Credit Rating Agencies Upgrade, Maintain Outlook for State

Wall Street sent Connecticut good news this week, with rating agencies upgrading or maintaining their outlook and credit ratings for the state’s bond debt.

Kroll Bond Rating Agency raised its outlook for Connecticut general obligation bonds from negative to stable while reaffirming its AA- credit rating for the state.

Standard & Poor’s reaffirmed its positive outlook for the state’s GO bonds—which the agency upgraded from stable in March—and maintained Connecticut’s credit rating at A.

An improved outlook indicates an agency is less likely to downgrade the state’s rating, avoiding increased interest rates on borrowing and debt service.

The other two bond rating agencies—Moody’s and Fitch Ratings—also maintained their stable outlook and credit ratings for the state.

Moody’s rates the state’s outstanding GO bond debt and new bond issues as A1.

Fitch also affirmed its A+ rating for Connecticut’s outstanding GO debt and assigned the same rating for the state’s new bond issue.

Lamont: ‘Right Direction’

Gov. Ned Lamont said the ratings news showed the state’s finances were stabilizing.

“The credit rating agencies have affirmed Connecticut is continuing to move in the right direction, but there is still much work to be done,” he said in a statement.

“This year we were able to deliver an honestly balanced budget on time that held the line on tax rates for everyone, took significant steps to address the fixed costs, and added to our reserves.”

Fitch said its rating incorporates expectations for “relatively flat economic performance that will continue to challenge the state.”

Fitch said its Connecticut credit rating incorporates “expectations for relatively flat economic performance that will continue to challenge the state in matching revenues to expenditures, despite recent improvement in financial performance.”

Moody’s said its GO rating “reflects Connecticut’s high income levels, strengthened governance, and significantly improved liquidity, offset by high liabilities and the resulting high fixed costs for debt service, pension, and post-employment benefits relative to the state’s budget.”

‘Debt Diet’

Earlier this year, Lamont promised to put the state on a “debt diet,” pledging dramatic cuts in state borrowing, with annual bond authorization reductions of almost $600 million.

Connecticut averaged about $1.59 billion a year in bond authorizations between 2012 and 2019, with current obligations of $31.7 billion.

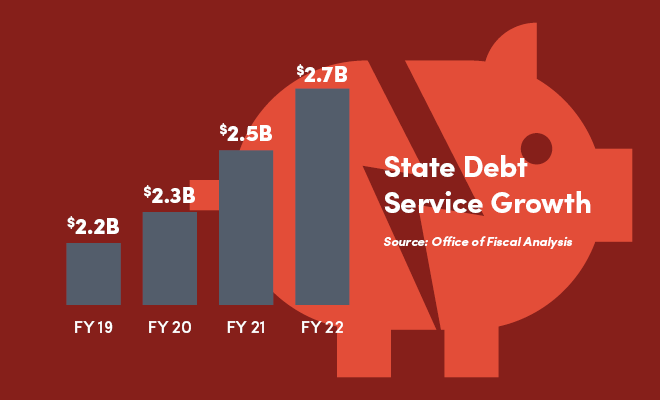

Debt service will cost the state $2.2 billion this fiscal year and is projected to rise 23% to $2.7 billion by fiscal 2022.

“The credit rating agencies, investors, businesses around the globe, and our taxpayers are watching what we do and have responded positively—so far,” Lamont said.

“As we move forward we cannot let them down by returning to old, bad habits and hoping for a different result.”

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.