$400M Tax Hike Follows Legislature’s Failure to Resolve UI Debt

Connecticut employers face $400 million-plus tax hikes over the next four years after policymakers allocated just $40 million towards the state’s unemployment loan debt.

That represents just 8% of the $495 million Connecticut owes the federal government and is $25 million less than a new $65 million loan the state took out just last month.

Employers will see unemployment taxes increase over a four-year span from this September, eventually jumping 22%—or an estimated $119 per employee—in 2026.

Connecticut has now borrowed $953 million from the federal government to cover pandemic-related unemployment claims.

The unemployment trust fund’s solvency issues—it’s been insolvent 48 of the past 50 years—also drove some of that federal borrowing.

The legislature adopted much-needed reforms to the unemployment system during the 2021 session. Those reforms take effect in 2024.

Tax Hikes

CBIA president and CEO Chris DiPentima called the modest loan debt allocation—part of the fiscal 2022 state budget revisions adopted by the legislature this week—a “major missed opportunity to support small businesses.”

“For all the talk about historic tax cuts, the state budget revisions actually represent a $400 million-plus tax hike on employers,” he said.

“By not fully addressing the unemployment debt crisis, policymakers failed to support Connecticut small businesses, too many of whom are struggling to recover from the pandemic.”

“It’s terribly shortsighted—a majority of states are using federal COVID relief funds to pay down their unemployment loans and, in many cases, replenish their trust funds.”

Of the 30 states that borrowed money from the federal government, just seven—including Connecticut—have loan balances, with interest payments due Sept. 30.

For instance, Minnesota’s governor signed a bill May 2 allocating $2.7 billion to pay off the state’s federal loans and replenish its unemployment trust fund.

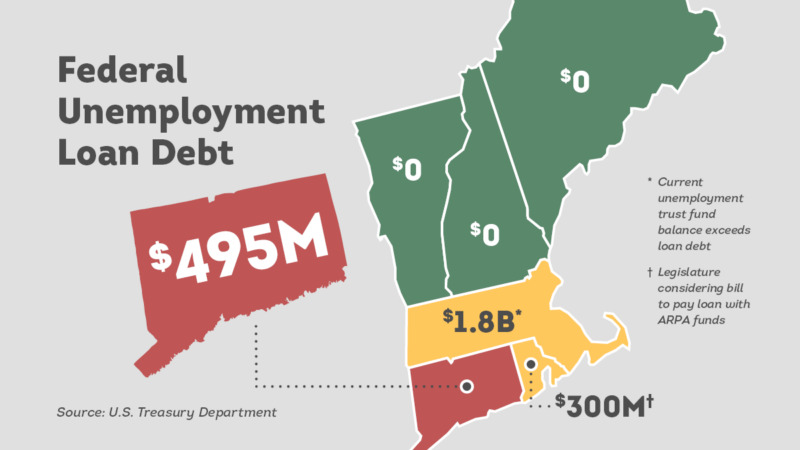

Among the New England states, Maine, New Hampshire, and Vermont all fully repaid their federal loans.

Rhode Island lawmakers are considering legislation addressing the state’s $300 million debt and Massachusetts’ unemployment fund balance is higher than its $1.8 billion loan debt.

Recovery Threats

It took six years of higher taxes to pay off Connecticut’s federal unemployment loans after the 2008-2010 recession, which contributed to the state’s failure to fully recover from that economic downturn.

DiPentima noted that businesses now face additional challenges, with the labor shortage crisis, inflation, and supply chain bottlenecks all threatening the state’s pandemic recovery.

“Connecticut employers didn’t cause the pandemic and were forced to lay off workers because of government mandated restrictions and shutdowns,” he said.

“Why is Connecticut burdening employers with this debt, when the state had the means to address it?”

CBIA’s Chris DiPentima

“Why is Connecticut burdening its employers, particularly small businesses, with this debt, when the state had the means to address it?

“That $400 million in tax hikes is money better invested by employers to address the labor force crisis, the biggest threat to Connecticut’s economic recovery.”

A late March-early April Public Opinion Strategies poll of 500 registered voters found broad support for the state paying down the debt, with more than two-thirds of voters agreeing with the proposal.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.