Labor Shortage, Omicron Impact First Quarter GDP Growth

Connecticut’s economy contracted 1.4% in the first quarter of 2022 as companies struggled to meet product demand amid the labor shortage and Omicron disruptions.

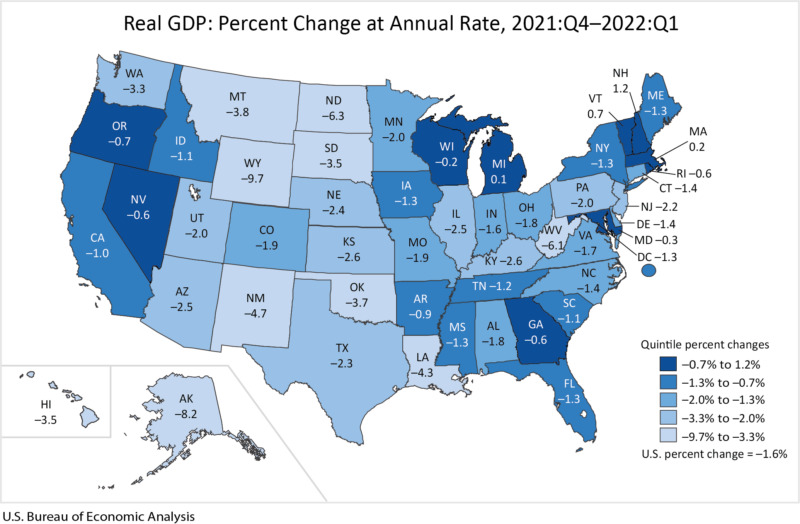

The U.S. Bureau of Economic Analysis’ June 30 quarterly report shows GDP declined in 46 states, with the national economy shrinking 1.6%.

Connecticut’s economic performance stood in contrast with most of the New England states, with regional GDP contracting just 0.2%.

New Hampshire’s GDP expanded 1.2% in the first quarter, the best performance in both the region and the country.

Vermont’s economy grew 0.7%, followed by Massachusetts (0.2%), Rhode Island (-0.6%), Maine (-1.2), and Connecticut.

Vermont’s first quarter GDP growth was second in the U.S. after New Hampshire, Massachusetts was third, and Rhode Island eighth, while Maine ranked 16th and Connecticut 22nd.

‘Frustrating’ Report

CBIA president and CEO Chris DiPentima called the first quarter numbers “frustrating,” noting that despite record demand for products and services, Connecticut companies remain challenged by the labor shortage crisis.

“Just imagine how our economy would be performing if we filled even half of the state’s 110,000 job openings,” DiPentima said.

“There’s no greater threat to our economic recovery than the labor shortage—Connecticut’s labor force declines since February 2020 represent 46% of the regional losses and 26% of the national decline.

“There is no doubt that the demand is there. Filling those jobs and meeting that demand means fixing issues like the state’s high cost of living and continuing to invest in workforce development programs.”

Connecticut’s GDP grew 4.2% in 2021, 36th fastest in the country after a strong fourth quarter performance.

Based on the first quarter of 2022, Connecticut’s annualized GDP was $312.2 billion, 24% of New England’s $1.28 trillion economy, and the second largest in the region behind Massachusetts ($663.79 billion).

Industry Sectors

Thirteen of the 21 Connecticut industry sectors BEA tracks expanded in the first quarter, led by accommodation and food services, which grew 0.39%.

Information grew 0.32%, followed by government (0.26%), real estate (0.21%), utilities (0.21%), educational services (0.16%), construction (0.1%), management (0.09%), durable goods manufacturing (0.08%), administrative services (0.06%), other services (0.04%), arts, entertainment, and recreation (0.03%), and healthcare (0.01%).

Connecticut’s nondurable goods manufacturing shrank 1.17% to lead all declining sectors after expanding 0.46% in the fourth quarter of 2021.

The key finance and insurance sector declined 1.12% after expanding 0.71% the previous quarter.

Connecticut’s key finance and insurance sector declined 1.12%.

Retail trade fell 0.6%, followed by wholesale trade (-0.19%), transportation and warehousing (-0.16%), agriculture (-0.05%), mining (-0.3%), and professional services (-0.02%).

BEA officials said an increase in COVID-19 cases related to the Omicron variant “resulted in continued restrictions and disruptions in the operations of establishments in some parts of the country.”

Michigan (0.1%) and Wisconsin (-0.2%) filled out the top five performing states in the first quarter.

Wyoming’s economy shrank 9.7%, the worst of all 50 states, followed by Alaska (-8.2%), North Dakota (-6.3%), West Virginia (-6.1%), and New Mexico (-4.7%).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.