How Much Larger Will Increase Budgets Be for 2023?

The following article was first published on Mercer’s insights blog. It is reposted here with permission.

In the August edition of Mercer’s 2022 U.S. Compensation Planning Survey, 78% of the almost 1,200 participant organizations reported that they are just in the preliminary stage of determining their 2023 annual increase budget.

At this same time last year, we asked survey participants to indicate what month they will have a finalized annual increase budget for the coming year.

More than 72% indicated their budgets are finalized between October and January, with most selecting November or December.

Despite knowing this, we have continued to ask survey participants to give us their budget projections in August, largely because, well, clients and consultants alike are used to survey vendors publishing budget numbers at this time of year.

What are we looking at for 2023 preliminary increase budget projections?

However, it should be noted that these budget numbers are only preliminary and should be considered to be one of several inputs used to determine an organization’s budget.

Given the typical budget approval process at any organization, we get it.

You need numbers to get the conversation started. Just always keep in mind that you will likely see a change from the September to the November publication of the projected budget numbers.

With all that said, what are we looking at for 2023 preliminary increase budget projections?

Salaries Are Going Up

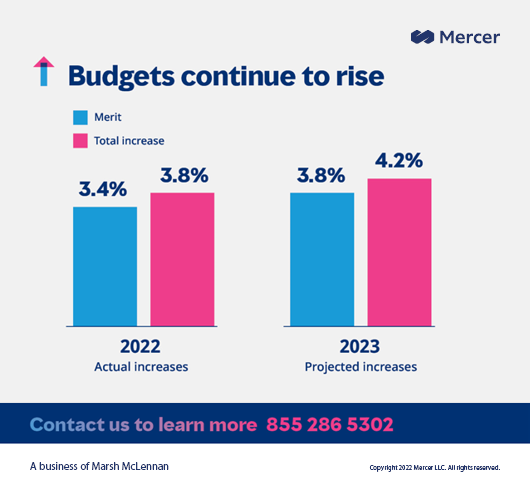

The average 2023 merit increase budget, including zeros, reported by survey participants came in at 3.8%, compared to the 3.4% actually delivered in 2022.

Likewise, we are seeing an increase in the total increase budget for 2023: 4.2% for 2023, compared to 3.8% in 2022.

Will annual increase budgets be higher when we run the survey again in November? It’s hard to say.

Depending on the industry, we may continue to see budgets increase, but some organizations bracing for a recession are likely providing conservative merit increases in an attempt to avoid layoffs later in the year.

However, no one is planning to freeze salaries, even with looming fears of an economic downturn.

Beyond budget numbers, we have recently started looking at the per capita increase, which is simply a calculation of the change in total salaries from one point to another divided by the number of employees.

This calculation gives us a look at how much average salaries are changing due to hiring rate increases and off-cycle adjustments.

From that lens, we are seeing that salaries across the board have increased 4.1%, but there are some significant differences by industry.

For example, life sciences, high tech and other manufacturing are all showing base pay changes over 5.6%, while healthcare and insurance/reinsurance are coming in under 2.7%.

Using Off-Cycle Increases

Employers are increasingly using off-cycle increases to combat retention concerns, along with other issues.

In March 2022, only 38% indicated that they were providing off-cycle increases, but in this pulse survey, 64% of participants report that they provide off-cycle increases.

Employers are increasingly using off-cycle increases to combat retention concerns.

Notably, when asked what they were doing to offset market inflation for their employees, only 38% indicated that they would provide an ad hoc off-cycle wage review and/or adjustment, while a similar percentage indicated that they were not planning to do anything.

This would lead us to believe that although they are providing off-cycle increases, inflation is not the driving factor.

Additionally, to keep it in perspective, the majority of employers did report that the percentage of employees receiving off-cycle increases is typically less than 30%.

Performance and Promotions, Business as Usual

Separate promotion budgets still don’t seem to be the norm—only 24% indicated that they have them.

As for the percentage of the total base salaries that are set aside for promotions, this year participants indicated that they budget 1.3%, which is slightly higher than this time last year.

Individual performance is still the most common factor that employers use to determine annual increases.

Individual performance is still the most common factor that employers use to determine the size of an individual’s annual increase.

Other factors commonly considered include internal equity and current salary compared to midpoint or market value.

Only 3% of participants responded that they did not use factors and instead provided an across the board increase, which would indicate that increasing pay across the board for inflation or cost of living is a prevalent practice.

Still Quite Opaque

While pay transparency might be in the news more and more, employers have been slow to modify their communication of pay ranges.

Still, only 30% of companies will communicate an employee’s grade/band upon request.

However, there is some variation by industry:

- Banking and financial organizations tend to openly communicate their structure information, even without being asked, more so than other industries.

- Retail and wholesale, along with mining and metals, on the other hand, tend to be a bit more conservative at communicating grades/bands than other industries.

Salary Structure Adjustments Increasing

In order to accommodate the increasing annual increase budgets, salary structures are increasing as well.

Of the 62% that plan to adjust structures in 2023, we expect to see the structures increase by 3.0%, which is just above the average actual adjustment of 2.9% reported in March of 2022.

Moving Forward

If your company runs on a calendar financial year, then it’s likely that you are putting together the numbers and justification for annual increases, structure adjustments, and other critical compensation management elements.

How will you use this information to develop your proposal, knowing it’s preliminary?

First off, use this as directional information and combine it with additional sources.

Then, collect and incorporate the unique factors of your organization that will influence the budgets (e.g., financial performance, hiring needs, etc.).

About the author: Mercer is a business of Marsh McLennan, the world’s leading professional services firm in the areas of risk, strategy and people, with 83,000 colleagues and annual revenue of approximately $20 billion. Mercer’s approximately 25,000 employees are based in 43 countries and the firm operates in 130 countries.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.