2017 Survey of Connecticut Manufacturing Workforce Needs

CBIA partnered with the NSF Regional Center for Next Generation Manufacturing, Connecticut State Colleges and Universities, to survey the state’s manufacturers about their hiring expectations and workforce challenges for the next three years.

We hope our findings will encourage the development of legislation and programs within manufacturing companies and our educational institutions to fill Connecticut’s manufacturing workforce needs.

Introduction

As one of the largest contributors to Connecticut’s gross state product, manufacturing is experiencing a resurgence in the state.

From power tools to roof racks, jet engines to elevators, products made in Connecticut are sold throughout the U.S. and around the world.

Connecticut is home to 4,011 manufacturing firms that:

- Represent a number of key industries, including transportation equipment (primarily aerospace, submarines, and automotive), chemicals, fabricated metals, electrical equipment, computer and electronic products, machinery, pharmaceutical and medical, and plastics

- Employ over 159,000 workers in the state, representing 9.5% of all nonfarm jobs

- Pay $12.6 billion in wages to workers, with an average annual wage of $95,118

- Pay $118 million in corporate business taxes

- Contribute $189.7 million in sales and use taxes to the state

- Export $13.47 billion in products

- Bring in $11.8 billion in defense contracts

- Generate an additional $1.35 of economic activity for every $1 spent in manufacturing

- Add $42.7 billion to Connecticut’s gross state product (2016)

The Milken Institute’s State Technology and Science Index, evaluating each state’s tech and science capabilities, ranked Connecticut sixth in the country in 2016. We are sixth in industry R&D per capita, ninth in patents issued per 100,000 people (41% over the national average), and tenth for manufacturing value added per production hour worked.

Our survey outlines where the greatest gaps exist in skills, training, and educational curricula, and offers policy recommendations for closing those gaps.

Recruiting & Hiring the Next Generation

Almost every manufacturer surveyed expects to grow their workforce in the next three years. Forty-two percent of manufacturers in Connecticut said they anticipated near-term workforce growth, while 44% predicted flat growth, and 14% have contracted out work.

With an average hiring rate of 22 people per year, manufacturers responding to this survey expect to hire primarily full-time employees by the end of 2019—98% of respondents—a significant jump from our last survey in 2014 (85%). Just over 13% of manufacturers will hire temporary workers, while nearly 11% will make part-time positions available.

Seven percent are unsure of what hiring strategies to implement going forward, and just 4% have no plans in place.

Skills Needed

The skills most lacking among recent hires are overall employability, such as punctuality and work ethic (cited by 74% of manufacturers), and technical skills (71%). Other deficits include problem-solving and troubleshooting (45%), interpersonal/teamwork skills (44%), and written/verbal communication skills (31%).

We also asked Connecticut manufacturers to weigh in on the specific skills that are most important to their companies’ competitiveness.

The top answers were engineering-specific skills and technical writing and comprehension (both cited by 93% of respondents), followed by simulation, modeling, and analysis (92%), critical thinking and problem solving (91%), CNC machining and geometric dimensioning and tolerance (both 89%), CNC programming (86%), and additive manufacturing (83%).

On-the-job training is rarely offered in these critical areas; for the most part, manufacturers expect new employees to arrive already trained. Of these eight technical skills preferred by manufacturers, only about a third of companies offer training in the areas of additive manufacturing (39%); critical thinking and problem-solving (30%); engineering-specific (29%); simulation, modeling and analysis (23%); and technical writing and comprehension (18%).

On-the-job training offered by manufacturers focuses primarily on occupational health and safety (75%), measurement (67%), blueprint reading (64%), CNC machining (63%), quality assurance (61%), and geometric dimensioning and tolerance (54%).

With a greater majority of hires graduating from their institutions of choice with increasing student loan debt, close to two-thirds of respondents (61%) provide tuition reimbursement. This provides an incentive for hires to further their education for higher-level positions, without burdening the students with debt.

Among the surveyed businesses, the greatest barrier to expanding their capabilities in advanced manufacturing technology is a lack of in-house expertise (which presents a steep learning curve for employees), the cost of new machinery or upkeep of older models, and lack of time to integrate new technologies during current business flow.

Jobs Are Here

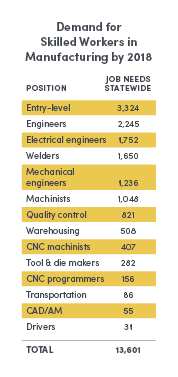

From a list of 14 different manufacturing occupations, respondents were asked to report the number of current vacancies for each type of job, as well as the number of workers they plan to hire for those positions by the end of 2018.

