Report: State Won’t Reach Pre-Pandemic Job Levels Until 2023

Economists project Connecticut will add 60,000 jobs in 2022, although the state will not reach pre-pandemic employment levels until 2023.

That’s one of the takeaways from the latest issue of The Connecticut Economic Digest, published by the state Department of Labor and Department of Economic and Community Development.

University of Connecticut economist Steven Lanza cites projections from the research company IHS Markit, noting the “focus of employment growth will shift to business services and to healthcare as the state’s jobs recovery really picks up speed.”

Connecticut has recovered 75% of the historic 292,400 jobs lost in March and April of 2020 to pandemic shutdowns and restrictions. U.S. employers have recovered 84% of lost jobs.

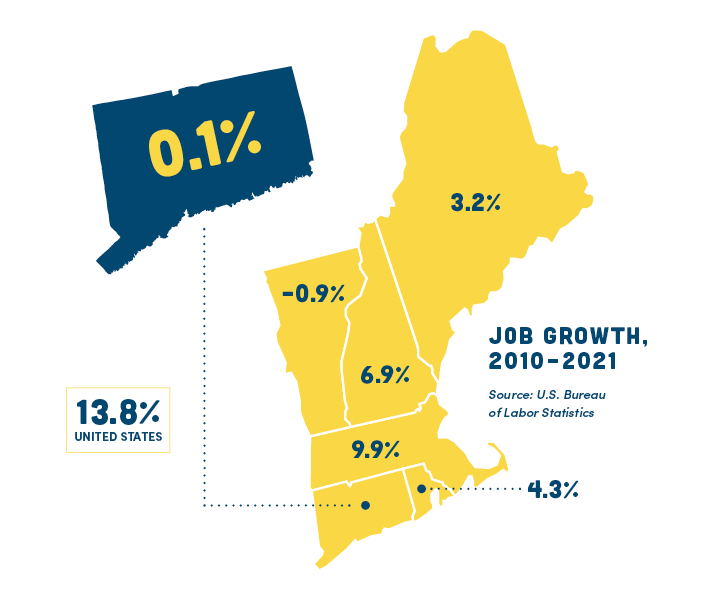

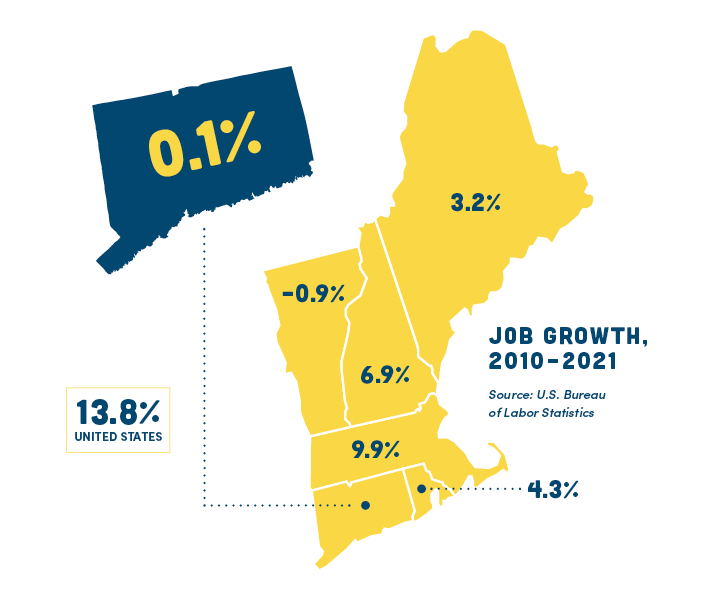

Based on U.S. Bureau of Labor Statistics data, Connecticut has added 53,400 jobs in the 11 months through November, a growth rate of 3.4%, tied with Vermont for second slowest in the region after Maine. U.S. job growth in 2021 was 4.5%.

[Some of the job growth numbers cited by the latest issue of the economic digest differ from the BLS numbers reported by the labor department.]Manufacturing, Finance Struggle

Seventy-two percent of those gains came from just three sectors—leisure and hospitality, professional and business services, and education and health services.

Manufacturing, one of the state’s key economic sectors, gained just 400 jobs through November. Another critical sector, financial activities, lost 1,800 jobs in that period.

IHS Markit projects “a modest bounce back” for employment in the financial activities and manufacturing sectors in 2022.

“Maintaining the state’s competitive advantage in financial activities and manufacturing will also pose a challenge.”

UConn economist Steven Lanza

“Maintaining the state’s comparative advantage in financial activities and durable goods manufacturing (e.g., aerospace, shipbuilding) will also pose a challenge,” Lanza writes.

“Finance, in particular, accounts for just 7% of the state’s jobs but 29% of its GDP.”

Lanza adds that the “focus of employment growth will shift to business services and to healthcare as the state’s jobs recovery really picks up speed,” in 2021.

