Paid FMLA, Minimum Wage Hike Will Cost Taxpayers Millions

We already know the two top policy initiatives of the governor and legislative Democrats— paid family and medical leave and hiking the minimum wage—could potentially further disrupt the state’s slow economic growth.

Now, the legislature’s nonpartisan Office of Fiscal Analysis says both proposals come with significant price tags.

Fiscal notes the office prepared for paid FMLA bills and legislation raising the state’s hourly minimum wage to $15 lay out what these proposals will cost the state.

The analyses don’t account for the massive new fiscal burdens the proposals impose on every business in Connecticut.

The three paid family and medical leave proposals that will apply to all private sector businesses are SB 1, HB 5003, and SB 881.

Employees will be able to take 12 to 14 weeks of paid leave each year to care for their own or any number of extended family members’ illnesses at 100% of pay, capped at $1,000 a week.

The state will tax workers 0.5% of their pay to fund the program—regardless of whether their employer already provides the benefit or whether the worker ever takes paid leave.

Unsustainable

Businesses must pay nonwage benefits for employees on leave for up to three months a year, and handle all new administrative and personnel challenges resulting from the leave.

The program is unsustainable—for instance, the leave benefits for one employee earning $52,000 annually will require the contributions of 47 workers. That raises concerns that additional taxes on businesses will follow to cover funding shortfalls.

And while lawmakers are exempting the majority of public sector employees from the program, there are still major costs to the state and taxpayers.

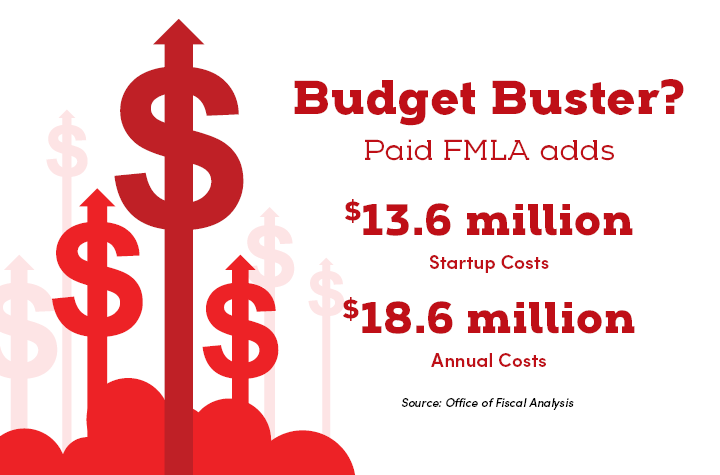

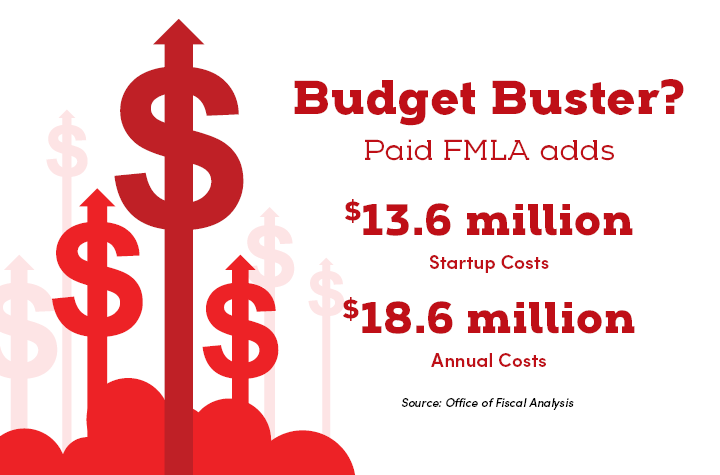

For one, the program requires at least $13.6 million in startup costs, including salaries and fringe benefits for new employees, information technology, overhead and capital needs, and marketing.

Two principal attorneys will also be hired at $100,000 annual salary each plus $38,000 in benefits, along with five staff attorneys ($75,000 plus $28,000 in benefits), and one assistant ($50,000 plus $19,000 in benefits).

Those startup costs may be covered by a $20 million dollar bond authorization—essentially the state putting the cost of the program on its credit card—despite the governor recently imposing a debt diet.

Hidden Costs

Bonding means another hit to taxpayers—OFA calculates the total debt service on $20 million in bonds at approximately $30 million.

And once the program is running, it will need another $18.6 million annually for administrative and personnel costs.

Taxpayer costs will explode further if lawmakers decide to include state employees in the program.

SB 1 and HB 5003 both allow state and municipal employees not subject to a collective bargaining agreement to participate in the program.

Bonding the startup costs for paid FMLA means another hit to taxpayers—OFA calculates the total debt service on $20 million in bonds at $30 million.

However, this includes only 11% of the state workforce and 5% of municipal workers. Most of these are salaried workers exempt from overtime.

SB 1 and HB 5003 also allow unionized employees to opt in to paid FMLA through collective bargaining.

The fiscal note indicates that if unionized employees participate, the state will see increased overtime costs.

Minimum Wage

SB 2 and HB 5004 raise the hourly minimum wage from $10.10 to $15 in a series of steps over three years, while HB 7191 spreads the increases over four years.

After the wage reaches $15, all three bills feature automatic annual increases linked to the consumer price index.

The cost to state taxpayers could be almost $80 million over just the next four years, according to a fiscal note attached to HB 7191.

“This could result in total state costs of at least $3.8 million in FY 20, $12.1 million in FY 21, $23.5 million in FY 22, and $40.6 million in FY 23,” the fiscal note says.

That will require various state agencies, including the departments of Administrative Services, Children and Families, Social Services, and others, to increase the contracts they have with private service providers.

Municipal Burdens

There’s also a cost impact to state agencies for personnel costs, particularly those agencies doing seasonal work, and students at higher education constituent units.

As the fiscal note warns, colleges and universities are likely to cut the hours paid to students to compensate for these increased costs, meaning students get higher pay but less hours and opportunities.

Cities and towns also share cost burdens for minimum wage increases.

By 2023, the increases could cost Bridgeport $1 million annually, Manchester $550,400, and Torrington $172,000.

The fiscal note looks at three municipalities to gauge these costs: Bridgeport, Manchester, and Torrington.

By fiscal year 2023, minimum wage increases could cost Bridgeport $1 million annually, Manchester $550,400, and Torrington $172,000.

Expensive Priorities

The majority party at the state Capitol plans to implement some expensive policy priorities in the coming weeks.

Business owners and their employees will not only pay for these proposals through lower wages, reduced hours and benefits, and lost productivity, they will also pay higher taxes because of the impact on the state workforce.

The fiscal note for HB 7191 also found that increasing the minimum wage could affect eligibility for income-based state assistance programs.

“Increasing the minimum wage could reduce participation levels in state assistance programs that have income eligibility requirements,” the fiscal note reads.

“Any savings associated with a reduction in state assistance will depend on the income limits for each program and the change in hourly wages, total hours worked, and the family size of program participants.”

In other words, the bill could hurt the people it was intended to help.

For more information, contact CBIA’s Eric Gjede (860.480.1784) | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.