2016 Survey of Connecticut Small Businesses

CBIA’s first-ever survey of small businesses, which includes significant input from family-owned and -operated enterprises, is aimed at better understanding and responding to the needs of Connecticut’s small businesses.

Our survey comes at a time when hiring is up and credit availability is good, but reports from McKinsey and others also show the state’s small business development is weak and legislative mandates on existing businesses are having a negative impact.

The survey was conducted in March and April 2016, in a presidential election year and in the middle of a Connecticut General Assembly session where the state budget took center stage.

Our findings guide us in developing programs and services and lobbying for public policies that help Connecticut’s small and family businesses succeed.

Who Are Connecticut’s Small Businesses?

Nationally, small businesses employ roughly 57 million workers, with an annual payroll exceeding $2.3 trillion. More than 99% of all U.S. businesses are small businesses, defined as having 500 or fewer employees.

A significant number of small businesses are family-owned and operated.

Vital to their communities and to the economy, family businesses comprise 80%−90% of all businesses in North America, contributing 50% of the nation’s gross domestic product, employing more than 60% of the U.S. workforce, accounting for over three-quarters of new job creation, and outperforming non-family firms on measures such as operating return on assets.

Small and family-owned companies make up the majority of CBIA’s membership and represent a cross-section of the state’s business community.

Participants in this year’s survey include manufacturers; professional services; utilities; retailers; construction companies; nonprofits; software/tech; medical; hospitality/ tourism; finance, insurance, and real estate firms; and businesses engaged in communications, transportation, and wholesale trade.

Most are long-time Connecticut companies, averaging 40 years in business. Four percent have been in business more than a century.

Key Findings

- The top three challenges for Connecticut’s small businesses are profitability and growth (31% of respondents); government regulations, mandates, and other policy decisions (21%); and the cost of doing business/taxes (20%).

- When asked if they believe that Connecticut’s public policies facilitate the efforts of small businesses in the state, more than nine out of 10 businesses (92%) said no.

The personal income tax is the single biggest tax challenge for small firms, followed by the corporate tax and property taxes. Many small businesses noted, however, that the problem isn’t any one tax but, in one respondent’s words, “a swarm of them,” including unemployment and workers’ compensation.

The biggest plus to doing business here is location (proximity to customers, vendors, family, other businesses in the supply chain, and major metropolitan centers), followed by quality of life and a skilled workforce. The biggest minuses are taxes, specifically; and a poor business climate and high business costs, generally.

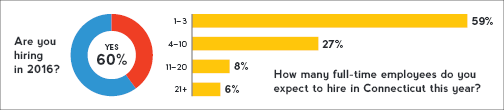

- Sixty percent of small businesses are hiring in 2016, though most will hire fewer than four new workers.

- Thirty-eight percent plan to expand this year, compared to 13% who say they will contract.

- Nearly two-thirds of small businesses surveyed (64%) say that over the past year, they or their employees communicated with state legislators about their business challenges and needs. Sixty-nine percent are not confident legislators will act consistently and predictably in enacting or rejecting legislation affecting business over the next three to five years.

- Sixty-five percent say Obamacare has had a negative impact on their business, compared to 7% who say the impact is positive.

- Labor regulations are overwhelmingly the most problematic for Connecticut’s small businesses.

- Sixty-five percent say their company brand has benefited from Facebook, LinkedIn, Twitter, and other social media; 61% have a social media presence.

- Data breaches worry 78% of respondents, and 79% have increased cyber security at their firm over the past year. Fewer (57%) have a disaster recovery plan.

Growth & Challenges

As a business location, Connecticut has its pros and cons.

For most respondents, Connecticut is home. It’s where small business owners trace their family roots and where they’ve raised their own families.

Not surprisingly, this is what respondents like best about running a business in Connecticut. As several business owners put it, “Family is local,” and “I live here.”

The biggest drawbacks, respondents say, are the state’s taxes (particularly the personal income tax) and regulatory burden, an anti-business attitude among policymakers, and the high cost of doing business.

Although concerns run high about the state’s economy and a shortage of qualified workers, small businesses see threats to profitability and growth as their biggest challenge in 2016.

By a factor of nearly three to one, businesses expect to grow this year (38% of respondents) rather than shrink (13%); just under half expect to stay the same.

About 29% plan to take out business loans; of these, most (77%) will take out bank loans. The rest will tap into personal savings (18%), government grants (11%), equity financing (11%), and SBA loans (10%).

Family Business Issues

The majority of small business owners who participated in our survey (71%) are family businesses.

They are nearly evenly divided about whether they believe the next CEO will be a family member (52% think it’s somewhat or very likely) or not (48% believe it’s somewhat or very unlikely).

Similarly, 53% say they prefer that the family retains ownership, while 47% plan to sell to non-family members.

