Will Tax Hikes Follow Union Deal Approval?

The Malloy administration’s deal with state employee unions gained final legislative approval Monday, despite concerns over some of the agreement’s provisions, including contract extensions.

Lieutenant Governor Nancy Wyman broke an 18-18 tie in the state Senate, with all Democratic senators voting to ratify the agreement and all Republicans voting against it.

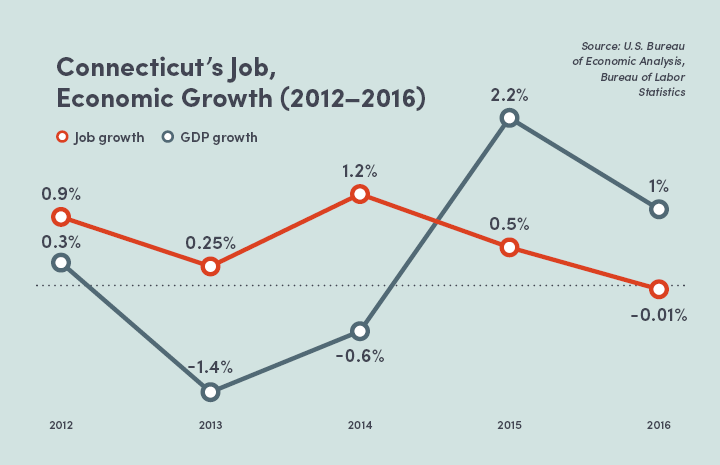

Connecticut’s economy has struggled to find momentum amid ongoing fiscal uncertainty.

The agreement struck with the State Employees Bargaining Agent Coalition is a key part of the Governor’s proposal to close the state’s two-year, $5.1 billion budget deficit.

State budget negotiations remain stalled more than a month into the new fiscal year.

A number of issues represent major stumbling blocks, including proposals to hike the state sales tax from 6.35% to 6.99% and levy additional taxes on restaurants and hotels.

Tax Hike Push

State employee union leaders are also pushing for $1 billion in tax hikes targeting the state’s financial sector and investment earnings.

CBIA president and CEO Joe Brennan called for state lawmakers to now focus on ending the budget deadlock.

“The General Assembly must turn its attention to passing a bipartisan budget that rejects tax hikes that will further damage our economy,” Brennan said.

“Failure to adopt a new spending plan only adds to the uncertainty that has plagued our economy in recent years.

State lawmakers must pass a bipartisan budget that rejects tax hikes that will further damage our economy.

The SEBAC deal includes a temporary wage freeze, furlough days, increases in medical and prescription payments for state workers, changes to retiree healthcare, and a hybrid pension/defined contribution plan for new workers.

However, it also extends current state employee contracts another five years to 2027 and includes no-layoff provisions, generating concerns about its long-term sustainability.

Additional Reforms Needed

Brennan noted that growing state employee retirement costs are one of the main factors driving the persistent deficits that have dominated budget debates since the last recession.

"Legislators must look to the recommendations in The Pew Charitable Trusts report and in the Republican budget proposals to find additional structural reforms and other ways to further rein in state employee costs," he said.

The Pew Charitable Trusts, a nonpartisan national policy research group, analyzed the SEBAC deal at the request of state lawmakers and recommended additional policy measures, including:

- Commission a 50-state comparative study of retirement benefits and policies, to help ensure Connecticut is in line with peer states

- Require stress test analysis of all retirement plans as part of regular reporting to determine how plans would perform during a financial crisis

- Consider adding future provisions that incentivize state workers to save more in defined contribution accounts given the low mandatory savings rate of 2% of pay

Republican lawmakers had sought more than $2 billion in state employee concessions, saying Connecticut must bring wages and benefits in line with other states and the private sector.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.