Manufacturing Report: Labor Shortage ‘Greatest Growth Threat’

Ari Santiago knows the passion and commitment that runs deep through Connecticut’s manufacturing community—no more so than during the pandemic.

“People want to make an impact,” the CompassMSP CEO told fellow manufacturing leaders at the Oct. 29 Made in Connecticut: 2021 Manufacturing Summit.

“They want to think what they do every day matters. And the manufacturing that we do here in Connecticut, it matters.”

Santiago spoke on a panel moderated by RSM’s Ryan McGurk that also featured National Graphics executive vice president and CFO Michele Etzel and Graham Robinson, senior vice president and president of Stanley Black & Decker unit Stanley Industrial.

Santiago’s optimism reflects the responses from other manufacturing leaders in the 2021 Connecticut Manufacturing Report, released at the conference by CBIA and affiliates CONNSTEP and ReadyCT with the support of RSM.

High Demand, Limited Supply

This year’s report captures how the state’s manufacturing community is navigating coronavirus pandemic disruptions, transitioning from what essentially was survival phase to pursuing growth opportunities.

It also reveals the factors behind that cautious optimism, with many manufacturers experiencing jumps in profitability, sales, and economic outlook.

And it spotlights the most significant issue facing the industry, and the country: the labor shortage.

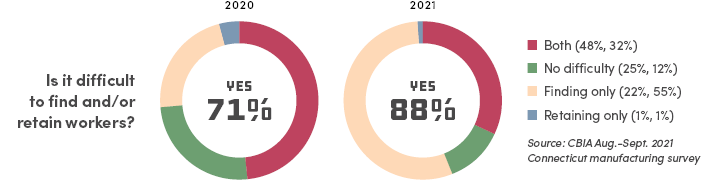

Nearly nine in 10 (88%) of manufacturers report difficulties finding and retaining workers, a 17-point jump from last year, and 41% describe the labor shortage as the state’s main obstacle to growth.

In the foreword he wrote for the report, Connecticut chief manufacturing officer Colin Cooper notes that demand for skilled manufacturing labor is more than 40% above pre-pandemic levels.

However, despite those thousands of unfilled job openings, there were 7,900 less manufacturing employees in Connecticut in September 2021 than in February 2020.

Recovery

The sector has recovered just 38% of jobs lost in March and April of 2020, while Connecticut has recovered 69% of all COVID-19 related job losses.

“Connecticut manufacturers are innovating to meet the challenges—cooperating, collaborating, and coordinating to identify new sources of talent and training opportunities,” Cooper wrote.

The pandemic exacerbated the labor shortage, an issue that has hampered Connecticut manufacturing growth for years.

A number of factors continue to drive the shortage of skilled workers, including the current wave of sector retirements, the state’s high cost of living, misperceptions about manufacturing as a career choice, and the need to continue aligning educational curricula with employer needs

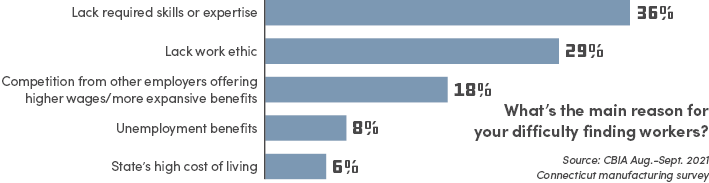

Thirty-six percent of those manufacturers struggling to find workers said applicants do not possess the required skills or expertise for the job, 29% report candidates lack the proper work ethic, and 18% cite competition from other employers offering higher wages and/or more expansive benefits.

Forty-three of surveyed manufacturers want lawmakers to prioritize investments in education and vocational training programs, 18% support additional unemployment reform, 14% want lower taxes—including exempting training programs from the state sales tax—and 12% called for work incentives.

Aging Workforce

Of those struggling to retain employees, 58% cited competition from other employers offering higher wages and/or more expansive benefits as the largest obstacle, 11% cited lack of employee engagement and recognition, and 10% credited the state’s high cost of living.

McGurk said that although “there is a need for that talent out there, there seems to be a very limited supply.”

Robinson noted a “rapidly aging workforce,” “a very very complex supply chain,” and “an environment that is very stressful overall” all add up to “a situation that makes it very, very difficult to attract and retain employees.”

