Report: State’s Pension Liabilities Underestimated by Billions

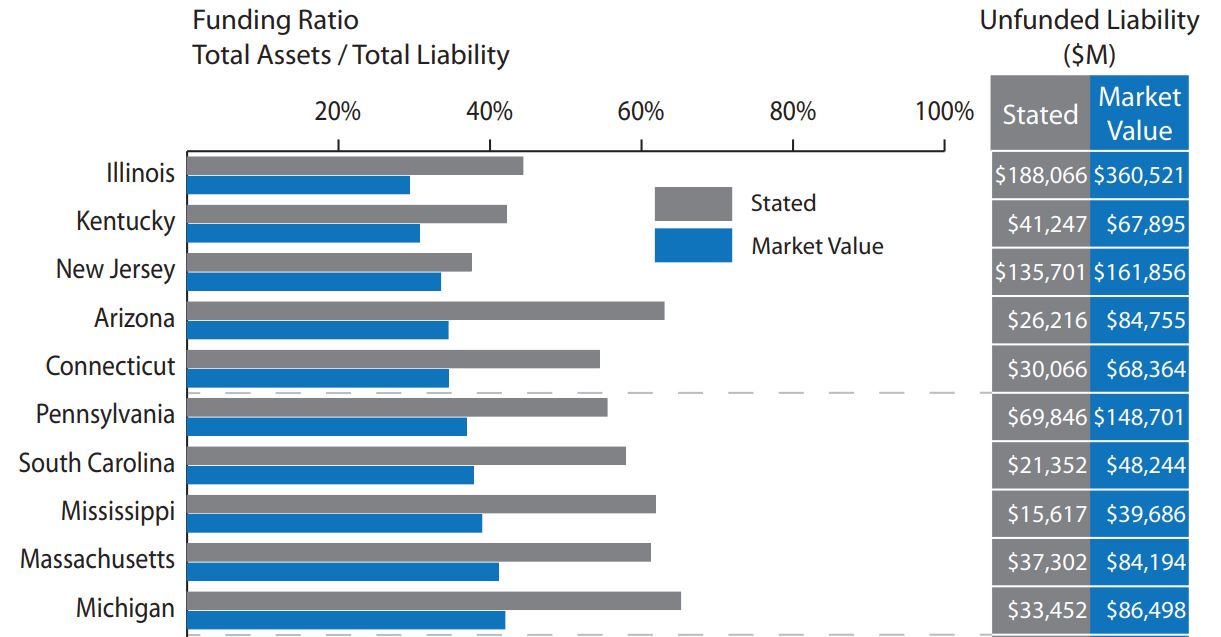

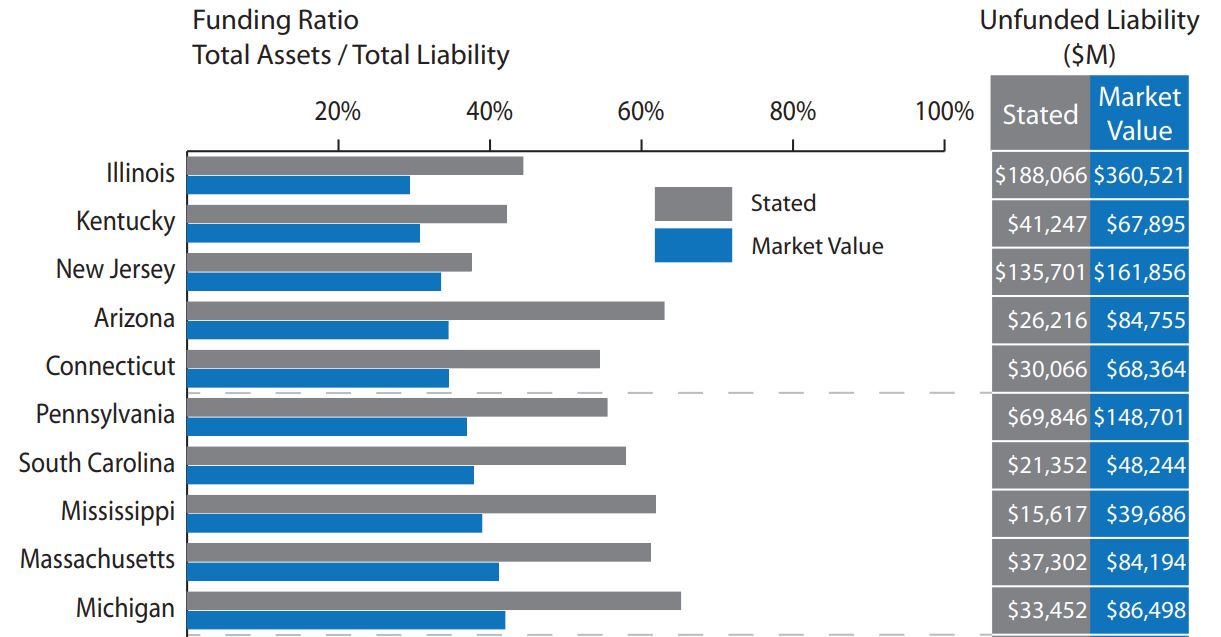

A report on government pension systems says Connecticut officials are underestimating the state’s pension liabilities by billions of dollars.

The report, Hidden Debts, Hidden Deficits: How Pension Problems Are Consuming State and Local Budgets, from Stanford University’s Hoover Institution, looks at government measurements of pension costs and obligations, and how these differ from market valuations.

The Hoover Institution report says Connecticut is underestimating its pension liabilities by by more than $38 million.

The culprit, Rauh’s report says, is unrealistic expectations on investment returns, which government officials use to calculate unfunded liabilities.

“These standards still preserved the basic flaw in governmental pension accounting: the fallacy that liabilities can be measured by choosing an expected return on plan assets,” Rauh says.

“This procedure uses as inputs the forecasts of investment returns on fundamentally risky assets and ignores the risk necessary to target hoped-for returns.”

Wholesale Changes Needed

The news is not good for Connecticut, where recurring tax hikes and the lack of meaningful, long-term spending reforms have stunted economic and job growth.

CBIA and its members have long pushed for real structural reforms to the state employee retirement system to bring benefits more in line with the private sector.

Rauh’s report confirms the need for wholesale changes.

The $30 billion in pension liabilities officials reported in 2015 is actually $68.4 billion.

"Otherwise we are certain to continue passing today's governmental costs onto our future taxpayers."

What's happening, Rauh wrote, is that "governments are borrowing from workers and promising to repay the debt when they retire, but the accounting standards allow the bulk of this debt to go unreported through the assumption of high rates of return."

'Unrealistic' Return Rates

By using unrealistic return rates, the report says, the government is miscalculating and, consequently, under reporting the size of its unfunded pension liabilities.

In 2015, for example, many pension funds assumed an investment return rate of 7.6%.

Under that assumption, money invested today will double in about nine-and-a-half years.

However, changes made in 2014 and 2015 to government accounting standards for pensions required some plans to assume a lower return rate of 7.3%.

But even that rate is unrealistic, Rauh says.

"In order to target high returns, systems have taken increased investment positions in the stock market and other risky asset classes such as private equity, hedge funds, and real estate," he says.

"The targeted returns may or may not be achieved, but public sector accounting and budgeting proceed under the assumption that they will be achieved with certainty.

"Furthermore, while systems face somewhat stricter disclosure requirements under the new [government] standards, these standards will not directly affect funding decisions."

For more information, contact CBIA’s Louise DiCocco (203.589.6515) | @LouiseDiCocco

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.