Of companies looking to hire by the end of 2018, the job categories most likely to be filled include entry-level production workers (identified by respondents as one of the easiest jobs to fill), warehousing and distribution staff, machinists, CNC machinists, mechanical/manufacturing technicians, electrical/electronic technicians, quality control personnel, and engineers.

The toughest position to fill is tool and die maker (with 63% of respondents rating it a five on a scale of one to five, from least to m

Based on the data collected from our sample, we estimate 13,601 job openings statewide across these 14 job categories by the end of 2018.

Educational Institutions

When hiring in-state, Connecticut manufacturers typically hire graduates from high schools and colleges, while out-of-state recruits are primarily college graduates.

High satisfaction is reported among manufacturers with graduates who have attained higher levels of education, as well as more relevant technical training. Students who completed certificate programs at the state’s community colleges are valued slightly above those who earned associate degrees (68% of manufacturers are somewhat satisfied or extremely satisfied with the former; 66% with the latter).

Graduates of major universities (such as the University of Connecticut), Connecticut’s private colleges, and private occupational schools are largely viewed as highly qualified job candidates (78%, 75%, and 74% of respondents, respectively, are somewhat satisfied or extremely satisfied). Additionally, 76% are somewhat satisfied or extremely satisfied with graduates of Eastern Connecticut State University, Central Connecticut State University, and other schools in the state university system.

Although the majority of hires in the manufacturing sector are high school graduates, there is a considerable difference in the perceived quality of job candidates from traditional high schools versus technical high schools. Forty-two percent of manufacturers report being neither satisfied nor dissatisfied with traditional high school graduates; another 42% are either extremely satisfied or somewhat satisfied with this group, while 15% are either somewhat dissatisfied or extremely dissatisfied with them.

By contrast, when it comes to graduates of technical high schools, 76% of manufacturers are either extremely or somewhat satisfied, 17% are neither satisfied nor dissatisfied, and only 7% report being dissatisfied with those hires.

Recommendations for how educational institutions could address the skills deficit problem include a greater emphasis on technical training and skills (60%), integration of employability skills such as punctuality and professionalism (57%), greater access to internships (38%), opportunities for career development (35%), and more rigorous preparation in basic skills like reading, writing, and math (28%).

Conclusion & Recommendations

Connecticut manufacturers plan to hire a considerable number of skilled full-time workers between now and 2018 to fill existing and projected vacancies due to retirements and growth in the U.S. manufacturing industry. Connecticut must ensure a pipeline of well-qualified workers to meet that demand.

Recruiting millennials and post-millennials (also known as Generation Z) into manufacturing has proven challenging. Persistent misconceptions about low pay and unappealing work environments belie the reality of modern advanced manufacturing and are a key barrier to growing the workforce. In our survey, manufacturers reported the average starting pay for all levels of workers ranged from $29,000 to $66,000 per year.

Many manufacturing jobs require advanced technological skills, such as computer and software programming. In addition, involvement and interest by manufacturers in high-tech advanced manufacturing, including relatively new additive manufacturing processes, is strong. Respondents said their companies are either already involved or interested in expanding their business into automation and control systems (55%), process modeling and simulation (41%), additive manufacturing of polymer deposition (12%) and of metal powder beds (23%), and precision and non-traditional machining (18%). Growing interest and involvement in these high-tech areas reinforces the need for robust advanced manufacturing training programs in state educational institutions.

To overcome Connecticut’s manufacturing workforce challenges, CBIA recommends the following:

- While the state’s community college technical training programs have expanded to offer additional training to more students, further expansion is needed. A significant gap exists between job openings in manufacturing and students enrolled in programs that will prepare them to transition seamlessly into those positions immediately after graduation.

- We must increase efforts to help manufacturers overcome difficulties attracting, training, and retaining talent. The state’s Manufacturing Innovation Fund Incumbent Worker Training program, a matching fund available to companies with up to 2,000 employees, has seen success in this area. The Small Business Express Program also supports training for smaller manufacturers. The state must continue expanding manufacturing training programs as the workforce issue becomes more acute in coming years.

- Public schools must increase efforts to educate students, guidance counselors, and parents about careers in modern manufacturing, with particular emphasis on outreach to female and minority students.

- While the University of Connecticut’s successful engineering program has grown in popularity, and graduates report positive outcomes post-graduation, other state and private schools need to work to create and improve engineering programs. The demand currently far exceeds the supply, and the hope is to attract not only out-of-state students to these programs but also students who already live in Connecticut.

Methodology & Demographics

The survey had 157 respondents for a 5% response rate and 8% margin of error with a 95% confidence level.

Participating manufacturers employ over 20,000 workers in all eight counties in Connecticut and represent a wide variety of sectors, including aerospace, metals, machinery, and chemical manufacturing.

Participating manufacturers range in size from two employees to 1,000, with annual sales ranging from $500,000 to $508 million.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.