Mark Your Calendar: State Minimum Wage Increases October 1

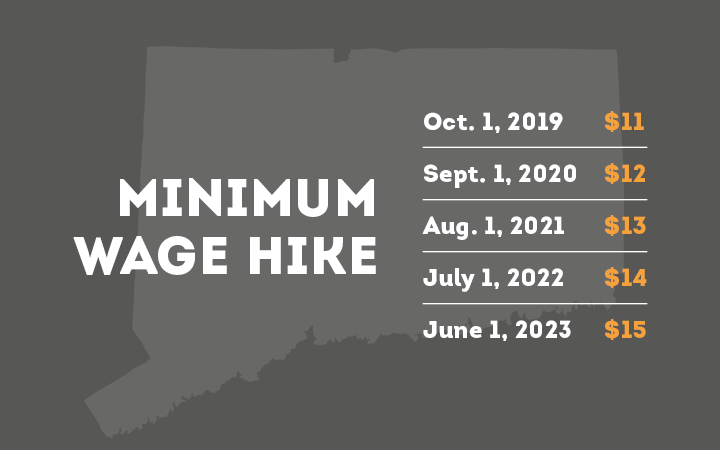

The first in a series of scheduled minimum wage increases, from $10.10 per hour to $11.00 per hour, takes effect October 1, 2019.

Connecticut’s hourly minimum wage will increase each year through 2023, when it reaches $15.

Gov. Ned Lamont signed legislation raising the minimum wage May 28. The move increases the wage by almost 50% in just four years.

The mandated hourly wage increases from $10.10 to $11 October 1; to $12 September 1 2020; to $13 August 2021; to $14 July 2022; and to $15 in June 2023.

Any increases after Jan. 1, 2024 will be tied to the employment cost index, a quarterly metric created by the U.S. Bureau of Labor that details changes in labor costs across the country.

Connecticut’s hourly minimum wage was last raised in 2017.

Midweek Pay Increase

As October 1 is a Tuesday, that will most likely be a midweek pay increase that will have to be programmed into your payroll calculations.

Any overtime hours worked that week will require even more careful calculations.

Hours worked October 1 and thereafter must be paid at no less than $11.00 per hour.

You may voluntarily choose to pay the new higher rate for all hours worked that week, but your legal obligation is to use the minimum rate applicable at the time the work was performed.

That means hours worked before October 1 must be paid at no less than $10.10 per hour and hours worked October 1 and thereafter must be paid at no less than $11.00 per hour.

Calculations

This is no different than the situation where a worker might perform different tasks that pay different rates, based on complexity, customer pricing, time of day, etc., resulting in a week of total hours reflecting several hourly rates.

In the event the weekly total hours worked exceed 40 and overtime pay is owed, you have to calculate an average hourly rate for the week.

Tally up total straight time wages for all hours worked at each applicable hourly rate; divide that total straight time wage by the total hours worked, giving you an average hourly rate for the week; divide that average hourly rate by 1/2 and multiply that 1/2 time rate by the number of overtime hours worked.

That will yield a gross pay amount that includes overtime pay at time and one half of a blended or average hourly rate.

For more information, contact CBIA’s Mark Soycher (860.244.1138) | @HRHotline

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.