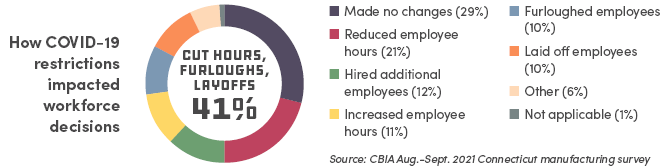

Etzel explained how her company “made a point” to keep all of their employees working during the worst of the pandemic, but had to make significant changes to their business operations, including enhanced air filtration, socially distanced workers, extensive cleaning, and “everything everyone else has done, but we did it very quickly.”

Although it was not easy, it was important to Etzel to retain all employees throughout the pandemic.

‘Ability to Adapt’

The pandemic has forced manufacturers to reassess their relationship with their employees.

Santiago said that to make employees feel valued, employers must move past short-term solutions and ask “do they understand the impact they can make by working here? Do they understand where their career can grow by investing their time here?”

“We have to win the hearts and minds if we want the hands to follow,” he said.

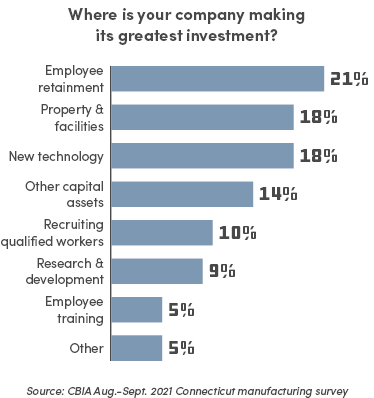

Not surprisingly, employee retention initiatives—including new benefits and enhancing company culture—were the priority investment for 21% of respondents, followed by property and facilities (18%), new technology (18%), other capital assets (14%), recruiting qualified workers (10%), research and development (9%), and employee training (5%).

Robinson focused on the disconnect between what employees think is important and what employers think is important.

Employers think “people want more money, people want to be promoted,” but what employees think is “I want to feel valued, I want my supervisor to respect me, I want to have an environment in which I like coming to work.”

“Our ability to adapt … is really what will separate us from the rest,” he said.

Opportunities

Speaking at the beginning of the Oct. 29 conference, CBIA president and CEO Chris DiPentima expressed optimism for Connecticut’s recovery, while encouraging greater collaboration between the public and private sectors.

“The opportunities for the state’s economy, job growth, and our communities are vast,” he said.

“Nonetheless, we must continue working together and policymakers must amplify their commitment to rebuilding Connecticut better and stronger than ever.”

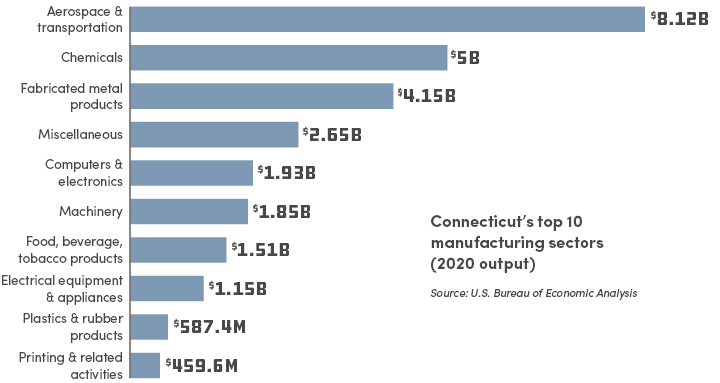

The manufacturing sector’s 2020 performance last year was the highest since 2015 and matched its 2019 output, contributing $29.66 billion to the state’s GDP, 11% of Connecticut’s gross domestic product.

That output included $13.8 billion in exports—down 15% from the previous year—and more than $19.7 billion in defense contracts.

All but one of the state’s export sectors declined in 2020, with pharmaceuticals the exception, as shipments of medicaments, pharmaceutical goods, bandages, and immunological products soared more than 138%.

Aerospace parts and components, the state’s leading export sector, fell 30% to $4.37 billion as the pandemic decimated global commercial air travel.

Profitability, Economic Outlook

When CBIA surveyed manufacturers last summer, only 47% expected to return a profit in 2020, 28% anticipated losses, and 11% projected to break even.

