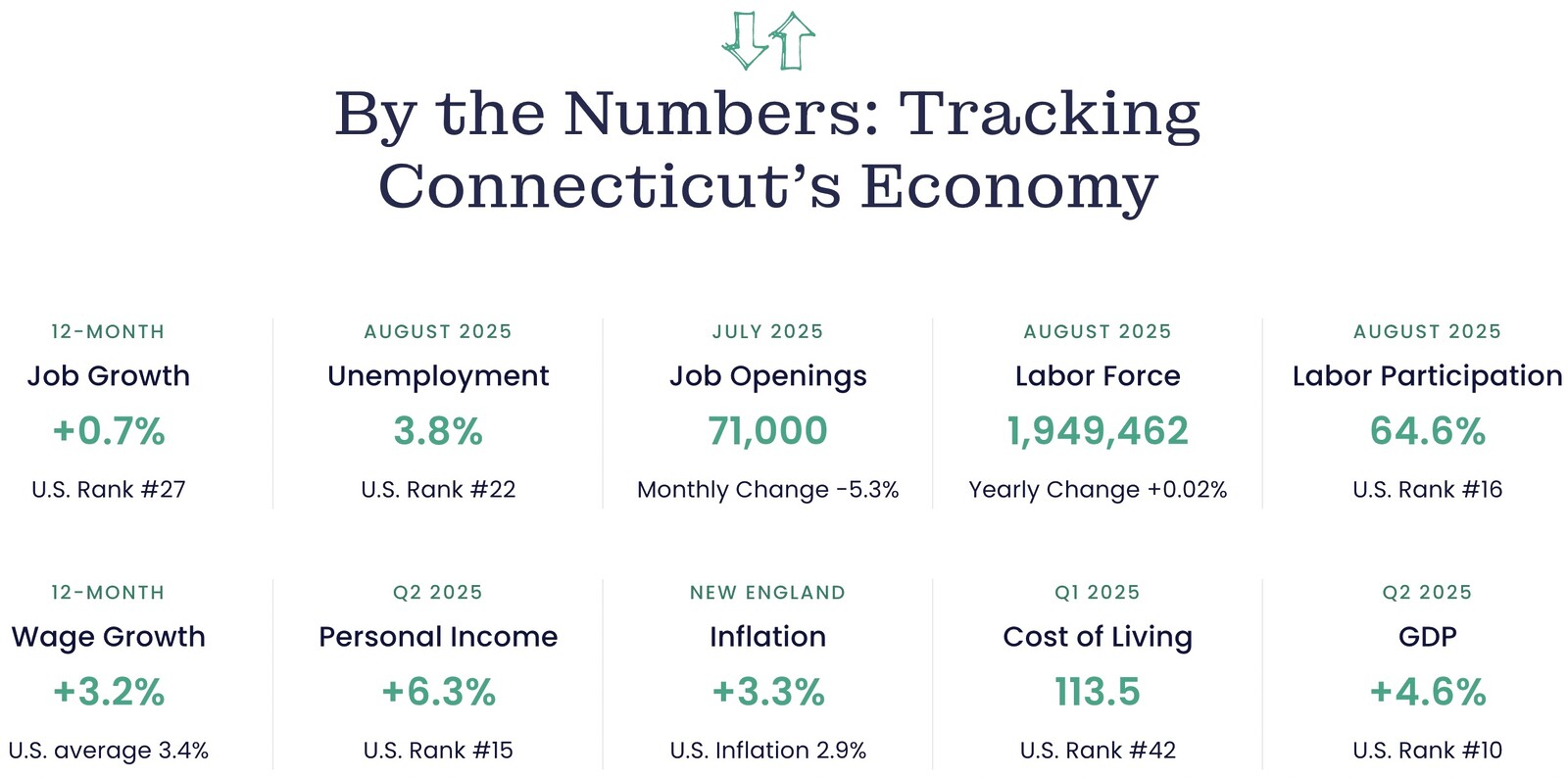

State’s Economy Posts Strong Second Quarter Growth

Connecticut’s economy expanded 4.6% in the second quarter, driven by strong performances from the critical manufacturing and finance and insurance sectors.

The U.S. Bureau of Economic Analysis’ quarterly report also revised first quarter data, with the revisions showing GDP increased 0.3% in the first three months—14th in the country—instead of the initially reported 0.9% contraction.

