2012 Survey of Connecticut Businesses

For over a decade, BlumShapiro and CBIA have partnered to produce the annual Survey of Connecticut Businesses, which explores the economic, fiscal, and regulatory climates for companies of all types and sizes throughout the state.

Since our last survey, conducted in the summer of 2011, the state’s economy has fluctuated, growing at a moderate pace through January 2012 but struggling to expand in the ensuing months.

Though companies are cautiously optimistic about their own profitability and hiring over the next year, business confidence remains fragile, and key metrics point to continued slow growth in the economy.

Key Findings for 2012

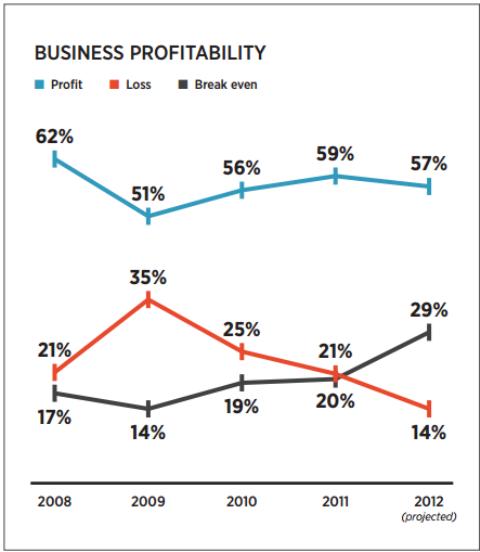

- Business profitability has not rebounded to prerecession levels but continues on a slight upward trajectory. The majority of companies surveyed (59%) recorded a net profit in 2011, and 57% expect a profit in 2012.

- While most companies surveyed (69%) have a negative view of Connecticut as a place to operate a business, the number of businesses considering moving or expanding to another state within the next five years (31%) is down significantly from 49% last year who contemplated moving or expanding out of state.

- The state’s quality of life and proximity to customers and major markets—historically seen as two of the greatest advantages of doing business in Connecticut—are still perceived as major assets. Its skilled workforce, however, traditionally considered a strength, has slipped in the view of business leaders. Fewer than one-third of businesses surveyed identified Connecticut’s workforce as a major asset.

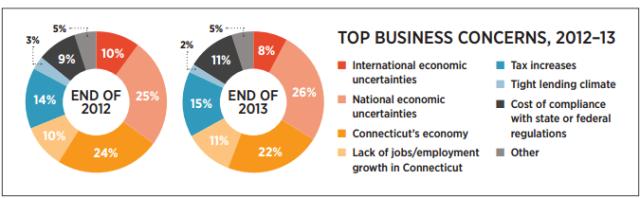

- National economic uncertainty topped the list of businesses’ greatest concerns over the next 18 months. Concerns about Connecticut’s economy ranked second, followed by tax increases. Roughly equal numbers of businesses are worried about Connecticut’s sluggish job growth (10%), international economic instability (10%), and the state and federal regulatory burdens (8%); however, concerns about international economic uncertainty for 2013 diminish (8%), while concerns about compliance costs (11%) and unemployment (11% of respondents) over that same period increase.

- This year’s results reflect an improvement in the lending climate and access to capital: Half of all businesses surveyed introduced a new product or service in the past 12 months, more than half plan to over the next 12 months, and only 2% rank credit availability as their top concern through the end of 2013. The average investment in research and development (R&D) is 4% of annual sales. (Excluding companies who made no investment, R&D investment averaged 8% of annual sales.)

Business Conditions

The number of respondents describing current conditions as good is not as high (20%), but that number increases as businesses look out to the end of 2012 (25%) and 2013 (26%). At the same time, the number of businesses projecting poor conditions decreases slightly (currently 14%, down to 13% by the end of 2012 and 10% in 2013).

Only around 5% believe conditions will be excellent over the next 18 months.

We still have a long road ahead to achieve solid, sustainable growth.

Profitability

Performance indicators are relatively similar to 2011, pointing to a tepid economy and slow growth.

Fifty-nine percent of businesses surveyed recorded a net profit in 2011 (an increase of three percentage points over 2010), and 57% expect to record a profit in 2012. Twenty-one percent broke even in 2011, and 29% expect to in 2012.

While most firms are on track for growth, 20% recorded a net loss in 2011 (down slightly from 25% in 2010), and 14% expect a loss in 2012.

For manufacturers, the picture is somewhat brighter.

