DRS: Review Form CT-W4 Withholding Status

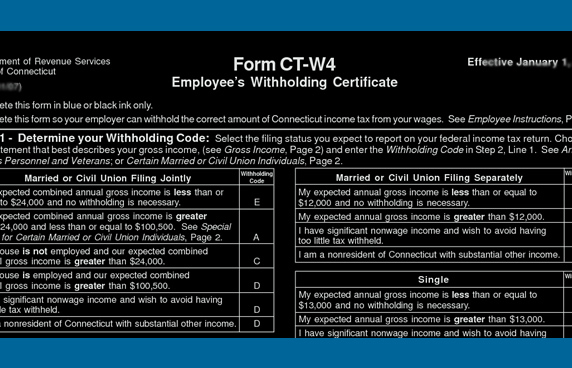

The state Department of Revenue Services (DRS) is urging employers and employees to review their Form CT-W4, Employee’s Withholding Certificate status for income tax withholding—especially employees who adjusted their Connecticut withholding during 2011 because of changes to the state tax rates.

Workers who made changes to their 2011 Connecticut withholding because of issues with under- or over-withholding, should file a new Form CT-W4 in order to avoid penalties for not having enough tax taken out of their paychecks in 2012, says DRS.

The General Assembly passed an income-tax increase retroactive to the beginning of 2011 that required catch-up withholding, beginning with August paychecks. The tax hike's unusual retroactive application has created many challenges.

Taxpayers who have questions about Connecticut withholding taxes will find more information in the DRS Informational Publication 2012 (7) Is My Withholding Correct? on the DRS website.

Taxpayers can also call DRS Taxpayer Services at 800.382.9463 (in Connecticut, but outside the Greater Hartford calling area) or 860.297.5962 (from anywhere).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.