Over the past 12 months, Connecticut’s economy has grown 1.6%, versus the U.S. at 1.2% and New England at 1.3%, highlighting strong growth trends.

CBIA president and CEO Chris DiPentima said volatility in the important finance and manufacturing sectors requires a cautious response, as federal policy uncertainty is heavily impacting the state’s economy.

“Connecticut is certainly navigating the volatility and uncertainty over the first six months of the year better than most states,” CBIA president and CEO Chris DiPentima said.

“As CBIA’s annual survey of businesses shows, employers are closely monitoring federal fiscal policy, trade dynamics, and inflationary pressures—all of which are contributing to a climate of uncertainty.”

Regional Numbers

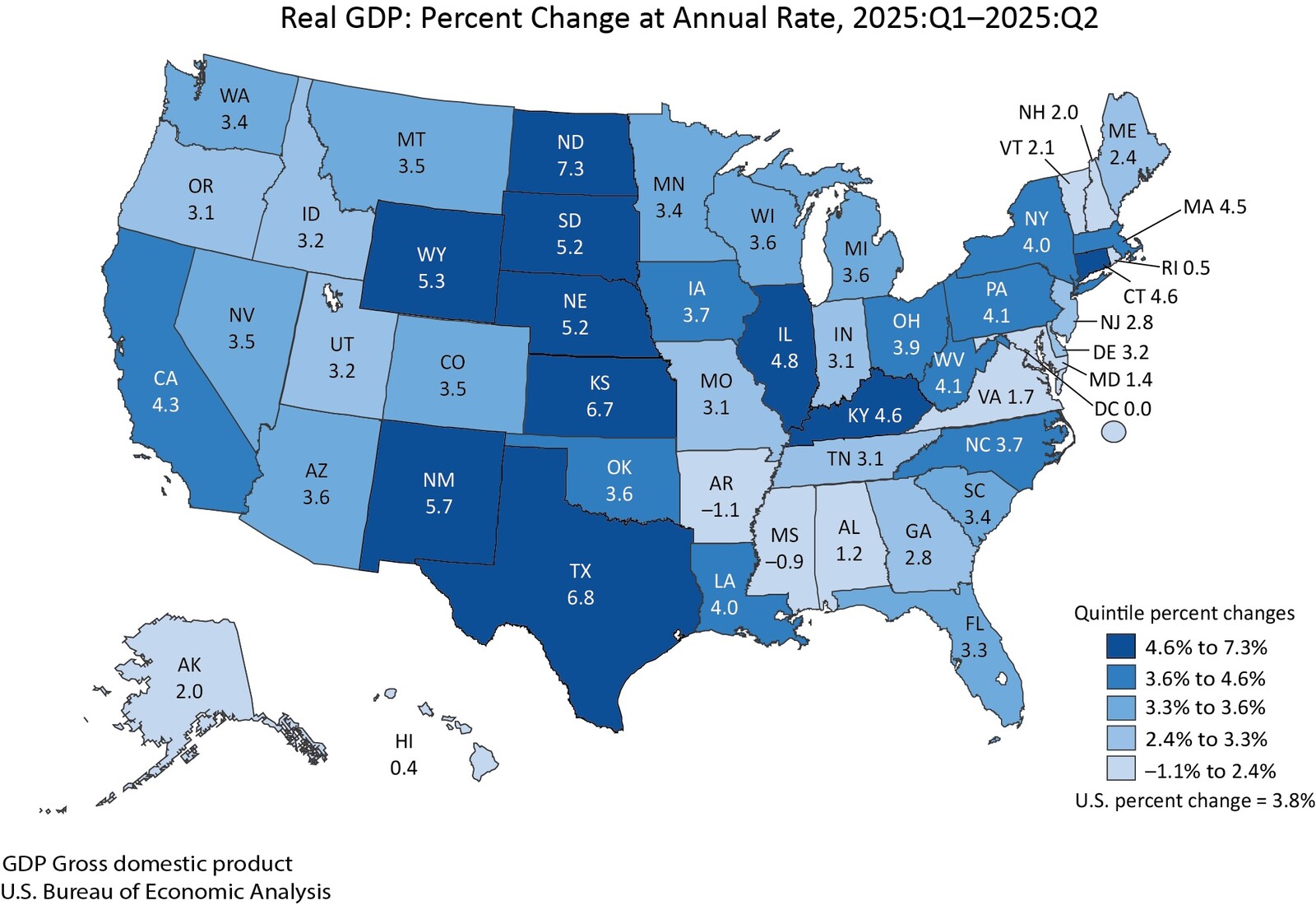

New England’s economy grew 3.9% and national GDP increased 3.8%, with 48 states posting positive economic numbers after a difficult first quarter that saw the national economy shrink 0.6%.

