As Budget Deadline Looms, Tax Hike Talk Continues

The General Assembly’s two budget-writing committees—Appropriations and Finance, Revenue, and Bonding—are each expected next week to release their tax and spending proposals for the 2018 and 2019 fiscal years.

Despite lawmakers enacting two of the largest tax hikes in state history in 2011 and 2015 to cover huge deficits, another massive deficit looms—projected at $3.6 billion over the next two years.

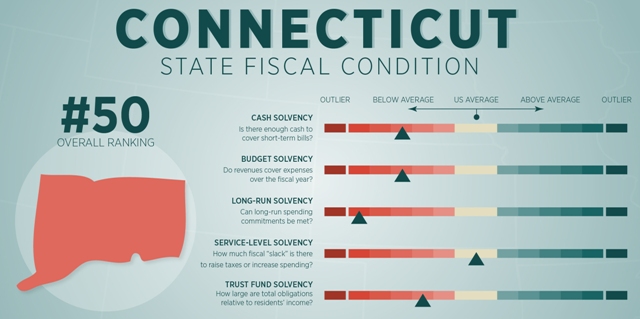

A Mercatus Center report ranks Connecticut last among all states for fiscal health.

“We’re not going to solve our problems by raising taxes,” Brennan said.

“We’re going to do it through economic growth, so more people are working and paying taxes.

“That’s why we’re in this situation—too many taxes on businesses and individuals.”

CBIA is calling for lawmakers to:

- Pass a two-year budget with no tax hikes.

- Enact the state’s original spending cap to ensure legislators make responsible spending decisions.

- Implement lean and other efficiency practices across state government, rebalance long-term care services, and use non-profits to deliver state services in a more cost-effective way.

- Negotiate smarter public-sector wages, pensions, and health benefits that align Connecticut with other Northeastern states.

With collective bargaining, CBIA supports ending the use of overtime in pension calculations, adopting defined contribution plans, requiring greater contributions to healthcare and retirement plans, avoiding long-term contracts, and requiring the legislature to approve all contracts.

Fiscal Health

A Mercatus Center at George Washington University report clearly illustrates why Connecticut must implement real, long-term reforms.

Mercatus ranks Connecticut 50th among the states and Puerto Rico for fiscal health, with researchers detailing chronic solvency issues across a range of short and long-term categories.

“The state is heavily reliant on debt to finance its spending,” researchers noted.

Despite recent history, some lawmakers are looking at tax hikes as a means of resolving the projected deficit.

The Finance Committee introduced two bills this week featuring a series of tax increases, new taxes, and new or increased fees.

SB 1054 raises the state income tax for high-income earners from 6.99% to 7.49%, imposes a 10% occupancy tax on bed and breakfasts, and levies an extra $5 fee for registering a motor vehicle.

HB 7322 increases the state sales tax from 6.35% to 6.99% and allows municipalities to tax real property at 100% of assessed value instead of the current 70%.

Connecticut faces a projected $3.6 billion budget deficit over the next two fiscal years.

The committee scheduled an April 25 public hearing on those proposals and a number of other spending and tax bills. The hearing begins at 11:30 am in Room 2E of the Legislative Office Building.

[If you’re interested in testifying or submitting testimony for the Finance Committee’s April 25 hearing, please contact CBIA’s Nicole Cline.] House Speaker Joe Aresimowicz (D-Berlin) said he expects the Appropriations Committee‘s budget proposal will assume the $1.5 billion in concessions Gov. Dannel Malloy hopes to negotiate with state employee unions.

“If, for some reason, [those concessions] don’t come to fruition, we will come back and act accordingly,” he said at an April 19 press conference.

Layoff Contingency Plan

Malloy informed state employee unions April 20 about a contingency plan to lay off state workers if his administration is unable to get the State Employees Bargaining Agent Coalition to agree to concessions.

Malloy, who recently announced he will not seek a third term, warned there could be as many as 4,200 layoffs if an agreement is not reached. His administration and union leaders have been holding confidential negotiations for months.

“I am optimistic that we will be able to meet our budget challenges as I proposed in February—with labor concessions that reduce our long-term fixed costs related to pensions and benefits for our employees,” the governor said in an April 20 statement.

“I believe that the leadership and members of SEBAC are also committed to a negotiated solution. We all hope that our contingency plans will ultimately not be necessary and that the structural solutions Connecticut needs can be found at the bargaining table.”

We're not going to solve our problems by raising taxes. That's why we're in this situation.

“In effect, we'd be raising taxes by driving [municipalities] to raise property taxes, and that's not where we want to go,” he said.

Malloy’s proposed budget increases state aid to poorer municipalities at the expense of wealthier towns.

The majority of Connecticut municipalities oppose the plan, which also concerns the business community because of the potential to raise property taxes.

Small Business Concerns

CBIA is concerned that any property tax increase will create competitive problems for many small and family-owned businesses across Connecticut.

We also understand that debate is necessary on how to fund state and local obligations going forward.

Aresimowicz said lawmakers will have to come up with their own plan “that represents Connecticut as a whole.”

“If you're involved in local government, if you're involved in state government, if you're a state employee, a municipal employee, or an elected official, we need to come to the table with answers,” he said.

For more information, contact CBIA’s Pete Gioia (860.244.1945) | @CTEconomist

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.