2013 Survey of Connecticut Businesses

BlumShapiro and CBIA have partnered to produce the 2013 Survey of Connecticut Businesses. This annual study, now in its twelfth year, is the premier research report examining the profitability, outlook, workforce, and legislative priorities of Connecticut’s business community.

Despite incremental employment gains and stronger credit demand and availability, however, the business outlook is far from optimistic.

Key Findings

- Roughly half of Connecticut business leaders surveyed (48%) rate conditions for their companies as below average.

- While a majority of businesses surveyed (56%) expect to record a net profit this year, that number is down slightly from the 59% that were profitable in 2012.

- Amid concerns about skills shortages, hiring expectations for 2014 are positive.

- Nearly one-third of businesses were approached by other states in the last five years about relocating or expanding, with most activity occurring in the past 12 months. More than half of the manufacturers surveyed received offers from other states.

- Most businesses (63%) report considerable investments in technology over the past 12 months. Fewer, however, invested significantly in employee training (45%), facilities/property (37%), capital assets (29%), or research and development (22%). Increases in the personal income tax rate, adopted as part of Connecticut’s 2012–2013 budget, were identified as having a dampening effect on capital investment, expansion, and hiring.

- The majority of businesses surveyed today have disaster recovery plans—a positive trend from a year ago.

- Controlling government spending is the top recommendation for ensuring a growing state economy.

- More than one in five companies (22%) report being negatively impacted by this year’s federal budget cuts (sequester).

- Businesses are mixed on whether they feel prepared to implement provisions of the Affordable Care Act (ACA), or federal healthcare reform.

- Exporting continues to be strong: 79% of Connecticut manufacturers and 32% of Connecticut businesses overall are engaged in international trade.

Business Outlook, Profitability

Reflecting steep declines in business confidence across the globe—back to levels not seen since the U.S. financial crisis—business optimism in Connecticut waned in the first half of 2013.

Expectations for the end of 2013 and 2014 show some improvement: while 48% of respondents rate current conditions for their companies as below average, only 38% believe that will be the case by the end of 2014.

At the same time, the number of companies expecting better-than-average conditions inches up to 27% by the end of 2013 and 32% by the end of 2014.

While more than half of businesses surveyed (56%) expect to record a profit this year, that number is down slightly from 59% that were profitable in 2012.

Twenty-eight percent of respondents expect to break even in 2013, up from 18% who broke even in 2012. Sixteen percent anticipate a net loss in 2013, down from 23% in 2012.

Economy: Stuck in Neutral?

Though economic growth has been steady, it has been slow, signaling a persistently weak rebound from the recession and the possibility of long-term stagnation.

In fact, Connecticut’s economy is the single greatest concern for 34% of businesses in 2013, followed by national economic uncertainties (21%), the tax burden (14%), implementation of Obamacare (11%), and compliance costs associated with federal and state regulations (9%).

Jobs

State and national economic weakness, poor business conditions, and labor costs associated with government mandates were cited as major barriers to job creation over the next two years. While business sentiment remains negative, however, job creation plans show modest improvement.

Of the companies looking to hire, however, 66% are having trouble finding qualified workers.

Sixty-three percent of respondents hired temporary or seasonal workers in the past five years, primarily because of workload fluctuations (cited by 66% of those hiring). Other reasons identified for temporary and seasonal staffing were to manage healthcare costs (21%), control overtime expenses (13%), and fill positions for which it was difficult to find qualified full-time staff (12%).

Sixteen percent of respondents used H-1B visas to bring in skilled workers; 10% plan to start or continue using H-1B visas. More than a quarter of those respondents (27%) who petitioned for H-1Bs say they do not have enough access to the visas to satisfy their workforce demands.

Among businesses overall, the greatest demand in 2013 is for mid-level professionals, followed by line workers. Fewer companies are looking to fill entry-level positions.

Expectations are the same for 2014, with the demand for mid-level professionals intensifying. (For manufacturers, production workers are in greatest demand for 2013 and 2014.)

As baby boomers begin to retire, the need for mid-level professionals is expected to become more acute.

One in ten employers expects retirement rates in excess of 20% between now and 2018.

Risk Management

Sixty-two percent of respondents in our 2012 Survey of Connecticut Businesses temporarily shut down operations as a result of major storms Irene and Alfred the previous year (with a mean shutdown time of 4.26 days).

Businesses surveyed in 2013 reported similar disruptions, but to a much lesser extent: physical locations closed or compromised (32% of respondents), production delays (28%), reductions in orders (24%), delays in processing orders (21%), and major repairs of facilities or equipment (10%).

In the wake of recent superstorms, more Connecticut companies than ever have business continuity strategies. Today, 58% have disaster recovery plans in place, compared to 48% only one year ago. According to our 2007 Survey of Connecticut Businesses, fewer than a third of companies surveyed (30%) had any kind of business continuity plan, and only 21% had a plan for natural disasters.

In spite of great strides in these areas, there is room for improvement. This year’s survey finds that only about half of Connecticut businesses (45%) consider themselves well-prepared in the event of a storm or other natural disaster; 44% believe they are somewhat prepared. One in 10 report that they are unprepared or unsure.

Innovation and Continuous Improvement

In addition, 63% invested in new technology, and 45% in employee training.

Lean/continuous improvement and 21st century workplace design models are in place at many Connecticut manufacturing facilities. These include Kaizen (43% of manufacturers surveyed), cellular manufacturing (41%), 5S (40%), Kanban (37%), and Six Sigma (29%).