Massachusetts’ economy performed best in the region after Connecticut, expanding 4.5%—11th among all states—after growing 4.2% the previous quarter.

Maine’s GDP grew 2.4% (40th), followed by Vermont (2.1%; 41st), New Hampshire (2%; 40th), and Rhode Island (0.5%; 47th).

DiPentima noted that manufacturing’s rebound from a first quarter contraction reflected inventory use after manufacturers stocked up ahead of scheduled tariffs, as net export data showed.

“We must pay close attention to signals of a softening in the economy, particularly with the weakening in the jobs market and ongoing labor force losses,” he said.

“Retail trade sector output also declined in the quarter, a sign that consumer confidence struggled in the quarter and a worrying trend as it also declined the previous three months.

“The best thing state policymakers can do is promote greater certainty on the state level that can mitigate federal issues and support continued growth.”

Sector Performance

Connecticut’s $291.7 billion real GDP accounts for 24% of New England’s $1.2 trillion economy, and is the second largest in the region behind Massachusetts ($642.8 billion).

Fifteen of the 22 major industry sectors that BEA tracks posted productivity gains in the second quarter, led by finance and insurance, which expanded 1.59% after shrinking 0.92% in the first quarter.

Manufacturing grew 1.01%—rebounding from -0.42% the previous quarter—followed by information (0.82%), professional services (0.49%), wholesale trade (0.48%), real estate (0.38%), healthcare (0.32%), construction (0.26%), accommodation and food services (0.16%), management (0.1%), state and local government (0.09%), arts, entertainment, and recreation (0.08%), transportation and warehousing (0.07%), agriculture (0.01%), and mining (0.01%).

Retail trade declined for a third consecutive quarter, down 0.55% to lead all losing sectors.

Utilities output declined 0.25%, followed by educational services (-0.19%), federal government (-0.17%), administrative services (-0.04%), other services (-0.04%), and military (-0.01%).

North Dakota’s economy went from third worst in the first quarter (-5%) to the best of all states in the second quarter, growing 7.3% with the state’s mining sector leading the rebound.

Texas rebounded from 3% first quarter decline, posting 6.8% growth, followed by Kansas (6.7%), New Mexico (5.7%), and Wyoming (5.3%).

Arkansas’ economy shrank 1.1% with Mississippi (-0.9%), Hawaii (0.4%), Rhode Island, and Alabama (1.2%) filling out the bottom five states.

Personal Income

Connecticut’s personal income, a key measure of economic competitiveness, grew 6.3% in the second quarter—15th best in the nation—after growing 6.4% in the previous quarter.

“Personal income growth is a positive sign,” DiPentima said. “Wage increases are keeping pace with inflation in Connecticut.

“And that means employers are doing everything they can to attract and retain people and grow their businesses, and ultimately grow Connecticut’s economy.”

The New England states averaged 6.2%, down from 7.3% in the first quarter, led by Massachusetts at 7%—fifth best in the country.

“Wage increases are keeping pace with inflation in Connecticut.”

CBIA’s Chris DiPentima

Maine saw 6.9% growth (sixth), followed by Connecticut, Vermont (4.8%; 35th), Rhode Island (4%; 42nd), and New Hampshire (3.3%; 48th).

U.S. personal income grew 5.5% in the second three months of the year, down from 6.4% in the first quarter.

Kansas (10.4%) posted the largest percentage increase, followed by New Mexico (8.7%), Arizona (7.7%), Nebraska (7.4%), and Massachusetts.

Arkansas saw the slowest personal income quarterly performance among the 50 states at 0.9%, followed by Mississippi (2.7%), Massachusetts, California (5.2%), and Arizona (5.4%).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.