Connecticut’s Hourly Minimum Wage Increases June 1

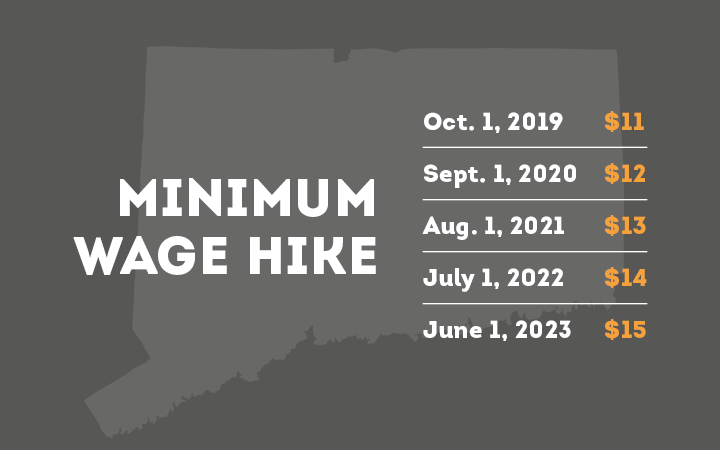

Connecticut’s hourly minimum wage increases to $15 on June 1, 2023, the last stage in a series of five scheduled increases that began in 2019.

The $1 increase over the current $14 represents a near 50% increase in the four years since Gov. Ned Lamont signed enabling legislation into law.

The legislation increased the hourly wage by $1 every 11 months, taking it from $10.10 to $15.

Employers are legally obligated to pay employees the updated wage on and after June 1, which falls on a Thursday.

This means employers can choose to pay employees $14 for every hour leading up to June 1, but must adjust payroll from that date.

Future Increases

Connecticut law retains a $6.38 minimum wage for tipped workers, which includes restaurant waiters, and the $8.23 minimum for bartenders. However, the employee must make at least $15 per hour including tips.

It also includes a 90-day, $10.10 hourly training wage for 16- and 17-year-old workers.

Beginning in 2024, Connecticut law requires the state’s minimum wage to be indexed to the employment cost index as calculated by the U.S. Department of Labor.

Beginning in 2024, increases in Connecticut’s hourly minimum wage will be tied to the employment cost index.

Any increase after Jan. 1, 2024 will be tied to the quarterly metric created by the U.S. DOL’s employment cost index.

After June 1, Connecticut’s minimum wage will be tied with Massachusetts for third highest in the country after Washington ($15.74) and California ($15.50).

Twenty states are tied for the lowest hourly wage, $7.25, which is the federal minimum wage for covered nonexempt employees.

3 thoughts on “Connecticut’s Hourly Minimum Wage Increases June 1”

Leave a Reply

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.

What’s better for workers than a higher minimum wage? A tax on vacant land and unoccupied premises. A higher minimum wage discourages hiring. But a vacancy tax on residential property makes the owners get residential tenants (and set the rents within reach of wages), while a vacancy tax on commercial property makes the owners get business tenants, who in turn will need workers, leading to higher *market* wages and more stable jobs.

What’s better for business than a lower minimum wage? A tax on vacant land and unoccupied premises! A lower minimum wage cuts the spending power of prospective customers, and makes it harder for prospective employees to afford housing within a manageable distance of your business. But a vacancy tax on nearby residential property keeps it populated with prospective customers and workers, while a vacancy tax on nearby commercial property keeps it populated with complementary businesses that will attract foot traffic to *your* business.

Notice that a vacant-property tax is meant to be AVOIDED. It’s not meant to be paid. Moreover, avoidance of it would generate economic activity, expanding the bases of other taxes and allowing their rates to be cut, so that both workers and businesses would pay LESS tax!

It cost more to live here than in 1983 can’t afford rent on minimum wage

Is a employer or the employee responsible for reporting there tips