State-Run Healthcare: Unregulated and in the Red

Connecticut lawmakers this week revived a controversial state-run healthcare proposal that was unsuccessful in 2019.

The legislature’s Insurance and Real Estate Committee held a public hearing March 5 on SB 346, which contains almost identical language to two bills that failed last session.

Despite evidence to the contrary, the bill is again being promoted as a small business measure that will save employers on healthcare costs.

SB 356 allows small employers to purchase health coverage for employees through the expansion of the state-run State Employee Partnership Plan.

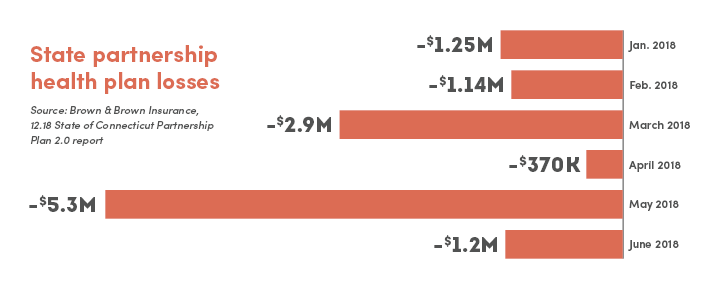

The partnership plan, which covers approximately 44,780 town, city, and other public sector employees, lost $10.3 million in 2018, paying out more in claims than it collected in premiums.

“It is unclear how small businesses will be affected if they enroll in a plan with significant solvency issues,” CBIA president and CEO Joe Brennan told Insurance Committee members.

Regulatory Issues

Brennan said the 2018 losses meant the state-run municipal plan operated at an MLR, or medical loss ratio, of about 105%.

“If a private insurer offered plans with an MLR of 105%, the Connecticut Insurance Department would discontinue those plans,” Brennan said.

If a private insurer offered plans with a medical loss ratio of 105%, the insurance department would discontinue those plans.

“Plans administered by the comptroller’s office are also regulated by his office, not the insurance department. Self-regulation equates to non-regulation.

“Until these plans are regulated by the insurance department, the comptroller can continue suppressing premiums with those plans continuing to operate at a loss.”

Subsidies

Under the proposal, the state subsidizes premium costs for plan enrollees who do not qualify for cost-sharing subsidies under the Affordable Care Act.

In addition, an affordability scale will be determined for premium rates based on an enrollee’s household income.

“A public health program will already have significant cost implications for the state, but the plan’s cost-sharing subsidies create an even greater burden on Connecticut’s uncertain long-term financial stability,” Brennan said.

“Additionally, the bill does not provide whether participants or taxpayers will be responsible for funding the plan.”

Consumer Protections

Former Wisconsin deputy insurance commissioner J.P. Wieske told the committee he found it “surprising” that SB 346 ignored minimum standards intended to protect consumers and taxpayers.

He also warned that the bill will cause “significant damage” to the ACA-regulated health insurance marketplace.

“The requirements ensure consumers can understand the difference between the benefit plans and make the best choice for them,” he said.

The state-run healthcare proposal ignores minimum standards intended to protect consumers and taxpayers.

“I find it surprising that SB 346 leaves these requirements out making consumer choices much more difficult.”

With small businesses struggling to afford the cost of healthcare for employees, employers are in no position to subsidize the state’s failing employee health insurance program.

For more information, contact CBIA’s Michelle Rakebrand (203.592.7532) | @MRakebrand

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.