As New Business Tax Hits, Labor Committee Pushes Mandates

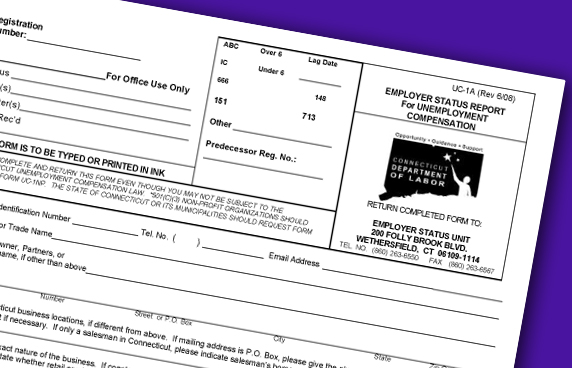

While Connecticut residents await word on how they will be asked to help fix the state’s budget gap, businesses are already facing an extra sacrifice this year—a new $40 million unemployment compensation tax.

The tax will be used to pay interest on loans the state took out to keep Connecticut’s Unemployment Compensation Trust Fund solvent after 100,000 job losses in the recession overwhelmed the employer-funded pool.

Despite the new tax levied on businesses, the legislature’s Labor Committee continues to advance proposals to hike other workplace costs. This week, the committee rushed out a measure to mandate paid time off and another, “captive audience,” measure that would limit the ability of employers to communicate in the workplace with their employees.

Both measures are just concepts at this time and details have not been released. The specifics of the “captive audience” proposal, not introduced in recent years, remains to be seen; but mandatory paid time off is certain to come with a heavy price tag—in dollars, lost productivity and the collateral message that Connecticut is unfriendly to business. (CBIA will have more about each proposal as the session develops.)

A recent study by Ernst & Young for New York City found that a similar proposal for mandatory paid time off there would cost employers $789 million a year. The specifics of the proposal differ slightly from recent legislation in Connecticut, but the impact would be the same.

Mayor Michael Bloomberg expressed “serious concerns about unfunded mandates on businesses at a time when we’re still feeling the effects of a national recession.”

And the Ernst & Young report said the New York City proposal “would be toughest on small businesses and nonprofits … and could threaten the jobs of the most vulnerable employees who are its supposed beneficiaries.”

Connecticut employers have repeatedly said that mandating paid time could prevent them from adding or keeping jobs, and at the least would hurt their ability to effectively manage their operations.

That would be a major step backward just when Connecticut desperately needs to create and hold onto good jobs—something candidates pledged to fight for throughout last year’s campaign and sounded again during last week’s session-opening celebrations.

For more information, contact CBIA’s Kia Murrell at 860.244.1931 or kia.murrell@cbia.com.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.