Nearly two-thirds of those surveyed (64%) recorded a net profit in 2011 (a decrease of six percentage points, however, from 2010), and 66% expect to in 2012.

Manufacturers also had fewer net losses. Thirteen percent saw a net loss in 2011 (down three percentage points from 2010), and 7% expect a loss in 2012. Another 23% broke even in 2011, and 28% expect to in 2012.

Innovation

Exporting, R&D

Innovation is in the DNA of this state.

The development of new products and services, which are often well-received by foreign markets and can command a premium price (helping offset high costs), are vital to the state’s economy.

Over the past 12 months, half of all businesses surveyed introduced a new product or service (down slightly from last y

Among manufacturers, innovation is somewhat higher than for non-manufacturers. Fifty-six percent of manufacturers introduced a new product or service in the past year, and 60% plan to in the next 12 months. Of those whose businesses are incorporated, roughly one-third of manufacturers took advantage of the R&D state tax credit for which they are eligible.

Connecticut is also a strong exporter, setting records over the past several years in the dollar amount of exported goods.

Twenty-nine percent of all respondents and 73% of manufacturing respondents export.

For half of the manufacturers who export, international trade accounts for 1-9% of annual sales; the rest realize 10% or more of their annual sales revenue from exporting. Top destinations for Connecticut exports are North America, North Asia/Pacific Rim, and Western Europe.

The chief barriers to export expansion, respondents say, are competition, lack of knowledge of some foreign markets, and licensing requirements.

Jobs

Hiring up, skilled workforce slipping

In 2012, 43% of respondents hired or had plans to hire new full-time workers (as opposed to replacement workers), and 44% planned to hire new employees in 2013.

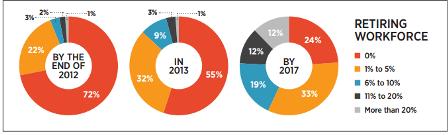

Despite an unemployment rate exceeding 7%, nearly half (48%) of all businesses surveyed (and 58% of manufacturers) report having difficulty finding qualified workers. Add to that the anticipated retirement of large numbers of baby boomers, and the challenge for Connecticut’s employers is clear.

One out of every four businesses surveyed expects at least 10% of their workforce to retire in the next five years; half of those anticipate losing over 20% of their workforce to retirement in that period. Forty-six percent say they are not very confident, not at all confident, or unsure of their ability to find qualified workers to meet their needs over the next three years.

Two promising initiatives have begun to address Connecticut’s talent shortage: a major education reform bill signed into law earlier this year and the expansion of precision machining training in several of the state’s community colleges.

The state also adopted a broad program of training and hiring credits as well as loan programs in the 2011 special session and recently expanded those with provisions that apply to businesses with up to 100 employees.

Connecticut’s Departme

Though a substantial number of survey respondents have added jobs or plan to do so, only 16% so far have taken advantage of the state’s incentive and loan programs.

Connecticut’s Assets, Challenges

Quality of life, proximity to markets still rank high; business environment weak

Proximity to major markets (Boston/New York City) and customers (51%) and a high quality of life (50%) are consistently cited by business leaders as two of Connecticut’s biggest assets.

Not surprisingly, the state’s highly educated workforce, cited by 50% of respondents last year, was identified as a major asset by only 30% of this year’s respondents.

A smaller percentage of respondents identified the state’s transportation infrastructure, telecommunications infrastructure, per capita income, and local suppliers as major advantages of operating a business in Connecticut.

Fewer respondents this year, compared to recent years, were of the opinion that Connecticut lacks any significant advantages. Nonetheless, a number of businesses, when asked to name Connecticut’s greatest assets, responded “none” or “I can’t think of any.”

These sentiments are in line with national indices that give Connecticut a low rating for its business climate. In Forbes’s Best States for Business, for example, while Connecticut took second place for quality of life, it ranked 19th for labor supply, 42nd for regulatory environment, and near bottom (47th) for business costs.

Only 15% of respondents have a somewhat or very positive view of Connecticut as a business-friendly state. Most (69%) have a somewhat or very negative opinion.

Roughly one in three businesses say they are considering moving or expanding to another state within the next five years, and nearly one in three have been approached by other states (mostly within the last year) about relocating or expanding there.

The most aggressive states have been Virginia, North Carolina, Florida, South Carolina, Massachusetts, and New Jersey.

If they hope to hold on to Connecticut businesses and the jobs that they create, state policymakers must continue to focus on making Connecticut more competitive and deal with the state’s long-term fiscal challenges.

