Despite Growth, Businesses Cast Wary Eye to Future

Connecticut businesses reported strong growth over the last year, with seven in 10 firms posting profits—a post-recession high.

That growth was largely driven by strong national and international markets according to the 2019 Survey of Connecticut Businesses, produced by CBIA and the public accounting and business advisory firm Marcum LLP.

Released today at the annual Connecticut Economy conference in Hartford, the survey shows location and quality of life remain the state’s best assets while the cost of doing business and legislative decision-making are its major weaknesses.

Forty-three percent of firms posted sales growth over the last 12 months, up seven points from the previous year and the highest in five years. Growth numbers were weaker for small businesses, with 35% growing, 47% unchanged, and 19% seeing declining sales.

Despite those numbers, business leaders have a dampened outlook for the national and Connecticut economies, reflecting concerns over trade disputes, workplace mandates, and the state’s high costs.

While 73% expect the U.S. economy to grow over the next 12 months, that’s an eight-point drop from the 2018 survey, when 85% expected growth, 11% saw static conditions, and 4% predicted contraction.

Almost half (48%) are concerned about the negative impacts of tariffs and trade disputes. Twenty-eight percent say they are unconcerned and 22% are neutral. “It’s simply awful—very destructive,” said one survey respondent.

Business Climate

Just 11% see the state’s economy expanding in the next 12 months, while 29% see no change and 61% forecast contraction. Eighty-one percent say the state’s business climate is declining, an alarming 20-point jump from last year.

Connecticut’s business climate continues to be a troublespot, and new workplace mandates—including paid family and medical leave and a $15 minimum wage—have companies wondering if lawmakers really understand the challenges they face.

“While Connecticut businesses are finding ways to survive and grow, their concerns for the future are clearly apparent in this survey,” said CBIA president and CEO Joe Brennan.

“Policymakers must acknowledge these very real concerns and focus on policies that will drive long overdue economic and job growth.”

CBIA’s Joe Brennan

“State policymakers must acknowledge these very real concerns and focus on policies that will restore confidence, promote investment, and drive long overdue economic and job growth.”

Brennan noted that small businesses were particularly frustrated with the 2019 legislative session, with the survey showing many felt unfairly targeted by the new mandates and tax changes.

Strengths

Marcum’s Hartford managing partner Michael Brooder explored the survey results at the conference with Scott Dolch, executive director of the Connecticut Restaurant Association, Kristofer Kolstad, vice president, marketing and business development at Kaman Speciality Bearings and Engineered Products, and Jessica Rich, managing partner and vice president of business operations at The Walker Group.

“It’s great to see Connecticut companies continuing to grow and expand despite the unrelenting negative trends in the state’s business climate,” Brooder said.

“I am hopeful that companies continue to find ways to be innovative for the next generation of Connecticut workers.”

One-third of surveyed companies said proximity to customers is the greatest advantage to running a business in Connecticut, while 29% cited quality of life and 9% access to major markets.

“The best thing about Connecticut is the proximity to our customers,” Rich said. “That’s a major plus for us.”

Weaknesses

For 24% of companies, the top factors hampering growth are the increasing cost of regulatory compliance, the unpredictability of legislative decision-making, and the state’s cost of living.

“To think about expanding and investing tens of millions of dollars in new factories in Connecticut versus, say, Alabama, Texas, or some other state is sometimes really tough,” Kolstad said.

Due to the complexities of Connecticut’s tax laws and regulations, Kaman has a team dedicated to cutting through red tape.

“That’s a cost in and of itself and it gives our CEO a headache,” Kolstad said.

Dolch urged the 280 business leaders at the conference to build relationships with their state lawmakers.

“As we talk about the future with the upcoming session, what relationship, as a business, as an individual, do you have with your legislator?” Dolch asked.

Just 3% of surveyed businesses approve of the state legislature’s handling of the economy and job creation, while 92% disapprove—an all-time high for this survey.

“It was a challenging legislative session,” Dolch said.

“We tracked 175 bills. We usually track 30 to 40. We probably had about 20 to 30 that passed that will have significant impact on the long term of our businesses in Connecticut.”

