Third Quarter 2016 Economic & Credit Availability Survey

About half of Connecticut business leaders expect stable economic conditions for their firms over the short term, according to a new survey released today.

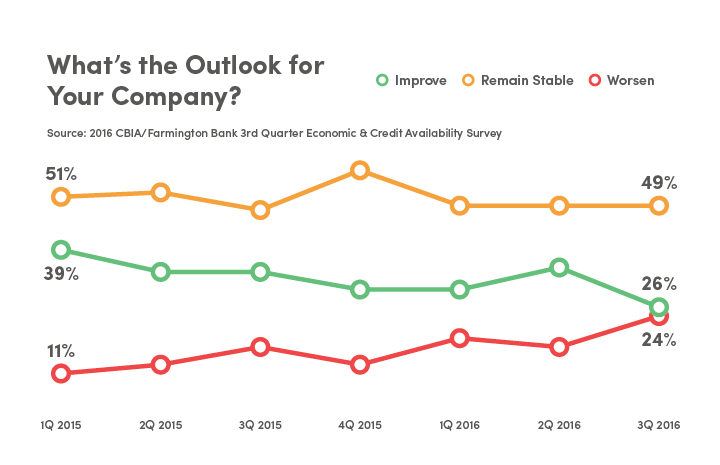

The 2016 CBIA/Farmington Bank 3rd Quarter Economic and Credit Availability Survey found 49% of businesses forecast stable conditions, unchanged from the previous two quarters.

Nineteen percent expect increases in workforce size compared to 32% last quarter, 59% expect no changes (53%), and 23% were planning on reductions (15%).

“While the probability of a recession is likely low, it’s important to note that more companies are preparing for a reduction in staffing,” said CBIA economist Pete Gioia.

“As the economy struggles to regain jobs, it’s always important to ask why companies are losing them, and right now, we don’t know.”

DataCore Partners’ economist Don Klepper-Smith agreed.

“We are clearly seeing starting to see cracks in our economic recovery, but recession is not a foregone conclusion,” he said.

The survey also found:

- 38% of respondents have used financing over the last three months

- 78% have used bank loans and lines of credit to meet those credit needs

- 79% would consider Connecticut’s lending climate to be average, good, or excellent

We are clearly seeing starting to see cracks in our economic recovery, but recession is not a foregone conclusion.

- 28% expect the lending climate to worsen over the next three months (up from 18% last quarter)

- 89% expect no impact from Brexit, while 3% expect a positive impact and 8% anticipate a negative impact

The Farmington Bank Credit Availability Index is a diffusion index that speaks to the health of Connecticut’s credit markets.

This quarter, the FBCAI was 54.7, down from last quarter (66.7).

“As businesses look to grow and invest here in Connecticut, credit conditions remain favorable for them to do so,” said John Patrick, Jr., chairman, president, and CEO of Farmington Bank.

The 2016 CBIA/Farmington Bank 3rd Quarter Economic and Credit Availability Survey was emailed to Connecticut business leaders in November 2016. A total of 176 responded, for an estimated response rate of 10.3% and a margin of error of +/- 7.5%.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.