Insurance Department Approves Workers’ Comp Rate Cuts

For the fifth consecutive year, Connecticut employers will see their workers’ compensation insurance premiums decrease in 2019.

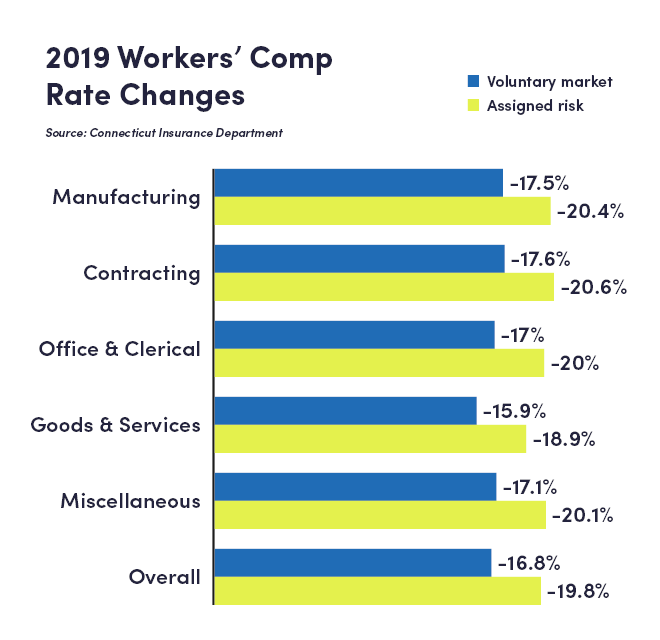

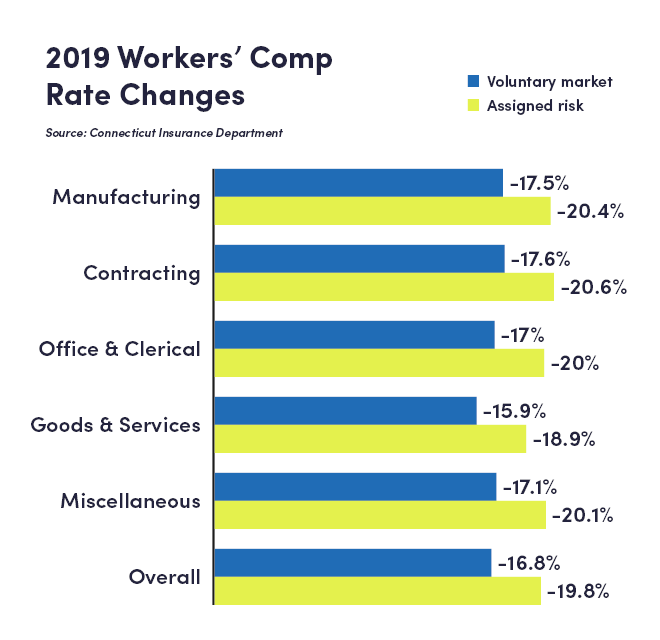

The Connecticut Insurance Department this week approved an average overall rate decrease of 16.8% for the voluntary market.

The department accepted recommendations proposed in September by the National Council on Compensation Insurance, which analyzes and recommends rates in more than 40 states.

“Considering that so many costs are rising for Connecticut businesses, this is good news,” CBIA’s Louise DiCocco said.

“Whether your company is small or large, workers’ compensation insurance represents a significant expense.

“This will be welcomed by all Connecticut businesses as it’s a substantial cost savings for employers.”

Claims Decline

CID commissioner Katharine Wade said workers’ compensation rates have steadily declined by nearly 50% over the last five years. The rates reflect an ongoing decrease in the number of workplace injuries and claims filed.

“The rates reflect an ongoing decrease in the number of workplace injuries and claims filed,” Wade said in a statement.

“We are also seeing, on average, lower medical costs per claim.”

NCCI recommended a 16.8% overall average rate reduction for the voluntary market and a 19.8% reduction for the assigned risk market.

The rate cuts vary by industry classification. In the voluntary market, they range from 17.6% for contracting to 15.9% for goods and services.

Manufacturers will see at 17.5% reduction in the voluntary market and 20.4% in assigned risk.

Connecticut regulators approved a 14% overall rate reduction last year based on NCCI's recommendations.

Overall rates dropped 10.9% in 2017, 3.9% in 2016, and 0.6% in 2015, ending five consecutive years of premium increases.

For more information, contact CBIA's Louise DiCocco (203.589.6515) | @LouiseDiCocco

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.