Lamont: Labor Shortage, Property Tax Priorities

Gov. Ned Lamont embraced one of the business community’s top legislative priorities—resolving the labor shortage—while adopting a wait-and-see approach to calls for tax relief and using additional federal COVID-19 funds to pay down unemployment debt.

Speaking Jan. 21 at CBIA’s annual Economic Summit + Outlook, Lamont was optimistic about the state’s outlook, while acknowledging that the pandemic continued to pose challenges for the economy and job growth.

“We’re with you on that [workforce development],” Lamont said. “We’ve got $100 million into job training programs. We’ve got to make sure we continue to have the best workforce in the world.

“And to each and every one of you, I want to make sure you know you have workers available through the apprenticeship program, through our certificate programs, so you know that your job needs can be filled not just this year, but for the foreseeable future.”

CBIA president CEO Chris DiPentima called the labor shortage “the greatest threat to the state’s economic recovery,” noting the organization’s 2021 survey of businesses showed that 80% of employers struggled to find and retain workers.

“A lot of it is confidence in getting people back to work—we were hit pretty hard,” Lamont said.

“We’ve got a lot of investment going on, starting with transportation infrastructure, environmental infrastructure—I think that’s going to represent tens of thousands of jobs.”

Workforce Challenges

The labor shortage is a central theme in CBIA’s 2022 legislative policy priorities, released during the Jan. 21 conference.

CBIA’s workforce proposals include enhanced efforts to prepare, train, and support incarcerated and returning citizens and a number of tax incentive measures.

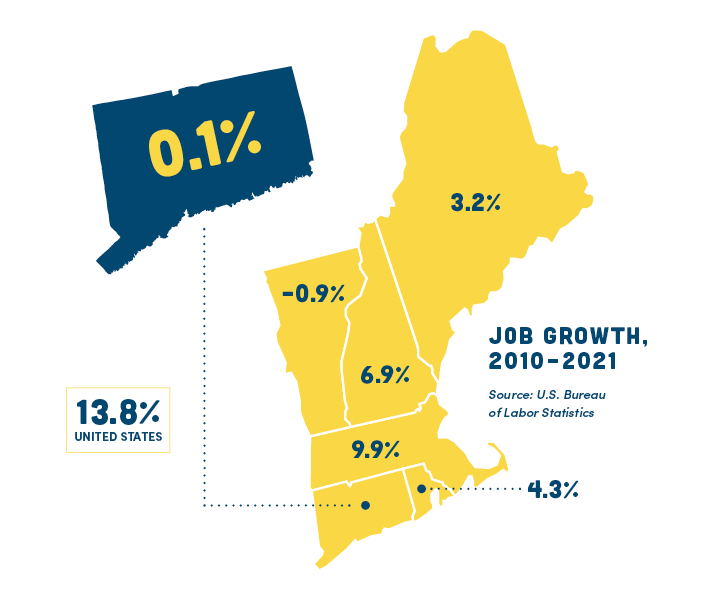

As of November, Connecticut has recovered 75% of COVID-19 job losses, second slowest in the region. The U.S. has recovered 83% of pandemic job losses.

Connecticut’s unemployment rate was 6% in November, the highest of the New England states and sixth highest in the country. The U.S. unemployment rate is 3.9%.

“We must address workforce challenges that have simmered for years,” DiPentima told an audience of 250 business leaders.

“As we enter the third year of the pandemic, the policy choices made over the next few months will determine the strength and viability of our economic recovery,” he added.

Tax Relief

CBIA’s legislative agenda also prioritizes a series of tax relief proposals, most targeted at helping struggling small businesses.

DiPentima said the proposals total about $200 million, and include expanding the manufacturing apprenticeship and R&D tax credits to smaller companies and exempting workforce training programs and safety apparel from the state sales tax.

He said adopting those measures “would send a huge message” to the state’s small employers, which make up 99% of Connecticut companies and employ almost half the workforce.

