2014 Survey of Connecticut Manufacturing Workforce Needs

CBIA partnered with the Connecticut Community Colleges’ College of Technology’s Regional Center for Next Generation Manufacturing and UIL Holdings Corporation to survey the state’s manufacturers about their hiring expectations and workforce challenges.

We thank the following organizations for their support in distributing and publicizing the 2014 Survey of Connecticut Manufacturing Workforce Needs:

- Aerospace Components Manufacturers

- Bridgeport Regional Business Council

- Central Connecticut Chamber of Commerce

- Connecticut Community Colleges’ College of Technology’s Regional Center for Next Generation Manufacturing

- CONNSTEP

- Department of Economic and Community Development

- Eastern Connecticut Chamber of Commerce

- Manufacturing Alliance of Connecticut

- Middlesex County Chamber of Commerce

- New England Spring and Metalstamping Association

- New Haven Manufacturers Association

- Smaller Manufacturers Association

Introduction

As the single largest contributor to Connecticut’s gross state product, manufacturing is vital to our state’s economy.

From power tools to roof racks, jet engines to fire alarms, products made in Connecticut are sold throughout the U.S. and worldwide.

Connecticut’s nearly 4,500 manufacturing firms:

- Represent a number of key industries, including transportation equipment (primarily aerospace, submarines, and automotive), chemicals, fabricated metals, electrical equipment, computer and electronic products, machinery, food and beverages, and plastics

- Directly employ over 161,000 workers (representing 10% of all nonfarm jobs in the state), with each new manufacturing job creating 1.5–4 jobs in other sectors; jobs are typically full-time with benefits, hourly wages averaging $22.83, and frequent opportunities for overtime

- Pay nearly $14 billion in wages

- Contribute more than $24 billion of the state’s output; every dollar of manufacturing input has an impact of $1.35 in output across the economy

- Make private capital investments totaling $1.3 billion annually

- Pay over $137 million in state corporate business taxes, before credits

- Account for more than $181 million in annual sales and use taxes

- Are responsible for the vast majority of the state’s nearly $13 billion per year in defense contracts

- Export $16.5 billion in products to over 200 countries around the world

The Milken Institute’s State Technology and Science Index, which evaluates states’ tech and science capabilities and their success converting those assets into companies and high-paying jobs, ranks Connecticut ninth in the country.

We are fourth in business R&D per capita, fifth in the percentage of scientists and engineers in the workforce, fourth in the nation (and seventh in the world) in gross state product per capita (28% above the U.S. average), eighth in patents issued per 100,000 workers (40% over the national average), and ninth for manufacturing value added per production hour worked.

Value added per manufacturing worker in Connecticut is $313,652, which exceeds the national average.

CBIA’s business and economic surveys consistently find that most manufacturers (more than 60%) introduce new products each year, and a skilled workforce is critical to their productivity and ability to innovate. Our findings also suggest that a growing shortage of skilled workers threatens the future of Connecticut manufacturing.

With a trend toward onshoring, a surge in aerospace demand (expected to double in the next 10 years), and the potential for abundant, low-cost natural gas to power the industry and lower its energy costs, Connecticut manufacturing is ripe for significant expansion.

But that will happen only if we boost our high-skill manufacturing workforce—a task made more challenging by an aging workforce, waning interest among young people in pursuing manufacturing careers, and skill deficits and training needs of job candidates.

Hiring Expectations

Most anticipate modest growth (1–5%) by the end of 2015 and in 2016, although more than one in eight project growth in excess of 10% by 2018.

Manufacturers will be hiring primarily full-time employees by the end of 2015—85% of respondents—a significant jump from 2011, when only 30% of manufacturers surveyed planned to make full-time hires.

Part-time positions also will open up (12% of manufacturers plan on hiring part-timers, compared with 6% in 2011).

Nearly one-third of manufacturers are developing or expanding an apprenticeship program (30%). Other strategies include hiring consultants or temporary workers (16%) and outsourcing work (9%).

