Trade, Tariffs, and the Global Economy

The global geopolitical scene and rapidly shifting trade and tariff policies are creating additional hurdles for Connecticut companies already navigating a challenging business climate.

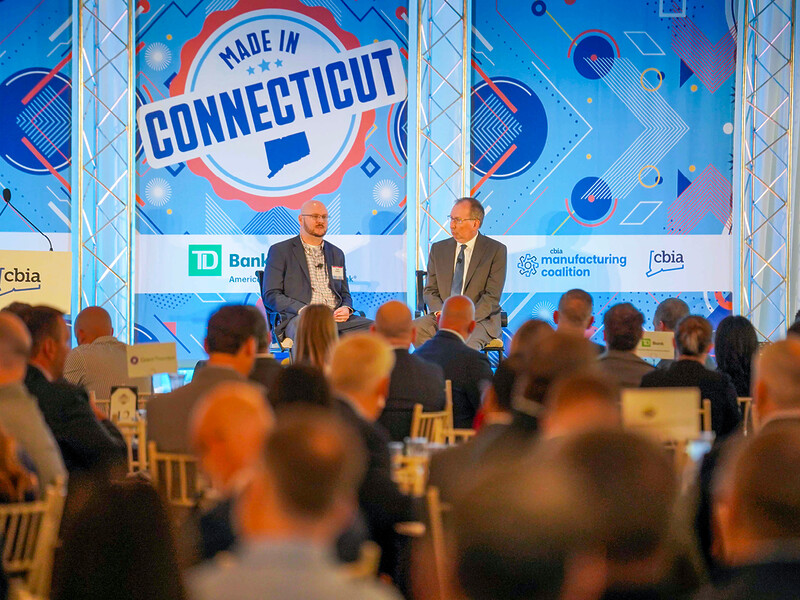

Weathering the tariff storm and planning for an uncertain future requires flexibility, global trade experts told a capacity crowd of over 600 attendees at the Oct. 2 Made in Connecticut: 2025 Manufacturing Summit.

They also emphasized potential long-term advantages from the One Big Beautiful Bill Act and innovative ways to reinvest in and redevelop U.S. manufacturing.

“The economy is doing really quite well—consumer spending is strong, corporate earnings are strong,” John Murphy, head of international trade and investment policy for the U.S. Chamber of Commerce, told Brad Hulbert, managing director with audit and accounting firm Grant Thornton.

“But there are warning signs out there.

“We’ve seen the manufacturing sector shed jobs for every month over the past year except for one, so there are challenges here and trade is part of that.”

Tariff Landscape

According to a recent CBIA survey of Connecticut manufacturers, 66% believe tariffs are negatively impacting operations, while three percent say import taxes are helping the sector.

Murphy said those numbers are generally reflective of national business sentiment, with frequent trade policy difficult for many to navigate.

“We need more of a flow of information between industry and the administration before tariffs go into effect,” he said.

“These are much higher tariffs, and they hit manufacturing first. The breadth of these tariffs is broader than it needs to be, than it should be.

“Fifty-six percent of all U.S. imports are raw materials, parts of components, capital goods, and machinery that is often only available from one or two suppliers.

“Ninety-five percent of the world’s consumers live outside our borders, so trade is a part of the picture and what we’re seeing right now is some pretty big changes in the trade environment.”

At Grant Thornton, Hulbert said he’s advising his clients to assess their bill of materials, look at alternative sourcing, and renegotiate supplier contracts.

“Really talk to your suppliers and try to find a middle ground with this new stealth tax that’s coming to our economy,” he said.

Impact

The U.S. Chamber has advocated strongly to exclude small businesses and goods that are not produced domestically from tariffs—without success to date.

With tens of thousands of small manufacturers often dependent on single-source imports, Murphy said none of the chamber’s petitions for corrections, or efforts by others—for any business sector—have succeeded.

“The tariffs that have been imposed are all still there,” he noted.

“There’s no tariff that has gone into effect, that has ceased to go into effect, and there’s no company that’s gotten a carve out.”

“There’s no tariff that has gone into effect, that has ceased to go into effect, and there’s no company that’s gotten a carve out.”

U.S. Chamber’s John Murphy

However, the administration has acknowledged some products aren’t really available and tariffs are broader than they need to be, so some negotiation may be possible, he added.

He also noted that manufacturers not only face higher costs to import materials, they must spend time and resources to find alternative suppliers.

“They have to be able to show where everything comes from,” he said.

“They have to be able to say where the steel is smelted or where the aluminum is smelted and cast; how much these things weigh; what their value is; and be able to do that all the way down through their tier two, three, four suppliers.

“And they never had to do that before.”

Mitigation Strategies

The CBIA survey showed that 45% of Connecticut manufacturers expect the U.S. economy to expand in over next 12 months, with 24% expecting a contraction.

Murphy said that while GDP has fallen to about half of last year’s near 3% growth because of tariffs and immigration restrictions, the economy generally remains resilient.

“Free enterprise works and finds a way,” he said, also noting that the Federal Reserve has signaled that additional interest rate cuts are likely.

Hulbert added that Grant Thornton was seeing growing domestic supplier reinvestment and development, with some reshoring of production that was previously located in other countries.

“What we’re seeing is really a hybrid approach.”

Grant Thornton’s Brad Hulbert

“It is not wide scale,” he said.

“What we’re seeing is really a hybrid approach—partial re-shoring of some suppliers; still a lot of interest in ‘near-shoring’ down in Mexico; and companies really starting to scratch the surface of automation and gain efficiencies.”

Hulbert also noted an uptick in the manufacturing merger and acquisition space.

“A lot more companies are thinking strategically about going out and acquiring different companies that can help them vertically integrate their overall supply chain,” he said.

“They’re looking at how they can improve their operations here domestically to try to mitigate some of the margin erosion that’s coming with these tariffs.”

One Big Beautiful Bill Act

Murphy called the federal budget reconciliation bill passed by Congress in the summer—the One Big Beautiful Bill—”a huge win” for businesses.

“We in the business community should be quite pleased with what we got for business taxes,” he said.

Previously temporary tax provisions are now permanent, which allows for more investment confidence and long-term planning.

Hulbert said bonus depreciation allows companies to invest in automation to improve overall efficiencies.

The bill includes expanded research and development expensing and the 100% bonus depreciation, provisions that are especially beneficial for manufacturing.

Hulbert said bonus depreciation allows companies to invest in automation to improve overall efficiencies, with companies also leveraging the R&D tax credit.

“All of this, I think, is really quite helpful for our objective of making the U.S. the best place in the world to manufacture,” Murphy said, adding that tariffs will remain “problematic.”

Energy Costs

With high energy costs and growing demand major issues in Connecticut, Hulbert asked Murphy about effective policies for lowering costs and expanding infrastructure.

“It’s a great question, and we do need to streamline permitting and build a whole lot of new energy capabilities across the U.S.,” Murphy said.

“Over the past four years, electricity prices nationally have risen by about 30% and there’s a lot of pressures from growing demand that are going to continue to send them up.

“We do need to streamline permitting and build a whole lot of new energy capabilities

Murphy

across the U.S.”

“But here in New England, probably the most important thing is to build gas pipelines. You know, we’re not that far away here in New England from the Marcellus Shale.”

A U.S. Chamber study showed that building additional pipelines could bring down the price of heating a home by 30% in New England.

“It would be a huge win for the manufacturing competitiveness of Connecticut and all New England,” Murphy said.

He added that China’s electricity production includes nuclear, solar, and an array of other sources, while U.S. energy production has “been pretty flat for years.”

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.