“The gains in transportation and warehousing will slow to a crawl and retail jobs could even head into reverse as brick-and-mortar stores are hobbled by a secular shift to online shopping that has only accelerated during the COVID era.”

Shrinking Labor Force

Despite 11 consecutive months of job growth, there were 72,100 fewer people working in Connecticut in November than in February 2020, despite an estimated 70,000 unfilled job openings.

Filling those job openings will be a challenge says Lanza.

The state’s labor force—the number of employed people plus the unemployed who are looking for work—is now 98,800 (5%) below pre-pandemic levels.

Connecticut’s labor force is now 98,800 (5%) below pre-pandemic levels.

“Connecticut saw an outsized drop in labor force participation as many workers quit their jobs during the pandemic’s so-called Great Resignation,” Lanza writes.

“Coaxing them back may hinge on whether these were mostly millennials and Gen Z workers unhappy with their jobs but who need the income or, in an older-population state like Connecticut, baby boomers with life savings who could afford to retire early.

“IHS Markit optimistically projects a return to a pre-pandemic-sized workforce by 2023.”

‘Major Growth Obstacle’

The CBIA/Marcum 2021 Survey of Connecticut Businesses found that 80% of employers reported difficulties finding and retaining employees.

The labor shortage was cited as the major growth obstacle for more than one-third (35%) or survey respondents.

“Employers are desperate to fill these jobs, but simply do not have enough qualified candidates to fill them.”

CBIA’s Chris DiPentima

“This is the same message we have been hearing for months,” said CBIA president and CEO Chris DiPentima.

“Employers are desperate to fill these jobs, but simply do not have enough qualified candidates to fill them.

“It is critical the that employment issue is tackled head-on to speed up the recovery and grow a strong, robust economy, unlocking the state’s true potential.”

GDP Growth

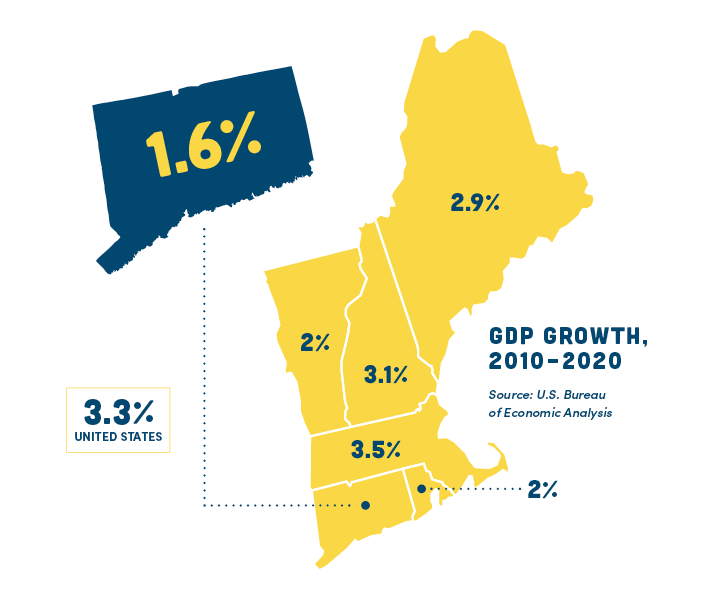

Connecticut’s economy contracted 6.2% in 2020 as the pandemic upended economic activity across the globe. New England GDP declined 4.1% while U.S. economic output fell 3.4%.

The state’s economy rebounded in the first three quarters of 2021, expanding 1.8% in the first quarter, 5.9% in the second quarter, and 2.7% in the third.

The New England states averaged 3.7% growth in the first quarter of 2021, 7.1% in the second quarter, and 2.6% in the third while U.S. GDP posted 6.3%, 6,7%, and 2.3% growth.

Lanza notes that “Connecticut GDP has been in a holding pattern since the 2008 recession, even as the economies of other states scaled new heights.”

He projected that based on preliminary 2021 GDP numbers, Connecticut’s economy regained much of the 2020 losses “and should recover the balance and then some in 2022 if real GDP expands at its expected 3.8%.

“With 2% annual growth in the years after that, the state would be on a path to renewed economic health with output in the information and professional and business service sectors leading the way,” he said.

Lanza does warn that “besides the state’s aging workforce and struggle to maintain a critical mass in its high-wage, flagship manufacturing and financial services sectors, Connecticut will, like other states, face continued headwinds in 2022 from coronavirus variants and supply chain shortages.”

DiPentima said the onus was now on state policymakers to enhance the state’s business climate to drive greater competitiveness, attract new private sector investment, and build a strong platform for job and economic growth.

“Connecticut is well positioned to continue our growth as long as we implement measures we need to take to combat the labor shortage, reduce the high cost of doing business, and improve our tax policies,” DiPentima said.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.