State Cuts Sales Tax Permit Period to Two Years

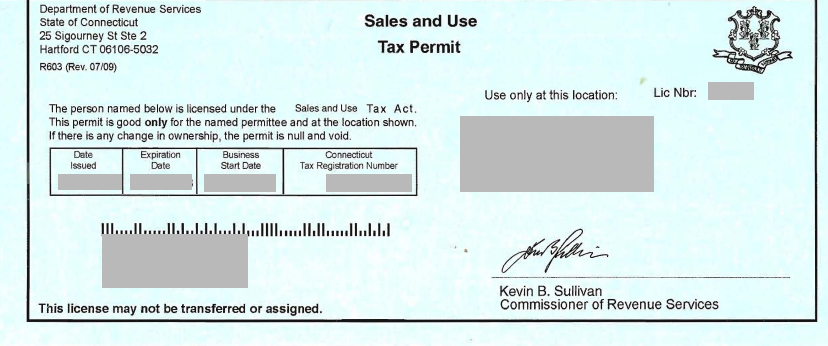

Connecticut businesses will have to renew state sales and use tax permits once every two years beginning Oct. 1, a change from the current five-year permit.

The new permit schedule is part of the state’s efforts to improve its revenue stream.

Under a law that went on the books Jan. 1, 2017, DRS will not renew a sales tax permit to any person or entity with an outstanding tax return.

Reducing the permit period from five to two years gives the state more flexibility to impose more frequent collection requirements.

The permit fee is $100. Businesses must get a new permit when the current one expires.

Beginning January 1, 2018, DRS also can require chronic late payers “to remit the tax collected during a weekly period on a weekly basis,” according to the law.

Weekly remittances are in addition to—not in lieu of—monthly or quarterly returns.

Patching ‘Revenue Holes’

It’s all part of an attempt by DRS to patch holes in the state’s revenue pipeline.

Speaking at CBIA’s Tax Conference in June, DRS Commissioner Kevin Sullivan said he wanted his department to have more authority to pursue habitual non-filers and non-payers.

Changing the duration of the sales tax permit will help accomplish that goal, Sullivan said.

Lawmakers are considering hiking the sales tax to 6.99% to help close a $5.1 billion budget deficit.

For example, Amazon and Airbnb agreed with state demands to collect sales taxes at the point of sale, Sullivan said.

This will help close what he says is a $200 million sales tax gap—money that companies doing business in Connecticut or with someone here fail to pay.

Tax Hike Proposal

That $200 million represents about 5% of the $3.94 billion in sales and use taxes Connecticut collected in fiscal 2017, $40 million more than the previous year.

At 6.35%, Connecticut's sales tax is the 12th highest among states according to a Tax Foundation study released earlier this year.

Lawmakers are considering hiking the sales tax to 6.99% to help close the state's projected $5.1 billion two-year budget deficit.

Sullivan's office also announced this week its successful efforts to crack down on businesses that avoid paying taxes by using what's known as tax suppression software.

DRS agents arrested a New Haven woman who allegedly used the "zapper" software, which creates bogus point-of-sale records, at her Milford restaurant.

Sullivan said Connecticut has been working with other states to detect the software and charge anyone who uses it.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.