Small Businesses in Limbo After Relief Programs Run Dry

Funding for the federal government’s main small business coronavirus relief program ran out April 16, less than two weeks after the $349 billion fund was launched.

And Congress remains in a stalemate over adding more capital to the Paycheck Protection Program, which offered forgivable loans to firms with less than 500 employees.

The U.S. Small Business Administration said a total of $4.15 billion in loans were approved for 18,435 Connecticut small businesses before applications were suspended April 16.

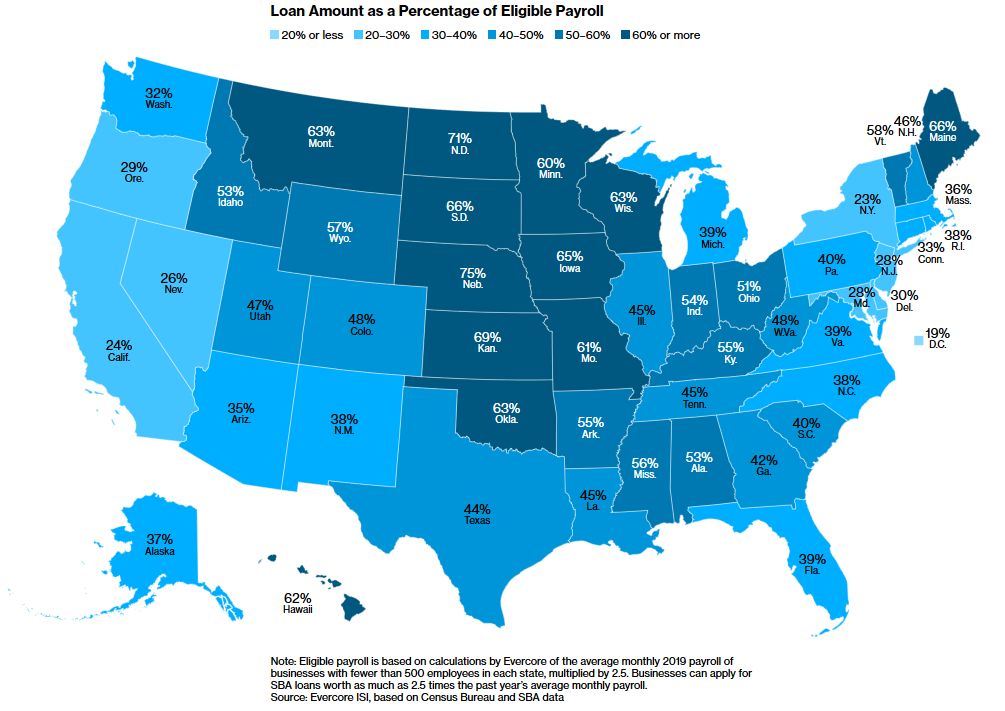

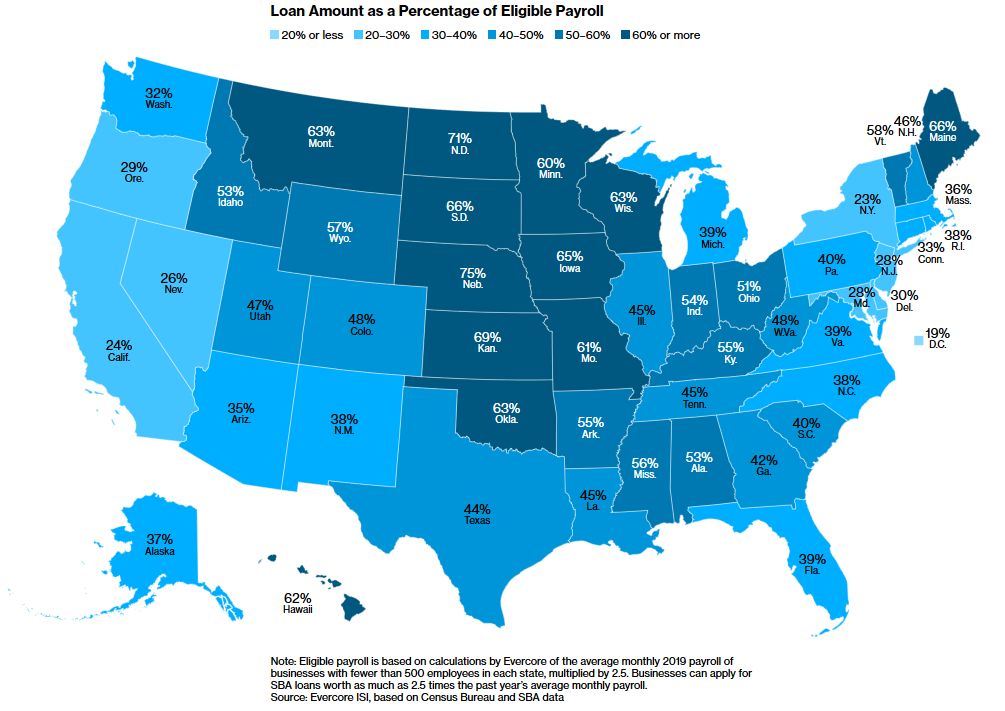

Bloomberg reported that those loans represented 33% of the payrolls of the state’s small employers—44th among all states.

Nationally, 1.7 million small businesses were approved for PPP funding, with 74% of those for loans of $150,000 or less.

The PPP provided forgivable loans up to $10 million to cover payroll and certain other costs to small businesses impacted by the pandemic.

Funding Concerns

“The $349 billion was a wonderful start,” CBIA president and CEO Joe Brennan said April 15 on a webinar hosted by the Hartford Business Journal and New Haven Biz.

“I think the biggest concern right now is if the federal government will recapitalize it.”

The PPP was the second federal relief program to run out of cash during the week, after the SBA suspended applications for its Economic Injury Disaster Loan fund.

That program provides small businesses with working capital loans of up to $2 million to help overcome temporary loss of revenue, with an immediate advance of up to $10,000.

Congressional leaders had yet to reach agreement April 19 despite more than a week negotiating a proposal to add about $310 billion to the PPP and $60 billion to the EIDL program.

“We hope there’s a grand compromise here, that Republicans and Democrats can get together and fund these critical programs,” Brennan said. “The immediate survival of tens of thousands of Connecticut small businesses depends on it.”

The SBA said EIDL applications submitted before the program was suspended will continue to be processed on a first-come, first-served basis.

A number of SBA lenders, including Bank of America and Wells Fargo, announced they will continue accepting PPP applications with the expectation that Congress would recapitalize the program.

State Loan Program

Connecticut closed its Recovery Bridge Loan Program March 27, less than 48 hours after rolling out no-interest loans of up to $75,000 to firms with fewer than 100 employees.

The state Department of Economic and Community Developed doubled the size of the fund to $50 million after more than 5,000 businesses applied.

DECD commissioner David Lehman said April 17 the state was partnering with an online financial institution to process loans and expected payments to be distributed by month’s end.

“Our intention is to make thousands of loans by the end of this month.”

DECD’s David Lehman

“We are super sensitive to time frame,” he told the Hartford Business Journal. “Given the overwhelming response, our intention is to make thousands of loans by the end of this month.”

He added that because of the volume of applications, successful applicants “are more likely to see $15,000 or $20,000, though a decision hasn’t been finalized.”

The U.S. Chamber of Commerce is making $5,000 grants through its Save Small Business Fund and the Hartford Economic Development Corporation is offering lines of credit to minority and women-owned small businesses.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.