Fixing the Unemployment Trust Fund—Without Tax Hikes

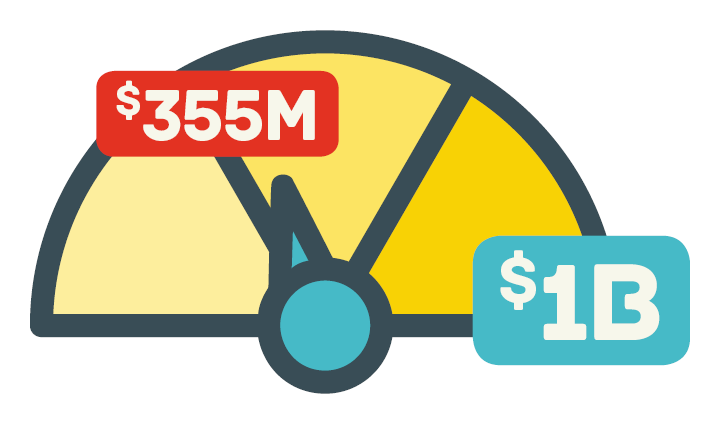

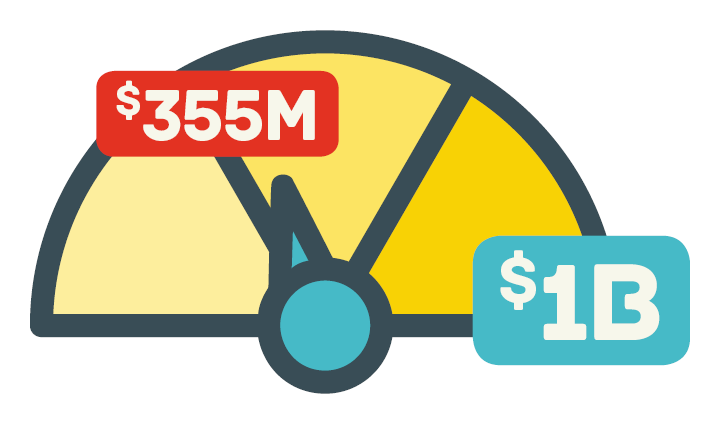

The General Assembly’s Labor and Public Employees Committee voted Feb. 7 to raise a bill that will help ensure the future solvency of the state’s Unemployment Trust Fund.

HB 6461 reforms the state’s current system without increasing taxes on businesses, or cutting a single dollar of benefits for year-round workers who, through no fault of their own, become unemployed.

HB 6461 is similar to a bill that made it through the state House last year with nearly unanimous support. Unfortunately, it died in the Senate due to a technical issue.

It proposes the following changes to the unemployment system:

- Raise the minimum earnings threshold to qualify for unemployment benefits to $2,000. Claimants in Connecticut need only earn $600 in a year to qualify for benefits—the second-lowest earnings requirement in the U.S. For perspective, 32 states and territories require between $2,000 and $5,000 in earnings. Connecticut’s earnings requirement has not changed since the statute went into effect 50 years ago. Savings: $5.6 million annually.

- Prohibit all claimants from receiving unemployment benefits until they have exhausted their severance pay. According to Connecticut’s Department of Labor, this would save up to $57 million per year.

- Base benefits on three quarters of an employee’s earnings rather than two highest quarters, to avoid inequitably rewarding seasonal workers. Under current law, a seasonal worker in Connecticut earning $30,000 over two calendar quarters would get the same unemployment benefits as a full time worker who earns $60,000 over four quarters. Savings: approximately $68 million a year.

- Freeze the maximum weekly benefit rate any year we have not attained 70% of the fund’s solvency goal. The maximum benefit rate is allowed to increase by $18 every year, and did increase throughout the recession. Foregoing increases in years when the fund is unhealthy would prevent the problem from getting worse. Savings: approximately $1.6 million per year—without reducing anyone’s benefits from current levels.

HB 6461 is truly a “Do No Harm” approach for helping fix the state’s unemployment system.

HB 6461 reforms the system without increasing taxes on businesses or cutting a single dollar of benefits for year-round workers.

Connecticut businesses already pay more state unemployment taxes than most of our neighboring states, and paid the highest federal taxes in the nation over the last three years.

The holes in our state's unemployment system must be fixed before there are any discussions about additional tax hikes.

In fact, these reforms could result in fewer taxes over the long term—meaning businesses can use the savings to create more jobs.

The bill also does no harm because the savings are targeted at those who do not need unemployment benefits, and those who are being unfairly rewarded by the system.

Unemployment benefits are a critical piece of the social safety net. HB 6461 protects the money in the system for those who deserve and need it most.

For more information, contact CBIA’s Eric Gjede (860.480.1784) | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.