Tax Hike on Financial Sector Could Cost Jobs

A proposal from certain state lawmakers to raise millions of dollars by closing the so-called carried interest loophole on certain parts of the financial sector could cause more job losses in a state struggling to recover from the recession.

Advocates say the proposal, which amounts to a 19% tax hike, could raise $530 million for a state facing budget deficits of roughly $1.4 billion in 2018 and $1.6 billion in 2019.

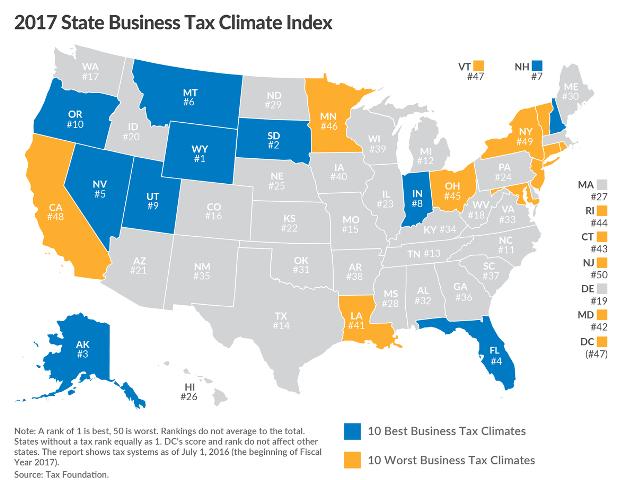

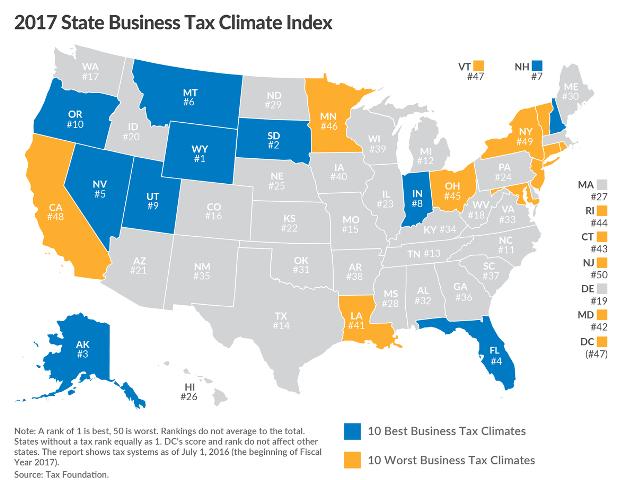

Connecticut’s business tax climate is ranked eighth worst in the country.

But not everyone agrees.

“We’re not going to solve our problems by raising taxes,” CBIA President and CEO Joe Brennan told the Hartford Courant. “We’re going to do it by economic growth, so more people are working and paying taxes.

“That’s why we’re in this mess—too many surcharges and taxes.”

The proposed surcharge on the state’s hedge-fund industry would only take effect if New York, Massachusetts, and New Jersey each adopted similar laws.

Connecticut’s hedge-fund industry is based largely in Fairfield County.

‘Detrimental to the State’

Governor Dannel Malloy said the proposal is not in the state’s best interests, noting that the state’s financial industry employs many people and pays high salaries.

“”We have employers who have a large number of employees in our state, and I just don’t think that’s an area that we should stake out,” Malloy said. “It would be detrimental to the state.”

We're not going to solve our problems with tax hikes. That’s why we’re in this mess—too many surcharges and taxes.

The proposal would bump the tax to 39.6% to reflect the rate for regular income.

The concern of CBIA’s Brennan and others is that the proposal will have the opposite effect that lawmakers intend and could chase established, well-paying companies from the state.

Connecticut has the third-highest number of hedge fund managers and investors in the U.S., according to the Connecticut Hedge Fund Association.

For more information, contact CBIA’s Louise DiCocco (203.589.6515) | @LouiseDiCocco

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.