Report: State’s Fiscal Health, Tax Policies Erode Manufacturing Climate

Connecticut’s fiscal instability and high state and local taxes led to the downgrading of the state’s manufacturing climate this week by an independent national study.

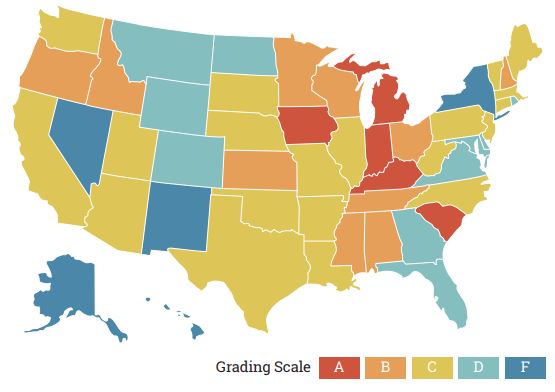

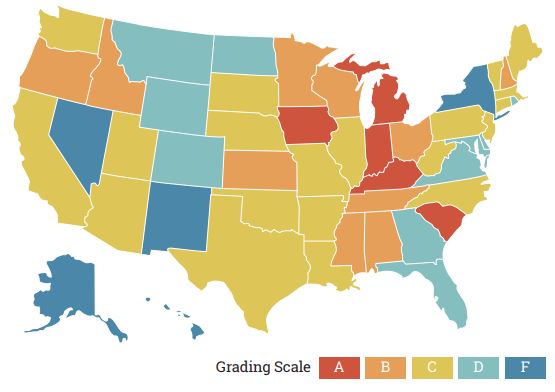

Conexus Indiana and the Ball State Center for Business and Economic Research dropped Connecticut’s manufacturing climate to a C grade in their 2018 Manufacturing and Logistics Report Card for the United States.

The 2018 Manufacturing and Logistics Report Card graded Connecticut’s manufacturing climate graded C-.

The annual report ranks states in several areas of the economy critical to the manufacturing and logistics sectors, including human capital, cost of worker benefits, diversification, productivity and innovation, fiscal liability, tax climate, and global reach.

Connecticut was graded highest for global reach, earning a B+ grade, up from last year’s B. The state’s manufacturers exported almost $14 billion in goods last year.

Workforce, Productivity

Human capital earned a B- grade, unchanged from 2017, while productivity and innovation dropped from a B+ grade to B.

“The value of manufactured goods per worker—productivity—as well as firm access to inventions and innovations is critical to the long-term performance of a firm and the industry as a whole,” the report noted.

Unfunded liabilities represent an expected fiscal liability gap, which is a good indicator of the direction of future taxes and public services.

Sector diversification earned a D grade, after receiving a D- last year.

Fiscal Liability, Tax Climate

The state's tax climate received a D grade, unchanged from 2017, while fiscal liability fell to a D- from last year's D grade.

Connecticut faces projected budget deficits of $2.2 billion in 2020 and $2.9 billion in 2021, driven in part by growing unfunded state employee pension and retirement benefit liabilities.

"Unfunded liabilities represent an expected state fiscal liability gap, which is a good indicator of the direction of future taxes and public services," the report said.

"Business taxes, individual income taxes (both on workers and small business), sales, unemployment, insurance, and property taxes all play a role in assessing regions for a potential employer location."

New Hampshire's manufacturing climate earned a B- grade, the highest of the New England states. Massachusetts and Vermont both received C grades, followed by Maine (C-) and Rhode Island (D).

Indiana, Iowa, Kentucky, Michigan, and South Carolina led all states with A grades, while Alaska, Hawaii, Nevada, New Mexico, and New York earned failing grades.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.