Credit Conditions Show Slight Improvement

Credit availability, crucial for job growth and business expansion, improved slightly in the third quarter of this year, reversing modest declines through the first six months of 2011.

However, the third-quarter 2011 CBIA/ Farmington Bank Credit Survey finds credit conditions remain below the level for the third quarter last year. And that gives economists pause for concern.

“Higher energy prices have siphoned off consumer spending power at a critical time,” said Connecticut Business & Industry Association economist Peter Gioia.

“Consumers are postponing purchases of services and goods, adversely impacting cash flows in the small business sector.”

Gioia added that the decline in revenue for many of Connecticut’s small businesses could cause area lenders to take a more risk-averse lending strategy, further stalling growth.

Don Klepper-Smith, chief economist and director of research at New Haven-based DataCore Partners, said that while he was encouraged by the third quarter credit findings, widespread uncertainty continued to undermine state and national economic recovery.

“I can’t recall an economic recovery where there was so much underlying uncertainty, and that is clearly problematic,” he said.

”Many businesses have postponed new hiring and are taking a wait and see approach to the current cycle.”

Less than half of survey respondents (47%) expect that near-term credit conditions would deteriorate in the coming months. Only 10% saw conditions improving, while 42% thought availability would stay unchanged.

Other key survey findings:

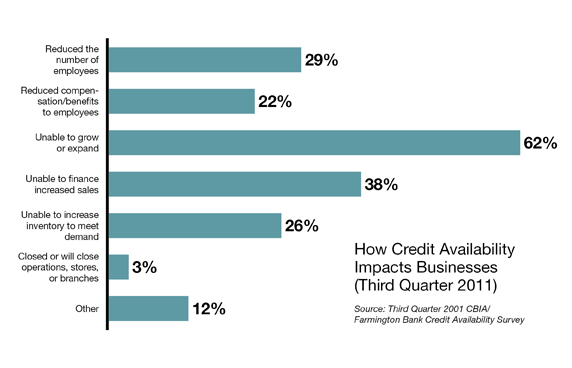

- More than half of respondents (62%) said they would be unable to grow or expand their business as a result of not being able to secure adequate credit.

- About 29% said they planned to trim their workforce, while about a quarter said they expected to reduce compensation and/ or benefits.

- About 32% of respondents used financing in the last three months, which is the same percentage reported in the third quarter survey.

- About 40% of respondents said that if credit was available they would be investing in new equipment. Another 18% said they would use the funds to expand into new stores, branches or operations.

- 17% said they would be hiring new employees if funds were made available.

“The national economic recovery is well into its third year and is still struggling,” said Marie O’Brien, president of the Connecticut Development Authority (CDA).

“For Connecticut companies that means credit availability and timeliness is crucial for job growth and business expansion.”</p>

The Third Quarter 2011 CBIA/Farmington Bank Credit Availability Survey was emailed to 2,000 Connecticut businesses in September of 2011. A total of 235 executives responded, for an 11.75% response rate and margin of error of +/-6.2%.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.