The actual returns were more positive, with 64% reporting a profitable 2020, 22% posting losses, and 14% breaking even. n 2019, 76% of Connecticut manufacturers were profitable, 13% broke even, and 11% saw losses.

Seventy percent of manufacturers anticipate a profit in 2021, one-fifth (20%) expect to break even, and only 10% projected losses—the latter the lowest percentage in the three years of this survey’s publication.

Over half (53%) of surveyed manufacturers expect their business to grow next year, a 35-point increase from last year’s survey. Over one-third (35%) expect to hold steady, and only 12% forecast a contraction (down from 45% last year).

Manufacturers are optimistic about the outlook for the state and national economies, with 40% projecting that Connecticut’s economy will grow over the next 12 months, a 30-point increase from last survey.

Thirty-seven percent expect the state’s economy to remain static, and less than a quarter (23%) expect it to contract, down 37 percentage points from last year.

Fifty-eight percent believed the U.S. economy will grow in the next 12 months—a 26-point increase from last year—24% expected it to remain static (23%), and only 17% projected a contraction (46%).

“It is clear that the resiliency and innovative spirit that marked the response by Connecticut manufacturers during the initial months of the pandemic continues,” DiPentima told the 200-strong in-person audience (another 40 watched the event online).

‘Now Is Our Time‘

One quarter (25%) of surveyed manufacturers believe proximity to customers is the greatest advantage to running a business in Connecticut, followed by quality of life (23%), a skilled workforce (20%), access to major markets (8%), and a strong industry-specific ecosystem (6%).

Etzel said being based in Connecticut “allows us to be centrally located” and provides “a ton of opportunity” by being on the coast and near major cities.

“We’re close to our people, we’re close to our clients, and that’s really important,” she said.

McGurk also cited the size of the state allowing significant connections between “the public sector, the private sector, and educational institutions.”

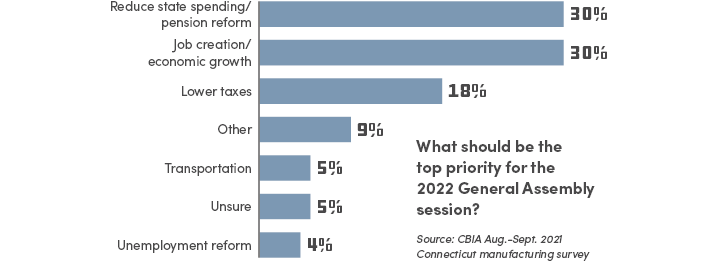

For the 2022 legislative session, 30% of manufacturers want state lawmakers to focus on job creation and economic development. Another 30% prioritized spending and pension reforms, with 18% calling for lower taxes..

McGurk noted the importance of “continued investment from the Capitol down on vocational training” and getting young people entering the manufacturing workforce.

Robinson spoke about how in Connecticut, organizations “can make a difference in people’s lives. And manufacturing is the perfect vehicle to do this.”

“Few other states have the opportunity we have, with the proximity, the location, and the types of companies that we have,” he said. “Now is our time.”

Competitiveness

McGurk noted that while the manufacturing industry is more competitive than ever, “competition is welcome, it’s a good thing.”

“Competition is what drives and helps companies strive to be profitable,” he said.

Etzel warned about complacency.

“Don’t get complacent,” she said. “If our state wants to do well, we have to remember that so do the other states.”

Staying focused on continuous improvement will “keep people here, and make it more exciting for people to come in.”

“Wherever there’s change, there’s opportunity. We have to go out and do the work. If we do, the sky’s the limit.”

CompassMSP’s Ari Santiago

Robinson said that he was in fact looking forward to the various challenges facing the industry.

“What I see is a movement from resilience to agility,” he said.

Robinson said the reimagining of the relationship between employer and employee is “ultimately the reason for optimism, because that’s how we get to the hearts of the people that we need in the factories.”

Santiago mirrored that sentiment, saying “wherever there’s change, there’s opportunity,” and that “we have to go out and do the work” to make the most of the opportunities Connecticut offers manufacturers.

“If we do, the sky’s the limit.”

The Made in Connecticut: 2021 Manufacturing Summit was produced by CBIA, CONNSTEP, and ReadyCT and made possible through the generous support of TD Bank with additional support from RSM, GuardSight, and Stanley Black & Decker.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.