Executive Order Offers Employers Some Unemployment Tax Relief

Gov. Ned Lamont signed an executive order April 9 partially shielding employers from increased unemployment taxes based on coronavirus-linked benefit claims.

The order modifies state law setting employer experience ratings that are used for calculating the per-employee tax employers pay into the state’s Unemployment Trust Fund.

Executive Order 7W temporarily prevents an employer’s state unemployment tax experience rating from being increased, provided layoffs are linked to the COVID-19 pandemic.

As of this week, more than 302,000 Connecticut workers have filed for unemployment benefits as the pandemic wreaks havoc on the state and federal economies.

While many employers are taking advantage of federal relief programs— like the Payroll Protection Program and the Employee Retention Tax Credit—government closure orders have led to significant layoffs or furloughs.

This massive increase in unemployed workers is taking a major toll on the state’s unemployment system.

Fund Solvency Issues

Despite quadrupling the number of state Department of Labor staffers processing claims, benefit applications are taking up to five weeks to process.

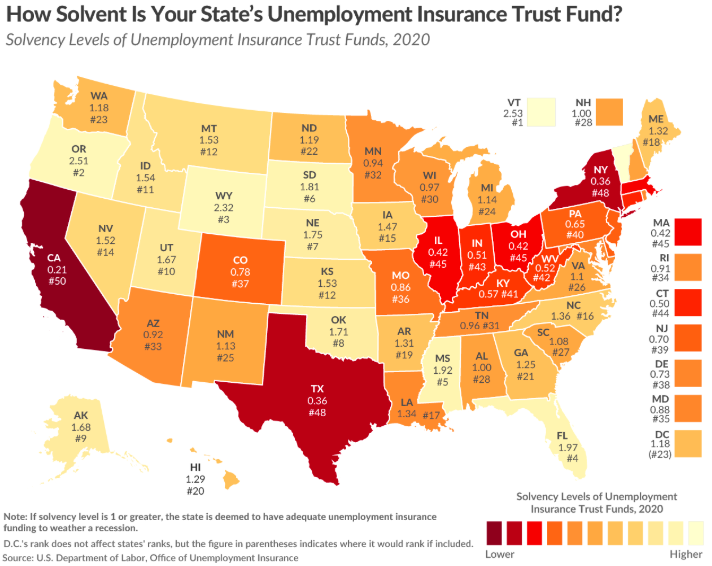

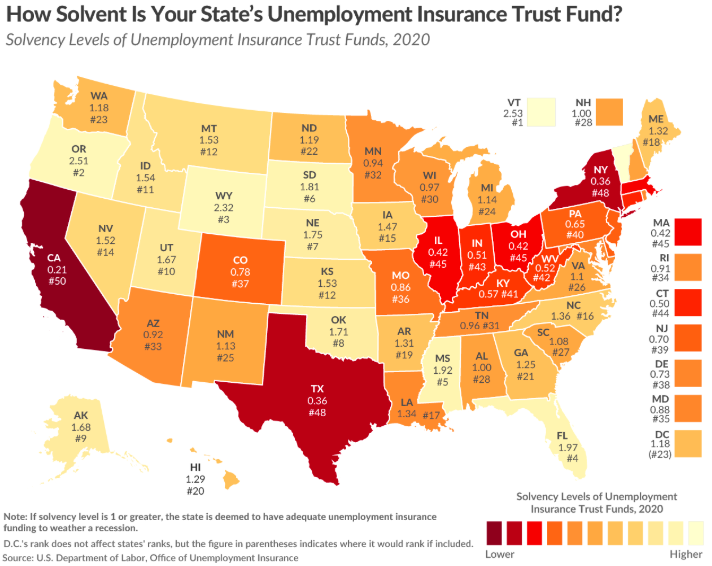

The solvency of the state’s unemployment compensation trust fund was an issue even prior to the pandemic, with the Tax Foundation ranking it seventh worst among all states.

Long-term resistance to any modest benefit reforms—despite repeated warnings from employers—has left the fund’s balance at about half its $1.4 billion solvency goal.

Connecticut is one of 21 states with unemployment compensation trust funds below the minimum recommended solvency level to weather a recession.

Employer Burden

As of April 4, the Tax Foundation estimates Connecticut’s fund has enough cash to cover just 10 weeks of unemployment benefits.

State labor department officials have already acknowledged they will seek federal loans to cover shortfalls in the fund, as the state also did during the 2008-2010 recession.

Those federal loans have the potential to increase taxes on employers in a manner quite distinct from the experience rating factor.

Connecticut’s unemployment fund has enough cash to cover just 10 weeks of benefits.

Those federal loans must be paid off, with the burden placed on employers in the form of increased unemployment taxes.

States with low solvency levels, like Connecticut, incur immediate interest on those federal loans.

Connecticut also took too long to pay off the loans after the last recession, incurring additional federal tax assessments that were passed on to employers.

Reforms Needed

The state borrowed more than $1 billion during the last recession, with Connecticut employers paying as much as $196 per employee in unemployment taxes.

Some state lawmakers are working on approaching the federal government to convert federal unemployment fund loans into grants.

While the governor’s executive order offers temporary, and welcome relief for many businesses, employers may face experience rate consequences after six months unless the legislature takes additional action.

The legislature also must finally act and reform the state’s unemployment fund to mitigate precarious situations such as the current crisis.

For more information, contact CBIA’s Eric Gjede 860.244.1931 | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.