Employers Face State-Run Retirement Plan Deadlines

The state’s problem-plagued retirement plan finally launched this month, more than four years after its originally scheduled launch date.

The Connecticut Retirement Security Authority, overseen by the state comptroller’s office, officially launched MyCTSavings March 24, with a New York-based firm serving as the program’s third-party administrator.

Connecticut employers with five or more employees—each paid a minimum of $5,000 in the calendar year—are required by law to join the program if they don’t offer employees a retirement plan.

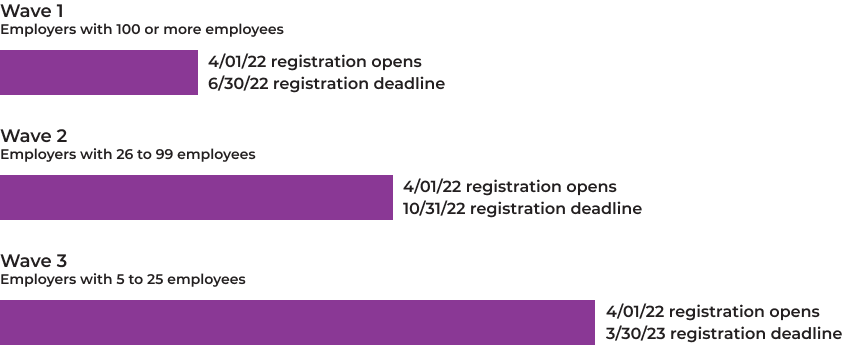

Covered employers must register with the state by either June 30, 2022, Oct. 31, 2022, or March 30, 2023, depending on the company’s size (see above chart).

Employers that offer employees qualified retirement plans are exempt from participating, but still must certify that exemption.

Qualified employer-sponsored retirement plans include a those under Internal Revenue Code sections 401(a) (including a 401(k) plan); qualified annuity plan under section 403(a); tax-sheltered annuity plan under section 403(b); Simplified Employee Pension plan under section 408(k); a SIMPLE IRA plan under section 408(p); or governmental deferred compensation plan under section 457(b).

Qualified, employer-sponsored plans do not include payroll deduction IRAs.

Employer Responsibilities

Eligible employees will be automatically be enrolled in the program with a default 3% deduction from their gross pay.

Once enrolled, employees can choose to opt out of the program or adjust their contribution rate at any time.

An employee’s retirement account is portable. If they change jobs, their account follows them.

Once enrolled, employees can choose to opt out or adjust their contribution rate.

The plan requires that covered employers:

- Provide the program administrator employee names, Social Security or taxpayer ID numbers, dates of birth, addresses, and email addresses

- Create payroll deductions to employees and remit employee contributions to the program administrator

- Review employee opt-out and contribution decisions before each payroll submission

- Add new employees and remove former employees when needed

No Pre-Tax Benefits

There are no employer fees and employers are neither required nor permitted to contribute to the program.

Employees must work for a covered employer for at least 120 days to be eligible for the state-run plan. They also must be at least 19 years old.

Once enrolled, employees manage most account functions online and are responsible for communicating directly with the plan administrator about their investments.

As a Roth IRA, the state-run plan does not provide the pre-tax benefits of other retirement plans offered by numerous private sector institutions.

In addition, the state plan is not subject to the federal Employee Retirement Income Security Act, which sets minimum standards for most retirement and health plans to protect enrolled individuals.

MyCTSavings is structured as a payroll deduction Individual Retirement Account and does not need to be reported on an employee’s W2.

Penalties

The IRA trustee for the MyCTSavings program will file Form 5498, IRA Contributions Information with the IRS and send employees a copy.

The CRSA FAQ sheet provides detailed information for employers and how they should handle questions from employees about their selections.

CRSA said it will monitor businesses for compliance, noting that “if a business falls out of compliance and fails to register, an investigation could occur and there may be penalties.”

“Failure to remit deductions in a timely manner violates Connecticut law, including wage and hour requirements,” the authority warned. “The state may impose penalties for these violations.”

The state is sending explanatory materials to employers—through email and USPS—including access codes for registering or filing for an exemption.

However, numerous employers report receiving mailings from the state in March with incorrect or misleading information, including notices warning they missed registration deadlines and face penalties.

Series of Setbacks

It’s not the first stumble for the plan, which was narrowly approved by the state legislature in 2016 and has experienced a series of setbacks related to financial, legal, and personnel issues.

The comptroller’s office assumed oversight of the plan in 2020 after CRSA exhausted its funding and laid off its executive director.

When the Lamont administration declined to extend a requested $1 million line of credit to the authority, the comptroller’s office received state funds to hire program personnel.

The comptroller’s office assumed oversight of the plan in 2020 after CRSA exhausted its funding.

The retirement plan—now more than four years past its original January 2018 launch date—was supposed to be managed without using taxpayer funds.

In 2019, Connecticut lawmakers inserted language in the new state budget that added further controversy—requiring multiple plans as originally intended, but now from only a single vendor.

That contradicts then-Governor Dannel Malloy’s insistence in 2016 that the plan offer participants multiple options from multiple vendors to ensure competition among retirement plan providers.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.