CBIA Economist: ‘Can’t Build an Economy on Shifting Sands’

Gov. Dannel Malloy’s proposed two-year budget reflects the state’s fiscal realities while taking strong actions in many areas to close a massive fiscal hole, CBIA economist Pete Gioia told the legislature’s Appropriations Committee Feb. 14.

As lawmakers began reviewing the plan the Governor submitted earlier in February, Gioia asked them to consider the one thing Connecticut’s business community has wanted for years: a stable, predictable state budget.

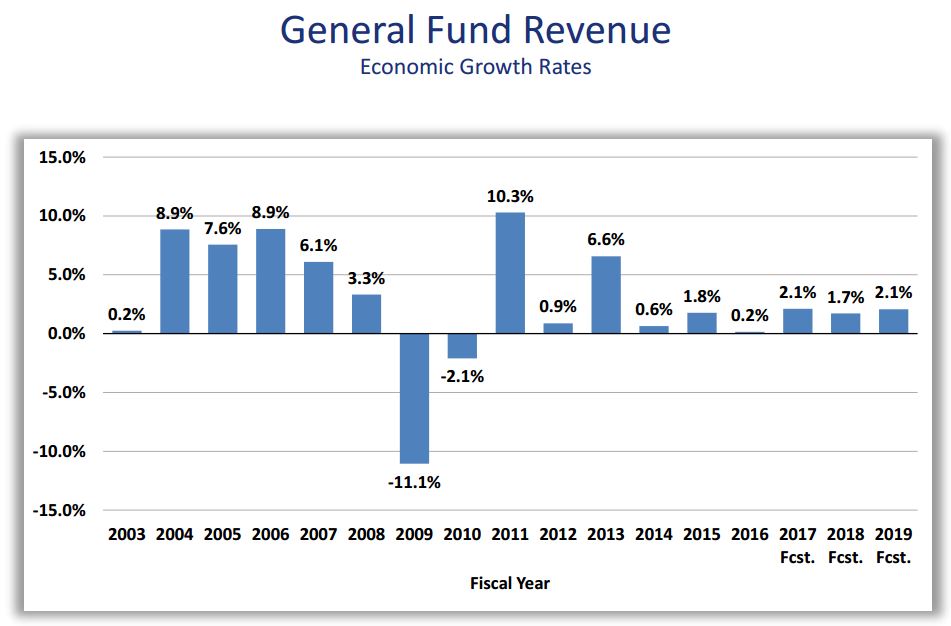

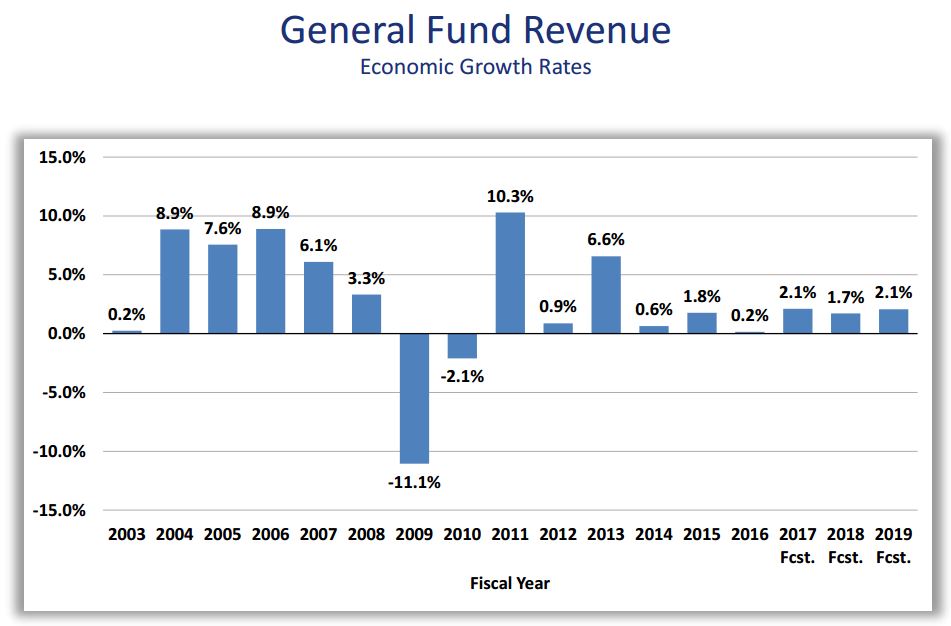

The Governor’s state budget proposal assumes revenue will grow 1.7% in FY 2018 and 2.1% the following year. Source: Office of Policy and Management.

“You can’t build an economy on shifting sands.

“Connecticut must effectively manage its state budget to maximize growth potential by providing confidence for investors to create jobs that will have a positive effect on our economy and for our citizens.”

And the only way legislators can accomplish this is to put their differences aside and work to advance Connecticut, he said.

Concern Over Property Taxes

One of Gioia’s main concerns with the budget—one he shares with CBIA’s many small businesses members—is its potential to increase local property taxes.

The Governor’s proposal calls for shifting 30% of the annual cost of pensions and health benefits for retired educators onto cities and towns.

That’s roughly $407 million in the first year and $421 million in year two of the two-year budget proposal.

In addition, the proposal changes how state aid flows to cities and towns, leaving the majority of municipalities with fewer funds.

“While we appreciate the areas continuing or adding on to business tax reform and adjustments in the budget, we are quite concerned that the substantial cuts impacting over 130 municipalities may lead to property tax increases for companies,” Gioia said.

More Efficient Government

Given its current condition, Connecticut’s state government has no choice but to become more efficient, he said.

“It’s essential for building and sustaining a healthy economy and an improved quality of life,” Gioia told the committee.

Government has no choice but to become more efficient. It’s essential for building and sustaining a healthy economy.

- Having the budget come in under the spending cap.

- Advocating use of not-for-profit providers for more services to lower costs and improve customer service.

- Supporting long term and comprehensive transportation infrastructure needs.

- Continuing prison reform as outlined in the "Second Chance" initiatives.

- Appropriate pension and retirement benefit concessions from state employee unions must be negotiated into this budget.

“Now is the time for this committee and the legislature to do serious work on our fiscal condition,” he said.

“Now is still the time to be prudent in spending and to seek out and seize opportunities for cost savings.”

He said CBIA has confidence that lawmakers will “see to it that the budget is used as a tool to help create future economic growth that will lead to more jobs and job opportunity, more wealth and security for our citizens and ensure greater budget flexibility in future years.”

For more information, contact CBIA’s Pete Gioia (860.244.1945) | @CTEconomist

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.