Paid FMLA Leaves State Employees Behind

The state legislature’s Labor and Public Employees Committee approved two bills March 9 creating a new paid family and medical leave program in Connecticut.

SB 1 and HB 6212, identical bills, were approved along party-line votes. They now go to their respective chambers.

No explanation was readily available for why the bills now exempt state employees.

However, it could be an effort by proponents to minimize the bills’ fiscal impact to the state, suggesting they now understand the cost and burdens it places on employers.

Under the proposals, employees at businesses with two or more workers are eligible for up to 12 weeks of annual paid leave for their own, or a family member’s, illness.

Employees would be entitled to 100% of their wages, capped at $1,000 per week.

While the wage portion of the benefit is funded through payroll deductions, the employer is required to continue providing employees with expensive, non-wage benefits for up to three months, despite their absence from the workplace.

At this stage, no fiscal analysis has been conducted on these bills. Yet we know from previous years that Connecticut taxpayers would pay for the program.

In 2016, the legislature’s nonpartisan budget office pegged the cost at $13 million to launch, and another $18 million annually.

Small Business Impact

This new paid FMLA mandate impacts the smallest businesses in Connecticut, and it’s also a bad deal for employees.

Each pay period, a percentage of an employee’s wages—the amount has yet to be determined—will be deducted to fund a program they may not ever use, or one their coworkers could abuse.

Further, some of money contributed by employees goes toward the program’s $18 million annual cost.

If every employee pays so little to a program that pays out so much, who pays when many workers take leave?

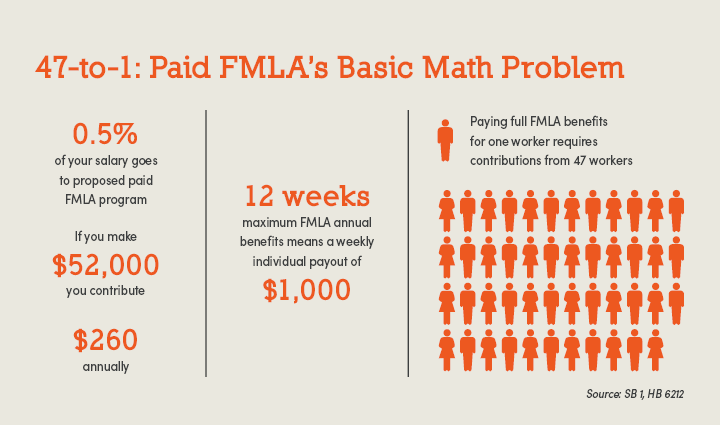

This is based on simple math rooted in advocates’ claims that employees would have to contribute only 0.5% of their wages each pay period.

Using that calculation, an employee who makes $52,000 a year only contributes $260 in a year to the program but is eligible for up to $12,000 annually in paid leave.

Who Pays?

That begs the question: If every employee pays so little to a program that could pay them so much, who pays when many workers take a family and medical leave?

A fiscal note with last year’s bill indicated the state expected a large number of people to use this new program.

This could be why this year's paid FMLA bills exclude state employees, leaving the private sector, municipalities, and public and private schools subject to the mandate.

Advocates of this proposal have for years attempted to downplay the massive startup and operating costs and burdens of this program.

The business community hopes lawmakers will realize that pushing this inflexible, one-size-fits-all mandate on Connecticut’s businesses will not encourage them to adopt more flexible work policies.

After all, if state government is going to protect itself from the costs in these bills, perhaps it should do the same for everyone else.

For more information, contact CBIA’s Eric Gjede (860.480.1784) | @egjede

RELATED

EXPLORE BY CATEGORY

Stay Connected with CBIA News Digests

The latest news and information delivered directly to your inbox.