of small business leaders (63%) surveyed by CBIA last month oppose the proposed public option plan.

Fifty-seven percent said they were concerned taxpayers would subsidize plan deficits and almost 50% said they don’t trust the state to manage health insurance plans.

SPP-Presentation-from-Brown-Brown-02-12-21For more information, contact CBIA’s Wyatt Bosworth (860.244.1155) | @WyattBosworthCT

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.