A slight majority of family businesses (61%) have a succession plan, but not necessarily in writing. About one in four (26%) have a written succession plan; 35% have a plan, but not in writing; and 39% have no plan.

Only 39% have written workplace policies that apply to family members in the business; the rest do not.

Public Policy & Business Climate

A state’s business climate is shaped in no small part by policies that support or stifle output, employment, and economic growth. These include state spending, corporate tax structures, labor laws, and environmental regulations.

Consistent with annual rankings of states’ business climates, 92% of our survey respondents say Connecticut’s public policies do not facilitate the efforts of small businesses in the state.

Sixty-nine percent are not confident that legislators will act consistently and predictably on legislation affecting business over the next three to five years.

Forty-three percent report that the estate tax has a negative impact on their firm’s future.

Among state laws and regulations that businesses find most onerous, those governing labor and employment—in particular what respondents view as an unemployment compensation system that unfairly punishes businesses—were cited most often.

Other regulatory burdens considered problematic include those coming from the departments of Transportation, Motor Vehicles, and Energy and Environmental Protection.

Several business owners indicated that it wasn’t any one particular regulation or set of regulations but the sheer number of them—or as one respondent put it, “death by a thousand cuts.”

With the adoption of Obamacare six years ago, many small businesses we surveyed raised concerns about the threat of added burdens and administrative costs. In 2010, 63% expected their costs to increase as a result of healthcare reform.

Today, 65% say Obamacare has in fact had a negative impact on their business, compared to 7% who say the impact has been positive.

Political Engagement

Small businesses are trying to positively influence policy at both the state and federal levels.

Sixty-four percent report that over the past year they or their employees communicated to legislators regarding their business challenges or needs.

Though they primarily correspond with their legislators by email, more than 25% had a one-on-one meeting with a legislator.

Respondents and their employees also communicate with their elected officials by phone and in writing, and many have attended public hearings or hosted legislators at their place of business.

Ninety-nine percent of our respondents are registered to vote, and 95% plan to cast their ballots in the Connecticut legislative election this fall.

Technology & Talent

Sixty-one percent of businesses surveyed have a presence on social media, and 65% say Facebook, Twitter, LinkedIn, and other social sites helped promote their company brand.

Compare that to 2010, when more than half of all Connecticut businesses we surveyed either believed social media had no benefits for their company or were unsure.

While technology proves useful to small businesses, taking full advantage of it has proven difficult for many.

Businesses’ greatest hurdle in this area is a shortage of employees adequately trained in appropriate technologies.

Interestingly, human capital is also their greatest technological asset; the most common response to our question about companies’ strongest tech asset was “the people we have recruited and developed,” “key personnel,” and “knowledgeable and creative staff.”

Other tech assets noted were companies’ software and databases, web presence, machinery and other equipment, and their ability to adapt to change.

Challenges included cost, data protection and other cyber security issues, keeping up with the pace of change in technology, and integrating devices across multiple locations and servers.

While large firms have dedicated staff and consultants in the area of technology, smaller firms face the same challenges and exposure as their larger counterparts without the same level of resources.

Cyber security issues worry 78% of our small business respondents, and 79% increased cyber security at their firms over the past year.

In addition, companies are increasingly seeing the need for solid plans to deal with natural and man-made disasters.

Fifty-seven percent of those surveyed have a disaster recovery plan; 43% do not.

This is a modest but measurable improvement over 2010, when 50% of companies had no continuity plan for responding to emergencies and disasters and no intention of developing one.

Methodology & Demographics

Questionnaires were emailed and mailed in March and April 2016 to top executives at approximately 3,800 small businesses throughout Connecticut; 232 questionnaires were returned, for a response rate of 6.1% and a margin of error of +/– 6.6%.

The oldest companies represented in our survey date back 135 years. The newest were established in 2014.

They range in size from two employees to 320; include veteran-, woman-, and minority-owned firms; and represent industries ranging from construction to manufacturing and professional services.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.

The personal income tax is the single biggest tax challenge for small firms, followed by the corporate tax and property taxes. Many small businesses noted, however, that the problem isn’t any one tax but, in one respondent’s words, “a swarm of them,” including unemployment and workers’ compensation.

The personal income tax is the single biggest tax challenge for small firms, followed by the corporate tax and property taxes. Many small businesses noted, however, that the problem isn’t any one tax but, in one respondent’s words, “a swarm of them,” including unemployment and workers’ compensation. The biggest plus to doing business here is location (proximity to customers, vendors, family, other businesses in the supply chain, and major metropolitan centers), followed by quality of life and a skilled workforce. The biggest minuses are taxes, specifically; and a poor business climate and high business costs, generally.

The biggest plus to doing business here is location (proximity to customers, vendors, family, other businesses in the supply chain, and major metropolitan centers), followed by quality of life and a skilled workforce. The biggest minuses are taxes, specifically; and a poor business climate and high business costs, generally.