Technologies that manufacturers use or plan to use include ISO 9000 (59%), additive manufacturing/3D printing (34%), cloud computing (39%), new product development (NPD) software (27%), robotics (27%), and enterprise social software (17%).

Exporting

One in three companies surveyed are engaged in international trade. Among manufacturers, the number of exporters is significantly higher—79%—an increase of six percentage points over last year.

Among respondents, top destinations for Connecticut exports are, in order, North America, North Asia/Pacific Rim and Western Europe (tie), South Asia, Eastern Europe, South America, and the Middle East. Chief barriers to export expansion are competition, lack of knowledge about certain foreign markets (in particular, Asia, Eastern Europe, and Latin America), and licensing requirements.

When asked which country has the greatest potential over the next decade as an export destination for their company, most respondents identified China or Mexico. Brazil, India, Canada, Japan, and Germany also were named.

Connecticut’s Assets, Challenges

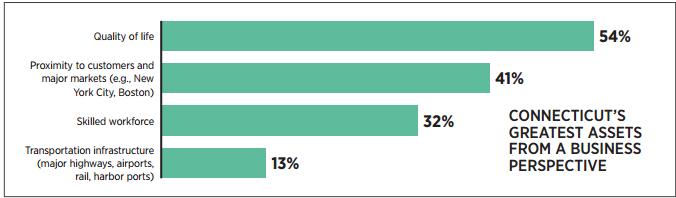

Quality of life (cited by 54% of respondents) remains one of Connecticut’s greatest business assets, followed by proximity to customers/major markets (41%).

Skilled workforce, typically cited by more than half of businesses as a key asset, was identified by fewer than one-third of all businesses surveyed (32%). Respondents who did not characterize Connecticut’s workforce as a key asset cited a decline in workers’ skills (34%), a workforce no more or less skilled than those of other states (30%), and a shortage of skills specific to their business needs (23%).

In spite of the state’s quality of life and strategic location, 80% of Connecticut business leaders surveyed have a negative or somewhat negative opinion of Connecticut as a place to operate a business. Nearly two-thirds (65%) are somewhat or very pessimistic about the state’s economy over the next five years.

Indeed, CNBC’s annual state business rankings (released the same month we surveyed businesses) found that Connecticut sank to 45th place nationwide, slipping for the third consecutive year in categories such as the cost of doing business (falling from 43rd place last year to 46th), infrastructure and transportation (ranked 49th, ahead of Hawaii only), and education (moving from second place to fifth).

The increase in the personal income tax rate adopted in 2011 has had a lingering effect on Connecticut business owners, 62% of whom report a direct impact on their company budget and, consequently, decisions on hiring, capital investment, and expansion.

When asked in an open-ended question what single action state government could take to grow Connecticut’s economy, respondents overwhelmingly noted a reduction in state spending. Balancing the budget, easing the tax and regulatory burdens, addressing state pension issues, and providing tax incentives and support for small businesses were also proposed as solutions.

Affordable Care Act

National polls conducted earlier this year revealed that employers’ concerns about the federal Affordable Care Act were delaying hiring and expansion decisions—primarily because of a lack of clarity about how the law would affect business costs and operations. With a round of changes to the law’s provisions and deadlines in recent months, concerns about implementing the ACA are no less acute now.

In an open-ended question on actions taken or anticipated because of healthcare reform, Connecticut businesses offered a wide range of responses, among them:

- “Cost-sharing plans”

- “No new hires”

- “Talk to advisors”

- “Raising deductibles to mitigate price increases”

- “Just starting to pull back the curtain on this”

- “Continue to offer healthcare—it’s a good thing”

- “Spending more time reviewing current insurance plans, compliance”

- “We have not decided what to do yet”

The majority acknowledged they did not have enough information to proceed with a plan.

Note: Our survey was conducted prior to the Obama administration’s July 2013 announcement that the ACA’s employer mandate will be delayed until 2015. The mandate penalizes employers with 50 or more full-time equivalent employees who do not provide health benefits that comply with the law.

Connecticut’s Place in a Competitive Market

Nearly one-third of Connecticut businesses say they were approached by other states in recent years about relocating or expanding. Ten percent were contacted in the last two to five years. Twice as many (20%) were approached in the last year alone.

Manufacturers are significantly more likely to be courted by other states: 56% have received offers in the last five years. States most actively recruiting are North and South Carolina, followed by Florida, Virginia, and Texas.

Although most business leaders surveyed say they have no plans to move in the next five years, manufacturers are more inclined to consider relocation—34%, compared to 21% of businesses overall—a threat that could have a ripple effect on an already struggling economy. (Fifty-nine percent of companies surveyed say they depend on large Connecticut companies for business.)

A bleaker outlook, deep and persistent concerns over Connecticut’s economy, and flagging momentum in the state’s economic recovery suggest that lawmakers have their work cut out for them in the 2014 legislative session.

To boost business confidence and job creation, company leaders are calling on legislators first and foremost to control state spending and balance the budget without any additional tax increases.

They also point out that the interests of big and small businesses often are seen as mutually exclusive in public policy discussions, when in fact the two groups are largely interdependent.

The 2013 Survey of Connecticut Businesses was emailed to 5,112 businesses (both CBIA members and nonmembers) in late June and early July 2013. We received 377 responses—141 from manufacturers—for a return rate of 7.4% and a margin of error of +/- 5.2%.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.