Thirteen percent of manufacturers report that they are unsure how they will replace retiring workers, and 4% do not plan to fill positions vacated because of retirements.

Jobs in Demand

Jobs in Demand

We listed 14 manufacturing jobs and asked respondents to report the number of current vacancies they have for each type of job as well as the number of workers they plan to hire for those positions in 2014 and 2015.

The largest single category of employees manufacturers expect to hire will be entry-level production workers (identified by respondents as some of the easiest jobs to fill), followed by CNC machinists, mechanical/manufacturing technicians, engineers, quality control workers, and tool and die makers.

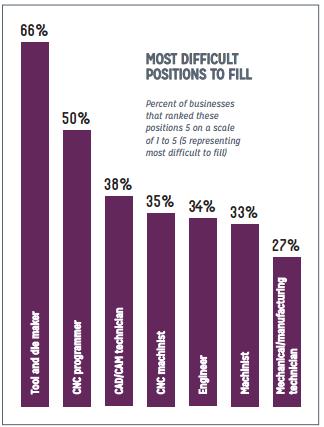

CNC programmers were second (50%), followed by CAD/CAM technicians (38%), CNC machinists (35%), engineers (34%), machinists (33%), and mechanical/manufacturing technicians (27%).

Based on the data collected from our sample, we estimate 9,300 job openings statewide across these 14 categories by the end of 2015.

Skills Gap

Qualities most lacking among recent hires or attempted hires are overall employability and technical skills (both cited by 60% of manufacturers surveyed).

Other deficits are advanced skills (cited by 33% of manufacturers), interpersonal/teamwork skills (31%), and leadership (24%).

Aside from employability and basic skills identified in a separate question, we asked Connecticut manufacturers to weigh in on the specific skills most important to their companies’ competitiveness.

The top answer was critical thinking and problem solving (cited by 98% of respondents), followed by engineering (94%), robotics and automation (93%), CNC programming, (93%), CAD/CAM (92%), and technical writing/comprehension (91%).

Training is rarely offered in these areas; for the most part manufacturers expect the employees they hire to come to the job with these skills.

On-the-job training focuses primarily on occupational health and safety (71% of manufacturers surveyed), quality (51%), CNC machining (51%), blueprint reading (47%), and instrumentation (44%).

Of those companies that provide employee training, onsite training is most common (98%). Less frequent is classroom training outside of work hours (46%) or during work hours (42%). Manufacturers are somewhat more likely to offer online training during work hours (22%) than outside of work hours (20%).

Nearly two-thirds of respondents (65%) provide tuition reimbursement.

Among the businesses we surveyed, the greatest barrier to expanding their capabilities in advanced manufacturing technology is not cost or lack of time, but lack of talent.

A shortage of manufacturing employees with engineering/four-year degrees, a steep learning curve, and an overall lack of in-house expertise are the biggest hurdles.

Education

Connecticut manufacturers typically hire graduates from schools and colleges within the state. (Out-of-state recruits are primarily college graduates.)

In general there is greater satisfaction with graduates who have attained higher levels of education as well as more technical training relevant to manufacturing.

Graduates of major universities (such as UConn) and Connecticut’s private colleges are largely viewed as qualified job candidates (77% and 78% of respondents, respectively, are satisfied or highly satisfied).

Two-thirds of manufacturers (68%) are satisfied or highly satisfied with graduates of Eastern Connecticut State University, Central Connecticut State University, and other schools in the state’s university system.

Forty-four percent of manufacturers report being satisfied with traditional high school graduates; only 2% are highly satisfied with this group, while nearly one in five (18%) are dissatisfied or highly dissatisfied with them.

By contrast, 52% of manufacturers are satisfied, and 15% are highly satisfied with graduates of technical high schools, while 12% report being dissatisfied or highly dissatisfied with those hires.