“Lawmakers should be making it easier to create jobs here and to attract and keep companies here.”

CBIA’s Chris DiPentima

“Connecticut lawmakers should be making it easier—not more difficult—to create jobs here and to attract and keep companies here,” DiPentima said.

When asked if he could support CBIA’s business tax relief proposals, Lamont advised DiPentima to work with his administration and “our friends in the legislature to see what the priorities are.”

“If you tell us that is going to be tied to real job creation and economic growth, that makes it all the more compelling and a much easier case for me to make,” he said.

Property Tax Cuts

Lamont told conference attendees he will again push for property tax relief, saying the state’s current fiscal position allows cuts of between $250 million and $300 million.

“I’ve been trying to do this for some years now,” he said. “It’s time for us to take a good hard look at property tax. That’s the car tax as well as residences.

“That will be one of my strong initiatives, to do what we can to reduce the property tax.”

Gov. Ned Lamont

“It’s a tax that’s fixed. You pay it during bad times and good times. It’s unforgiving in that sense. It hits the middle class particularly hard.

“So that will be one of my strong initiatives, to do what we can to reduce the property tax and expand the base of who gets access to property tax reduction.”

Unemployment Fund Debt

The governor was also noncommittal when DiPentima asked if he could support another CBIA priority, using additional federal COVID-19 relief dollars to help address the unemployment trust fund’s pandemic-related debt.

Connecticut owes the federal government more than half-a-billion dollars for loans taken out over the last two years to cover historic unemployment claims.

Lamont said using federal relief dollars to pay down the state’s unemployment fund debt “is something we’ll look at.”

“The rest of it as of right now would fall on the shoulders of the business community come November when the assessments come,” DiPentima said, noting that it took six years of higher taxes and assessments to pay off the $1 billion the state borrowed after the 2008-2010 recession.

Lamont responded that he was a “little hesitant” to commit to the proposal, saying that he must determine whether purchasing additional COVID-19 testing resources was a better use of federal relief dollars.

“It’s something we’ll look at,” he said. “I’m not going to let those rates go up on small businesses.”

Fiscal Health

DiPentima said the state’s near-term fiscal health “is one the country’s strongest, with a projected $2.2 billion budget surplus this fiscal year, $1.9 billion the following year, and a reserve fund projected to exceed $5 billion by June 30.”

“We must maintain the fiscal discipline that put us in this position,” he added. “We still face long-term fiscal challenges and cannot afford a return to the endless deficit-and-tax-hike cycles of the past decade.”

Connecticut will receive $5.4 billion over five years through the federal Infrastructure Investment and Jobs Act, funds that will provide much-needed investments for a range of projects, ranging from roads and highways to airports, transit, and electric vehicle charging networks.

Last month, Lamont appointed Mark Boughton, commissioner of the state Department of Revenue Services, to coordinate multi-agency approaches to administering those funds.

“Our job is to make sure the money makes a difference, it is well invested, accounted for, and shows results at the end of the day,” said Lamont, who called the federal infrastructure funding “transformative.”

State Employee Retirements

DiPentima asked Lamont about the recommendations in the CREATES Report, commissioned by the administration to evaluate workforce efficiency and identify potential spending reductions.

The report, framed around the pending surge in state employee retirements ahead of a key change in retirement benefits, identifies between $600 million and $900 million in annual savings.

“We’ve got a big tsunami of people retiring in less than six months,” Lamont said. “We’ve got to prepare for that.

“Let’s continue to work together. We want to make it easier for you to grow and prosper.”

Lamont

“That means training people—in many cases to replace those that are leaving—and make sure we’ve got people trained on the technology, so we can do more with less and provide a much better customer experience.

“We’re trying our best to make sure government is a partner. And I need you right back as a partner. I need you as champions for the state of Connecticut.

“Let’s continue to work together. We want to make it easier to you to grow and prosper.”

The 2022 Economic Summit + Outlook was made possible through the generous support of Webster Bank.

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.