Administration Releases COVID-19 Relief Fund Spending Plan

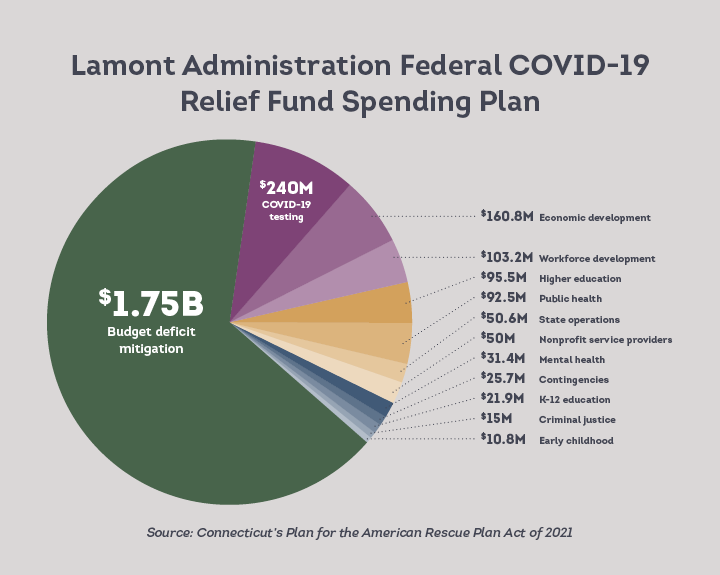

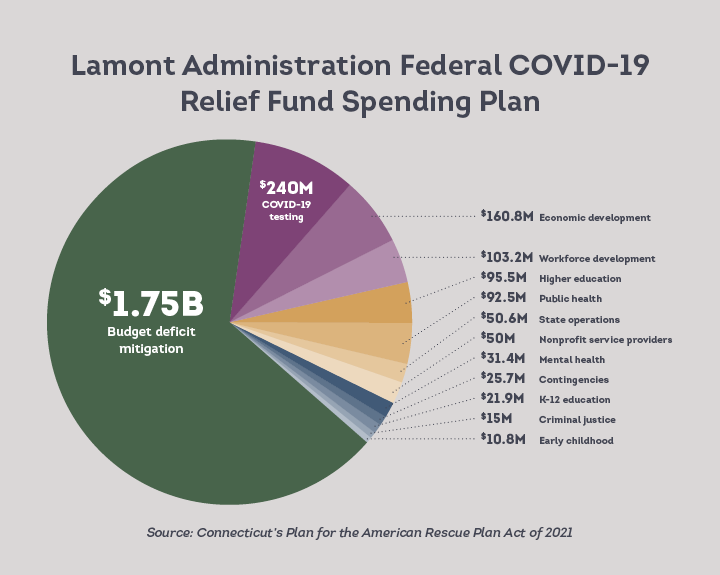

The Lamont administration this week released its proposal for spending $2.6 billion in federal COVID-19 relief funds, focusing on public health, education, workforce, and economic development.

The proposal allocates $1.35 billion in fiscal 2022, $1.2 billion in 2023, $75.8 million in 2024, and $1.5 million in 2025.

That’s in addition to another $3.4 billion in American Rescue Plan Act funds already allocated to education, childcare, municipal aid, rental assistance, and affordable housing initiatives.

Including the $4 billion in relief checks sent to individual taxpayers, Connecticut has now received about $10 billion in federal relief funding.

Office of Policy and Management secretary Melissa McCaw said April 26 that the administration wants to spend $1.75 billion—two-thirds of the $2.6 billion fund—to help close the state’s projected two-year, multi-billion budget deficit.

That proposal, pending additional guidance from the U.S. Treasury, will be reviewed by the General Assembly as a result of legislation passed earlier this session requiring legislative oversight and approval of the use of federal funds.

“The funds due to arrive in Connecticut through the American Rescue Plan Act represent an incredible opportunity for this state to make transformative investments to emerge healthier and stronger,” Gov. Ned Lamont said in a statement.

“Our proposal places a special emphasis on equity, investments in children and families, and making our state even more prepared in the event of another public health emergency or crisis.”

Economic Development

The administration is proposing to use $160.8 million for economic development, in combination with private sector investment.

That plan features the following initiatives:

- Greentech Fund that will invest in emerging renewable energy, clean technology, and sustainability companies with a goal of creating up to 2,000 jobs

- Grant and loan funding for small and under-represented businesses

- Marketing campaign to drive tourism and population growth and modernize outdated regulations and licensing regulations to improve business friendliness and open new career pathways

- Focus on smart manufacturing by creating and/or retaining 5,000 jobs through training and programs by recapitalizing the Manufacturing Innovation Fund

- Seeding three Innovation Corridor projects to drive job opportunities, innovation, and business formation in cities

Workforce Development

Another $103.2 million is allocated to workforce development projects including:

- $93.5 million for sector-based training for in-demand industries

- $2 million for youth employment and wrap-around services

- $4 million to support at-risk youth

- $3.7 million to extend the operating hours and opportunities at 10 Connecticut Technical Education and Career System schools

CBIA president and CEO Chris DiPentima welcomed the administration’s plan to use federal funds to address the budget deficit and said the proposed investments in economic development and workforce will help drive the state’s recovery.

“How we spend this money will determine what Connecticut does for the next two decades.”

CBIA’s Chris DiPentima

“Gov. Lamont continues to emphasis the need to avoid broad-based tax hikes, and we applaud the administration’s use of federal relief funds to help resolve the projected two-year budget deficits,” he said.

“The investments in economic development and workforce are also critical and will certainly lay the foundation for recovering jobs and rebuilding the state’s economy.

“How we spend this money will determine what Connecticut does for the next two decades. There is no greater economic concern in our generation.”

DiPentima noted the contrast between the administration’s budget strategy and that of legislative Democrats, who are pushing more than $1 billion in tax hikes.

Unemployment Fund Debt

The administration is proposing using $50 million of the $160.8 million allocated to economic development to help address the state’s unemployment fund debt crisis.

Pandemic-driven unemployment benefit claims have bankrupted the fund for the second time in a decade, with employers on the hook to repay a project $1 billion in federal loans.

Earlier this month, CBIA and other organizations called for the administration and legislature to follow the example of 24 states that are using federal coronavirus relief funds to either help meet unemployment benefit obligations or pay down debt.

DiPentima described the $50 million proposal as “modest,” adding that employers are looking to the legislature and the administration to provide significant relief for struggling small businesses.

“While we appreciate the administration’s intentions, we face a looming crisis and absent real relief, Connecticut employers will be paying down this debt for many years to come—threatening job recovery and the state’s economic recovery,” he said.

“We cannot afford what happened after the 2008-2010 recession, with Connecticut business paying four times the unemployment taxes of those in neighboring states, a financial strain that prolonged the economic downturn.”

For more information, contact CBIA’s Ashley Zane (860.244.1169) | @AshleyZane9.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.