CBIA Calls for Independent Audit of State-Run Municipal Healthcare Plan

CBIA president and CEO Chris DiPentima today called for Connecticut Comptroller Kevin Lembo to commission an independent audit of the state-run healthcare plan for municipal employees.

That call follows the release earlier this month of a report produced by the insurance agency Brown & Brown that raises serious questions about the Connecticut Partnership Plan’s fiscal performance and outlook.

The plan is administered by Lembo, who is also an advocate of legislation implementing a public option healthcare plan that is largely modeled on the state-run municipal plan.

In letters emailed Feb. 24 to DiPentima and CBIA assistant counsel Wyatt Bosworth, the Comptroller challenged the testimony Bosworth shared with a legislative subcommittee this week and an article posted on the organization’s website Feb. 18.

“It is incumbent on policymakers to address the significant questions surrounding the state-run municipal plan’s fiscal outlook and solvency status, given that it is the model for the public option legislation,” DiPentima said.

“As a proponent of transparency and open government, we are sure the Comptroller can appreciate the public’s interest in a full accounting of the plan and its operations and will support our call for a fully independent audit.

“That audit should be reviewed and approved by a certified actuary who is a member of the American Academy of Actuaries. We make this request in the interests of sound public policy.”

Shortfalls

Bosworth’s testimony before an Appropriations Committee subcommittee Feb. 22 was based on Brown & Brown’s detailed analysis of the municipal plan. Some of the agency’s clients are public entities covered by the plan.

The Brown & Brown report, released Feb. 12, utilized underwriting projections that “raise some concerns regarding the adequacy of the premiums being collected versus the claims being paid out.”

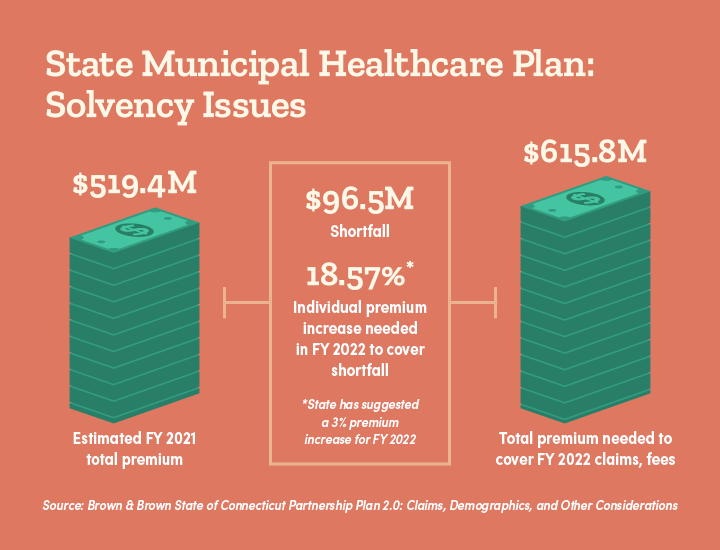

Brown & Brown estimates that a total of $519 million in premiums will be collected by the partnership plan in 2020-2021.

However, the report says that total premiums needed to cover claims and fixed costs for fiscal 2022 are projected at $616 million.

The Brown & Brown report notes the plan’s annual premiums need to increase 18.57% to cover the projected gap. The Comptroller’s office has released a preliminary premium increase of just 3% for next fiscal year.

‘Appropriate Oversight’

The municipal plan paid out significantly more in claims than it collected in premiums for both fiscal years 2018 and 2019, with losses in 2019 more than triple that previous year.

In his Feb. 22 testimony, Bosworth asked the Appropriations Committee to seek additional information from the Comptroller’s office detailing how previous deficits were funded and to develop “appropriate oversight” for the municipal plan.

“If taxpayer dollars are expended to correct previous year deficits and will be used to correct deficits moving forward, this committee should at least be made aware of any budgetary impacts before this new budget is ultimately adopted,” Bosworth testified.

In his letter to Bosworth, Lembo disputed the Brown & Brown analysis, claiming Bosworth’s testimony had “many erroneous statistics and inaccurate information.”

Lembo asked Bosworth to submit corrections to the Appropriations Committee, “and that CBIA should inform its members that the post on its website is also wrong to stop the spread of further misinformation.”

In a Feb. 25 response to the Comptroller, Bosworth wrote that “After careful consideration of your allegations and an additional review of the Brown & Brown report, which formed the basis of my testimony and web post, CBIA remains confident in the accuracy and substance of the information we presented.”

Addressing Healthcare Costs

DiPentima said CBIA works diligently to ensure the credibility of the information it provides to its thousands of member companies, the legislature, the media, and the general public.

“We may disagree from time to time with members of the legislature and administration on policy issues, but we firmly believe that collaborating with open, honest discussions leads to the best outcomes for Connecticut and the state’s residents,” he said.

“We trust the Comptroller will support our call to open the books and welcome an opportunity to work with him to address healthcare costs.”

CBIA’s Chris DiPentima

“We trust that the Comptroller will support our call to open the books on the state partnership plan and we welcome an opportunity to work with him and other stakeholders to address the major issue of healthcare costs.

“We can—and we have to—lower the cost of healthcare. We are proposing viable alternative solutions that deserve further discussion.

“Let’s change the narrative and work together so that we can rebuild Connecticut stronger and better.”

CBIA-Lembo-022521For more information, contact CBIA’s Wyatt Bosworth (860.244.1155) | @WyattBosworthCT

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.