Report: Small Businesses Expect a Recession in 2023

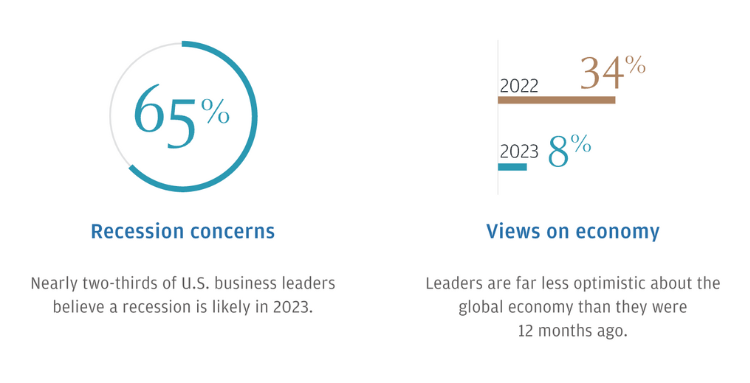

Nearly two-thirds of small businesses and midsize firms anticipate a recession in 2023, with many reevaluating their approaches to prepare, according to a new survey.

JPMorgan Chase’s newly released annual Business Leaders Outlook survey reflects how businesses are faring, and highlights the growing impact of inflation and workforce challenges.

The report also offers recommendations that businesses can implement to further prepare for an economic downturn.

“Businesses are signaling that they’re practiced in being nimble and prepared for several different scenarios, which are keys to operating effectively in today’s economy,” JPMorgan Chase head of middle market banking and specialized industries John Simmons said.

Economic Outlook

The survey found that business optimism depends heavily on the size of a company, despite similar challenges.

The survey found a mere 8% of midsize businesses are optimistic about the global economy’s prospects—down from 34% one year ago.

Those optimistic about the national economy fell to 22% from 50%.

Small business leaders see a brighter picture, with almost half expressing optimism about both the national and global economies.

Despite uncertainty about the economy, business leaders feel positive about their own company’s performance.

In 2023, 69% of small business leaders expect increased revenue and sales.

Sixty-three percent of midsize business leaders expect increased revenue and sales, with more than half predicting greater profits in 2023.

Inflation

Inflation concerns are on the rise this year, particularly for small businesses.

A staggering 91% of midsize business leaders said they are experiencing inflation challenges.

Half of surveyed small businesses acknowledged that inflation is a challenge this year. Nearly all reported inflation impacted their expenses.

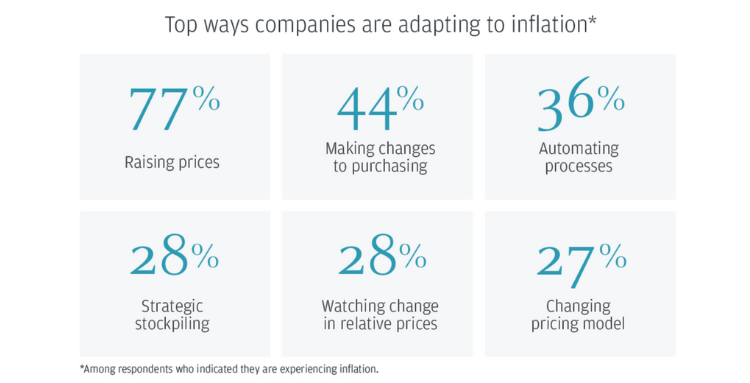

Nearly 38% noted expenses increased by 11% or more, leaving businesses with few options.

Eighty-three percent of midsize businesses passed prices to consumers and buyers, and more than two-thirds (68%) of small businesses raised prices on select goods or services.

“Inflation has been a challenging headwind impacting businesses of all sizes across all industries,” JPMorgan Chase head of research Ginder Chambless said.

“While we have seen some encouraging signs that inflation has started to moderate and should cool over 2023, businesses may still want to consider adjustments to strategies, pricing, or product mixes to help weather the storm in the near-term.”

Businesses already took that advice. The survey notes 82% of midsize businesses are likely to continue to increase prices to mitigate costs.

Workforce Development

Despite the rising cost of managing a business, businesses remain focused on growing their workforces.

“While businesses may be cautious in their economic outlooks, their actions display a focus on growth and investing in their employees,” Simmons said.

More than half of small and midsize business leaders expect to grow their workforces in 2023.

“While businesses may be cautious in their economic outlooks, their actions display a focus on growth and investing in their employees.”

JPMorgan Chase’s John Simmons

Wage increases will likely accompany waves of new hires.

Two-thirds of midsize business leaders, and 42% of small business leaders plan to increase wages and/or benefits to attract and retain employees.

Another way employers are working to attract and retain talent is through upskilling. Almost half of employers said they will offer upskilling and training opportunities for staff.

Performance

“Following the challenges of the last few years, it’s encouraging to see the resilience of small business owners and leaders,” Chase Business Banking CEO Ben Walter said.

“The next economic cycle is always right around the corner, so our role is to help small business owners plan ahead so they can succeed in good times and bad.”

Walter and others at JPMorgan Chase suggest business owners continue to stay in tune with economic trends and remain flexible about preparations for a recession.

The report recommends that businesses “bolster balance sheets and find opportunities.”

The survey report recommends that small businesses “bolster balance sheets and find opportunities amid volatility.”

Maintaining working capital is also crucial with today’s economic changes.

The report added that businesses should consider supply chain financing and dynamic discount solutions, implementing more efficient inventory management, and reworking current debt to reduce liabilities.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.