Growth Prospects

Where do employers want policymakers to focus their attention? Over one-third (34%) say next year’s legislative session should tackle government spending cuts, including reforming the state employee retirement system.

Fiscal instability is undermining economic growth—stripping resources from other critical areas like education and infrastructure and discouraging much-needed private sector investment.

“Stop trying to find creative ways of raising revenue and start looking for effective ways of reducing the amount of money Connecticut requires to operate,” wrote one survey respondent. “The long-term effect of all these tax increases is a talent and money drain on the state.”

In the last 12 months, 40% of surveyed companies introduced a new product or service, down from 48% the previous year.

Of the 35% of businesses planning on rolling out new products or services in the next 12 months, nearly half—48%—will produce in Connecticut, down slightly from 49% last year.

“It’s virtually impossible for us to attract new employees to Connecticut because of the state’s high cost of living,” Kolstad said.

“We need to be able to attract skilled workers.”

Workforce Development

Those skilled labor shortages may also influence where companies locate and produce.

In fact, employee training is the top investment priority for 29% of surveyed companies , with 14% emphasizing worker recruitment.

“The biggest place we’re investing is our people,” said Rich of The Walker Group.

“Our people are our product and really our only product, so we have to take exceptional care of them and we do.”

“The biggest place we’re investing is our people. Our people are our product, so we have to take exceptional care of them.”

The Walker Group’s Jessica Rich

In other investment areas, 16% are prioritizing new technology, 15% are investing in properties and facilities, 8% in other capital assets, and 8% in research and development.

Kolstad said Kaman’s decision years ago to invest in process development, automation, and Lean processes was key.

“Had we not started our Lean events nearly 20 years ago, we wouldn’t be in Connecticut today,” he said. “It’s really that simple.”

Hiring Trends

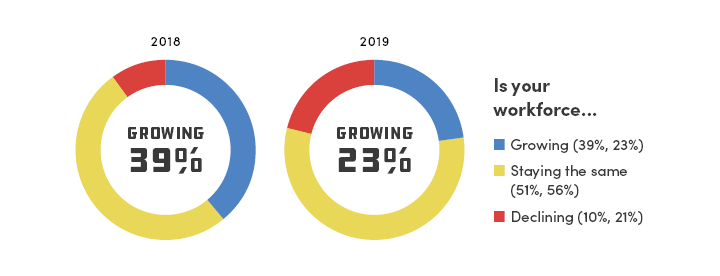

Almost a quarter (23%) of businesses plan on expanding their workforce this year, down from 39% in 2018. Fifty-six percent are maintaining current employee levels, 21% of companies expect to a decline (versus 10% in 2018).

Although uncertainty with Connecticut’s economy drives this trend, businesses—especially manufacturers—continue to face a shortage of skilled workers.

And it’s compounded by a labor force that’s shrinking due to population loss, retirements, and the state’s high cost of living.

Most companies struggle to find and retain young workers. While 55% of companies report difficulty hiring and retaining young workers, 19% have trouble finding them, and 8% with keeping them.

Rich said The Walker Group has made adjustments for the millennial generation born between 1981 and 1996.

She called them “a force to be reckoned with. They want a future. They really want to understand that they are part of something bigger.”

The top three obstacles to finding young workers are lack of skills or experience (34%), lack of proper work ethic (25%), and Connecticut’s high cost of living (19%).

Opportunity

Brooder said the survey revealed areas of opportunity for policymakers to pursue to improve the state’s business climate and drive economic growth.

“We all play a role—businesses, taxpayers, lawmakers—in helping grow the state’s economy,” he said.

“We need to celebrate the good things in Connecticut,” said Rich.

“We all play a role in helping grow the state’s economy.”

Marcum’s Michael Brooder

“This is a great place to live, work, and raise a family,” added Dolch.

Kolstad agreed.

“There are so many reasons to live in Connecticut,” he said.

“But it’s the career piece—and the cost piece—that we need to address to make sure we realize those opportunities.”

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.