State Labor Law: What Employers Can Expect in 2018

Now that the extended 2017 General Assembly session is finally over, Connecticut’s employers are already wondering what the legislature—specifically its Labor and Public Employees Committee—has in store for them in 2018.

CBIA’s public policy team spends as much or more time than anyone on the front lines of state labor and employment law, following the latest developments so our members can stay informed.

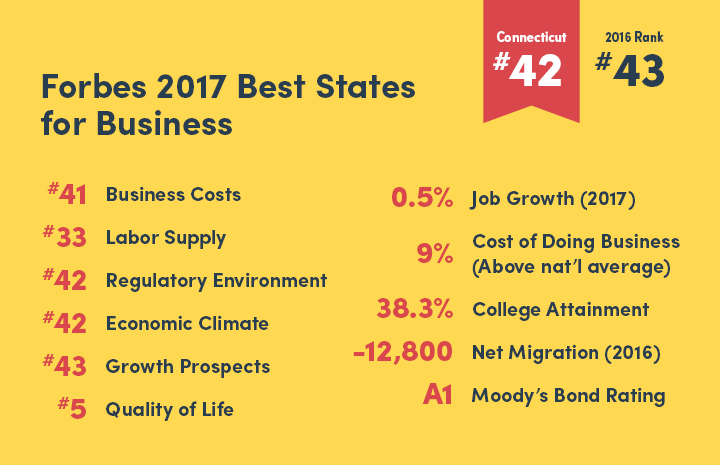

Burdensome workplace mandates are a major factor behind Connecticut’s high business costs.

Let’s start with the bad news.

Some of the same tired, old, one-size-fits-all workplace mandates are expected to make their annual reappearance in the 2018 legislative session.

Although the bills are the same, this year’s sales pitch will be slightly different given the fact that the session precedes the 2018 elections and follows a year with high-profile examples of workplace sexual harassment and discrimination.

Despite the changed political environment, the restrictions and costs that led to the defeat of these bills have not.

The following is a list of labor law proposals likely to be introduced this session.

New Paid FMLA Mandate

Paid family and medical leave mandates have been a persistent feature of recent state legislative sessions and this year will be no different.

A bill planned for introduction in 2018 will force Connecticut employers to deduct worker pay to fund the latest paid FMLA mandate.

Employees will be allowed up to 12 weeks of paid leave each year, at 100% of pay, capped at $1,000 a week.

Paid FMLA requires 160 new government employees at a cost of $13 million to start and $18 million to run each year.

In addition, legislative analysts say—based on legislation that failed last year—the program will require 160 new government employees at a cost of $13 million to start and $18 million to run each year.

Unpaid FMLA Expansion

You may have missed during the various budget sessions last year that lawmakers tried to slip in a provision to double the number of weeks of unpaid family and medical leave allowed under state law.

The business community found it hidden amid hundreds of pages of a budget proposal.

Once exposed, the provision was withdrawn.

The question is whether the inclusion of this provision was truly a mistake, or a preview?

Requesting Salary History

Preventing employers from requesting a job applicant's salary history was part of a package of proposals introduced last year in the name of promoting gender pay equity.

Men and women should receive equal pay for equal work. There were some elements of last year's pay equity package that were positively received by lawmakers in both parties, and that would have a positive impact for companies and their workforce.

Employers, however, use salary history information to assemble competitive compensation packages to lure and retain top employees.

We expect this debate to be a major focus in 2018.

Employee Scheduling Restrictions

Some lawmakers want employers to post employee schedules days, if not weeks, in advance—and most employers do this when they can.

However, past proposals have required the employee be paid an equivalent in hourly wages if there is any deviation from this schedule.

So when critical materials haven't arrived on a job site, or employers have no customers and want to send a few employees home, they are forced to keep workers on site and pay them for not working.

New Employer Tax

The state Department of Labor is proposing a new tax on employers—a 0.15% surcharge on all taxable wages —that will be used solely to cover departmental staff wages.

The draft proposal notes that Connecticut labor department employees have the highest salaries and fringe benefits in the country.

"Steep declines in federal funding coupled with our salary rates and fringe benefit rates (highest in the country) make it impossible to sustain mission critical operations," the department's proposal reads.

Federal funding declines coupled with our salary and fringe benefit rates (highest in the country) make it impossible to sustain mission critical operations.

As a result, the department wants approval from the state's Office of Policy and Management and lawmakers to impose this new tax on employers so DOL can sustain its operations.

We wonder: What happens when other agencies face similar needs?

Will we see the Department of Transportation levy a surcharge at the gas pump or the Department of Revenue Services place fees on our tax bills?

What's Missing?

Notably missing from the above list are proposals that would help Connecticut businesses share in some of the economic recovery that other states are enjoying.

Other missing items include:

- Unemployment benefit reform—something the legislature has avoided for 50 years

- Clarification on workplace rules for medical marijuana

- Greater consistency between state and federal wage and hour laws

If past is prologue, it will be a struggle to even get these bills out of committee.

Short Session

Time for some good news.

For one, it's a short legislative session, just over three months.

Lawmakers can only do so much before they need to return home and begin campaigning for the 2018 elections.

Second, the state Senate is tied 18-18 while Democrats have a narrow 79-71 margin (with one vacancy) in the state House.

That means legislative proposals need broad bipartisan support to pass.

Last year, lawmakers realized that with Connecticut lagging other states in job and economic growth, it was not the time to add more programs that further burdens the business community and stifles investment and growth.

Finally, and simply: there is no money for new programs.

Expensive new schemes are harder to enact when money is tight.

For more information, contact CBIA's Eric Gjede at 860.244.1931 | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.