Poll: Inflation, Cost of Living Top Issues for Connecticut Voters

Inflation and the state’s high cost of living are the top concerns for Connecticut’s voters according to a new statewide poll.

Conducted by Public Opinion Strategies for CBIA, the poll shows personal finance issues dominate voter priorities ahead of this year’s elections for governor and statewide offices and the General Assembly.

When asked to identify the two top issues for election candidates, 65% of respondents said inflation and the state’s high cost of living and 48% cited state taxes and government spending.

Inflation and affordability are the top issues regardless of political affiliation, identified by 63% of those who said they were registered Democrats, 66% of independents, and 67% of Republicans.

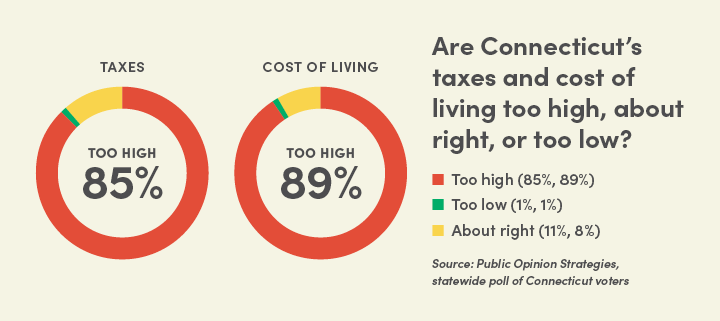

Eighty-five percent of surveyed voters said state taxes are too high and 89% believe Connecticut’s cost of living is too high.

State taxes were seen as too high by 79% of Democratic voters, 88% of independents, and 91% of Republicans.

Affordability Issues

Eighty-two percent of Democrats said the state’s cost of living was too high, as did 92% of independents, and 94% of Republicans.

Just 16% believed state taxes were “about right,” with 16% also feeling the same about Connecticut’s cost of living.

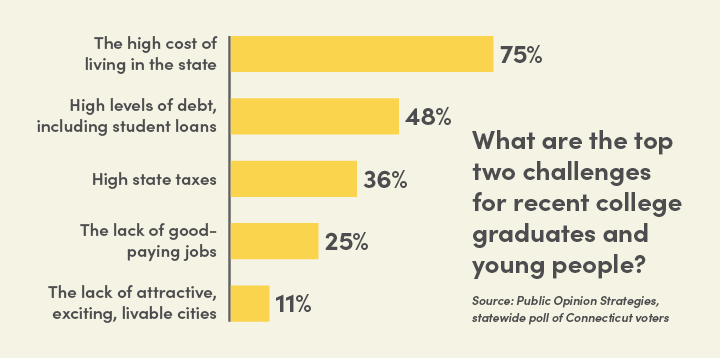

Connecticut’s lack of affordability was also seen by 75% of those surveyed as the most significant challenge for recent college graduates and young people, followed by student loan debt (48%).

Forty-five percent of those polled feel less secure financially than they did a few years ago, with 40% feeling the same, and 11% feeling more secure.

More than half of GOP voters (51%) said they felt less secure about their finances, as did 50% of independents and 37% of Democrats.

Those without a college degree were more likely to feel uncertain about their finances (49%) than those with a college education (41%).

Tax Relief

Seventy-nine percent of all surveyed voters support comprehensive tax relief for all individuals to lower taxes and raise take home pay.

While the state budget revisions adopted this year included $600 million in individual tax relief, $330 million is temporary, including suspension of the state’s 25 cents per gallon gas tax through Dec. 1.

The budget also expands the 50% tax credit for employers that contribute to an employee’s Connecticut Higher Education Supplemental Loan Authority student loan, although that program only impacts a minority of graduates.

“While any tax relief is welcome, less than half of what was in the budget package is recurring, so there are questions about the long-term impact beyond this year,” DiPentima said.

“It’s clear from this poll that voters want structural changes to both the state’s tax system and to the way state government operates.

“They want government to be more efficient and effective and they want a better return on their taxpayer dollars.”

Economic View

Voters were mixed about the state’s direction, with 46% believing Connecticut was on the “wrong track” and 42% saying it was headed in the right direction.

Seventy-one percent of Democrats approved of the state’s direction, while 54% of independent voters and 80% said Connecticut was on the wrong track.

When asked to rate Connecticut’s economy, 57% of voters described it as “only fair” or “poor,” with 40% calling it “good” or “excellent.”

Party affiliation played a major role in those responses, with 69% of independents and 74% of Republicans having an unfavorable view while 65% of Democrats were favorable.

Voters were evenly divided about the state’s economic outlook, with 31% expecting the economy to improve, 30% predicting a downturn, and 27% seeing no change.

Business Climate

A majority of voters (59%) believe state government makes it difficult for businesses to succeed in Connecticut.

The high cost of living (79%) and high state taxes (65%) were viewed as the top challenges to the future growth and survival of businesses in Connecticut.

Fifty-seven percent believe business taxes are too high, 14% said they were “about right,” 4% said they were too low, and 24% were unsure.

Eighty percent of voters support expanding the research and development tax credit to small businesses, while 72% believe lawmakers should restore the pass-through entity tax credit to its original level.

59% of voters say state government makes it difficult for businesses to succeed in Connecticut.

Over two-thirds (67%) said policymakers should use federal COVID relief funds and/or budget surplus dollars to pay off the state’s pandemic-related unemployment loan debt and ease the burden on employers.

Seventy-five percent support modernizing and streamlining government operations and the use of technology solutions to reduce the state’s physical footprint and cut high overtime and other costs.

Public Opinion Strategies surveyed a representative sample of 500 Connecticut voters between March 29 and April 4, 2022.

Forty-three percent of those surveyed identified as independents, 37% were registered Democrats, and 20% were registered Republicans.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.