Recommendations for how educational institutions could address the problem of skill deficits include a greater emphasis on basic employability skills (50%), student internships (39%), better technical training (37%), career development (27%), and more rigorous preparation in reading, writing, and math (also 27%).

In terms of enhancing job candidates’ technical skills, manufacturers emphasize computer numerical control, blueprint reading, and hands-on experience.

Credentials

Credentials count in hiring decisions for many manufacturers, and industry recognition of various credentials increased measurably in the past three years.

When we last surveyed Connecticut manufacturers in 2011 about their workforce needs, 92% were unfamiliar with the ACT National Career Readiness Certificate compared with 70% today; 82% were unfamiliar with Manufacturing Skills Standards Council (MSSC) certification compared with 55% today; 72% were unfamiliar with American Welding Society (AWS) certification compared with only 34% in 2014; and 66% were unfamiliar with National Institute for Metalworking Skills (NIMS) credentialing compared with 55% in 2014.

A greater awareness of manufacturing credentials, however, does not always translate into greater appreciation of those credentials. The portable, stackable ACT National Career Readiness Certificate, for example, verifies core qualities such as personal effectiveness, foundational academic skills, and general workplace skills that employees need to succeed in any entry-level manufacturing job. While 30% of manufacturers surveyed are familiar with this certificate, only 3% value it. At the same time, while 75% of manufacturers consider entry-level production jobs the easiest to fill, they also express a need for job candidates with better foundational skills.

The credentials recognized and valued by the greatest number of manufacturers surveyed are those offered by the Society for Manufacturing Engineers (SME). NIMS and AWS are also widely recognized and valued.

Forty percent of manufacturers surveyed use credentials as part of the hiring process; 43% say credentials help them gauge a new hire’s potential success in the workplace; and 59% say that given a choice between two otherwise equal candidates, their company is more likely to hire the candidate with nationally recognized credentials. Only 24%, however, agree that such credentials impact salary or promotion considerations.

Future Workforce

Connecticut manufacturers plan to hire a considerable number of skilled full-time workers between now and 2016 to fill existing and projected vacancies due to employee retirements and company growth. They need a pipeline of well-qualified workers to meet that demand.

Unfortunately, relatively few young people are interested in pursuing careers in manufacturing, and those who do frequently fall short in either (or both) the technical and basic skills necessary to succeed.

Satisfaction with high school graduates improved since our last survey, when only 28% of manufacturers were satisfied with graduates of traditional high schools (compared with 46% today) and 61% were satisfied with graduates of technical high schools (compared with 67% today). Satisfaction with graduates of community college associates degree programs remains relatively high (70%) despite falling from 2011 levels (76%). Satisfaction with graduates of community college certificate programs remains steady (72% today, compared with 71% in 2011).

Because Connecticut manufacturers tend to hire locally, workforce issues must be addressed at the local level as well.

First, educational, civic, and industry leaders must ensure that the image young people and their families have of manufacturing matches the reality: While the contemporary manufacturing environment is clean and high-tech and offers good salaries, negative and outdated perceptions about the manufacturing workplace and earning potential persist.

Increased emphasis on tours, student internships, and teacher externships at leading Connecticut manufacturing facilities would go a long way toward changing the stereotype.

Second, schools must continue partnering with manufacturers to ensure that their curricula, technologies, and methodologies keep pace with the industry’s evolving needs. Recent progress in this area can be seen in the establishment of advanced manufacturing centers at several of the state’s community colleges, offering business-driven curricula and measurable outcomes.

Our questionnaire was emailed to manufacturing executives and human resource directors throughout Connecticut in late March and early April 2014. The survey had 246 respondents, for a 6.7% response rate and a +/– 6.38% margin of error.

Participating manufacturers employ over 27,000 workers in all eight counties in Connecticut and represent a wide variety of sectors, most commonly aerospace, metals, machinery, and chemical manufacturing.

They range in size from 2 to 900 Connecticut employees, with annual sales from $1 million to $20 billion.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.

Jobs in Demand

Jobs in Demand