Economic, Policy Concerns

Effects of 2011 tax hike

In spite of significant and widespread financial crises throughout Europe, only 10% of respondents named international issues as their greatest concern for 2012.

More pressing in the minds of businesses are national economic concerns (26%), Connecticut’s economy (24%), and tax increases (14%). Despite many positive actions by government officials during both the October 2011 special session and the 2012 session, these remain the primary concerns for 2013 as well.

Only 18% of businesses are somewhat or very optimistic that Connecticut will overcome its problems and have a vibrant, growing economy over the next five years. Most (61%) are somewhat or very pessimistic that this will happen, and 21% are unsure.

The reality is worse: 79% of businesses surveyed this year said the tax hike has had a negative impact on their firms.

Clearly, business tax relief—especially for S corporations and other pass-through entities that are hit hard by personal income tax hikes—should be part of policymakers’ agenda to spur hiring.

Risk Management

Technology, fraud protection, disaster planning

More than a quarter (26%) of survey respondents rely on cloud computing to a significant extent, using remote servers, system software, or other off-site infrastructure and platforms to deliver computing services or store data in ways that are more reliable, scalable, and secure.

Over half (53%) have a cybersecurity plan, and 21% report that one or more of their customers require such protection.

Slightly fewer (48%) have a disaster recovery plan in place.

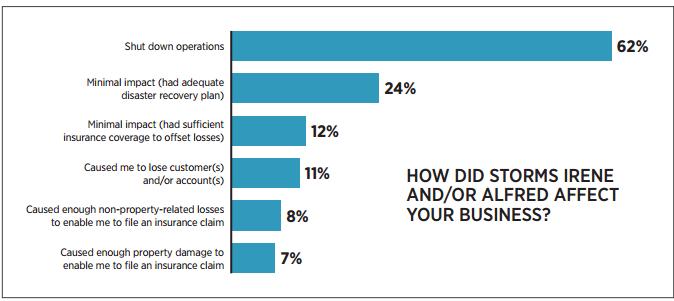

Last year, two major storms—Irene and Alfred—battered our state, knocking out power to thousands of businesses and residents. Sixty-two percent of respondents noted that they had to temporarily shut down operations (the mean shutdown time was 4.26 days), 12% reported a loss of customers or accounts, and 15% filed a property or non-property insurance claim.

In addition, several businesses noted a significant loss of billable hours and productivity. On the other hand, 24% reported minimal impact from the storms because of their disaster recovery plans.

The overwhelming majority of businesses surveyed (86%) have a code of conduct for employees, and 69% have anti-fraud policies and procedures in place.

Seventeen percent of respondents have been impacted by fraud in the past year, and more than half of those (54%) report that the perpetrator was an employee. Vendors, customers, and online fraud perpetrators were also named by 7%, 15%, and 14% of businesses respectively.

Alternatives, renewables, efficiency

Energy costs and policies are among the top three factors driving global manufacturing competitiveness, according to the 2010 Global Manufacturing Index developed by Deloitte and the U.S. Council on Competitiveness.

Unfortunately, Connecticut has one of the lowest penetration rates for natural gas, and its commercial and industrial electricity costs (which are tied to the price of natural gas) are the 10th highest in the nation.

While businesses we surveyed this year showed modest interest in and implementation of alternative energy resources (such as solar, wind, and biomass), 47% have ramped up their energy efficiency efforts.

The state’s Department of Energy and Environmental Protection is currently developing a comprehensive energy strategy (CES) that incorporates plans for diversifying the state’s fuel sources (including expanded access to natural gas), establishing viable goals for renewable energy, and hardening the state’s energy transmission and distribution infrastructure.

Future surveys will explore the impact of DEEP’s CES on producing cleaner, less expensive, and more reliable energy solutions for Connecticut’s business consumers.

Conclusion

Connecticut businesses are still struggling to grow in a post-recession economy. Business profitability and hiring intentions give some hope for the near future, and innovation, exporting, and better credit conditions will continue to help.

Despite the largest tax increase in Connecticut history in 2011 and promised (but so far unrealized) spending reductions, the state has been unable to solve its short- and long-term fiscal problems—raising concerns about the potential for additional tax increases for many businesses.

While some progress has been made in expanding small-business access to state financing programs and streamlining regulatory processes, Connecticut still has a long way to go in creating a business climate that fosters entrepreneurialism, business expansion, and job creation.

The 2012 Survey of Connecticut Businesses was emailed in June to businesses throughout the state. There were 580 responses, for a margin of error of +/-4.15 percent.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.