Job, Labor Force Losses Highlight Affordability Issues

Connecticut’s labor force declined in alarming fashion in 2025, with the population of those working and looking for work shrinking by 19,900 people (-1%).

Job growth also suffered last year, with the state Department of Labor’s latest employment report showing payrolls fell by 2,200 (-0.1%).

Private sector employment in Connecticut dropped by 5,400 jobs (-0.4%), despite the state’s 74,000 job openings.

CBIA president and CEO Chris DiPentima noted the contrast with the state’s strong third quarter economic numbers, saying job and labor force trends “raise serious questions about the sustainability of Connecticut’s future economic growth.”

“Connecticut employers and their employees are showing remarkable resilience—navigating uncertainty, innovating, and driving productivity,” he said.

“But innovation alone cannot sustain long-term growth if underlying workforce challenges remain unaddressed.”

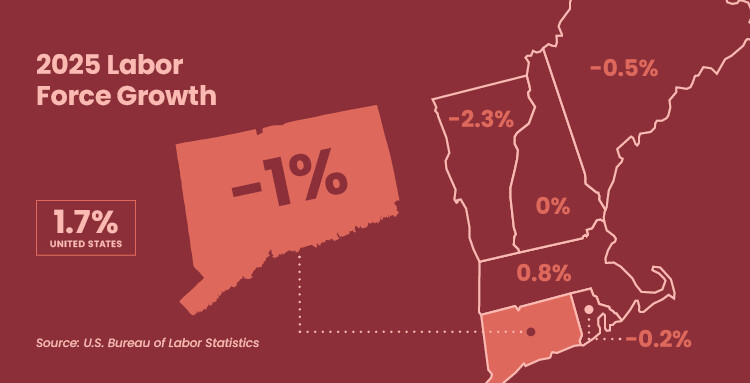

Labor Force

Connecticut’s annual labor force losses were the sixth worst of any state in percentage terms, with national growth at 1.7%.

Massachusetts’ labor force grew 0.8% to lead the New England region, followed by Rhode Island (0.2%), New Hampshire (unchanged), Maine (-0.5%), Connecticut, and Vermont (-2.3%).

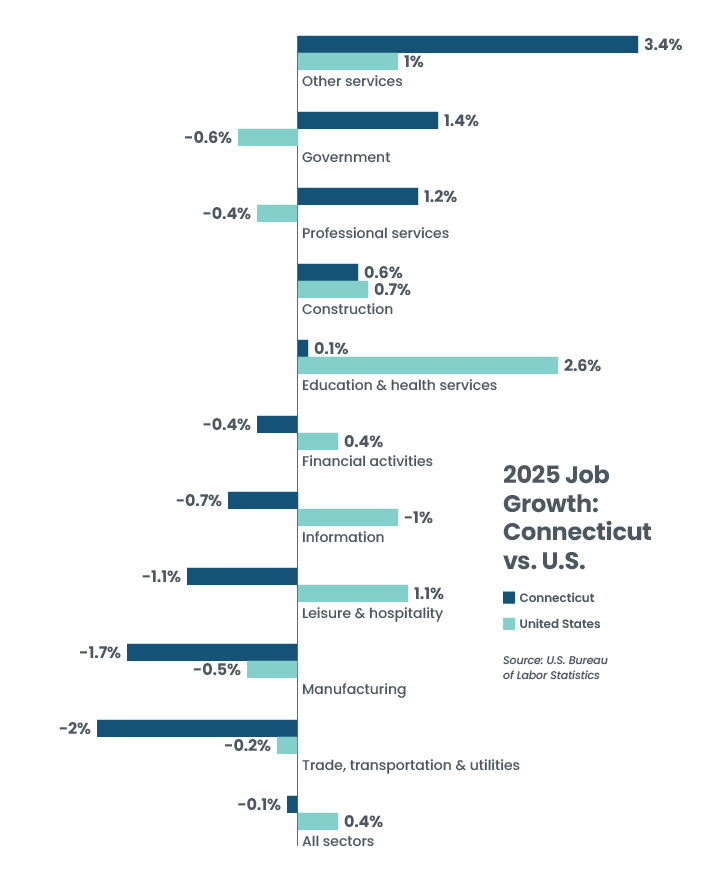

Connecticut’s employment losses placed it 38th among all states for job growth last year, with national growth at 0.4%.

Vermont (0.8%) was the only state in the region to add jobs in 2025, with Massachusetts unchanged. Employment in Rhode Island declined 0.3%, while Maine fell 0.6% and New Hampshire dropped 0.8%.

DiPentima said he was concerned with job losses in a number of sectors, including manufacturing and financial activities, both key economic drivers.

“One of the most troubling signals is the lack of growth in healthcare employment, up just 0.1% in 2025 compared with 2.6% nationally—a clear sign that demand is outpacing available workers,” he said.

“The workforce shortage is also likely contributing to rising healthcare costs faced by employers, workers, and families across the state.”

High Costs

DiPentima said the high costs of healthcare, energy, childcare, and housing “continue to undermine our ability to attract and retain workers—particularly younger people as our aging workforce retires.”

“With the 2026 legislative session about to begin, policymakers must prioritize making Connecticut a more affordable place to live and do business while strengthening workforce training and pipeline programs that connect residents with high-quality career opportunities,” he said.

“Employers are doing their part. If policymakers do the same, Connecticut can put all the pieces together for stronger, more sustainable economic growth.”

He noted that CBIA’s 2026 policy solutions, released Jan. 29—three days after the employment report—were designed to address the high costs of living and running a business and build new career pathways.

“The question is not whether Connecticut can compete—it can,” he said.

“The question is whether policymakers can act with the urgency needed to ensure that growth is broad-based, sustainable, and inclusive.”

Industry Sectors, Labor Markets

Employment grew in half of the state’s 10 major industry sectors in 2025, led by the government sector, which added 3,200 jobs (1.4%).

Professional and business services gained 2,700 positions (1.2%), followed by other services (2,200; 3.4%), education and health services (500; 0.1%), and construction (400; 0.6%).

Trade, transportation, and utilities suffered the biggest losses of any sector last year, shedding 6,100 jobs (-2%), including 4,800 retail positions.

Manufacturing employment dropped by 2,600 jobs (-1.7%) in 2025 and is now at its lowest level since August 2021, despite an estimated 7,000 sector openings.

Leisure and hospitality lost 1,800 positions (-1.1%), followed by financial activities (-500; -0.4%), and information (-200; -0.7%).

Hartford-West Hartford-East Hartford was the only one of the state’s five major labor markets to post employment gains last year, adding 1,100 jobs (0.2%).

Waterbury-Shelton saw the largest decline, losing 1,700 jobs (-1%), followed by New Haven (-800; -0.3%), Norwich-New London-Willimantic (-300; 0.2%), and Bridgeport-Stamford-Danbury (-200; -0.05%).

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.